IBM 2002 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

76 international business machines corporation and Subsidiary Companies

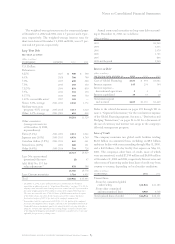

In accordance with SFAS No. 141, the unamortized bal-

ance for acquired assembled workforce of $33 million, which

had been recognized as an intangible asset separate from

goodwill, has been reclassified to goodwill effective January 1,

2002. In addition, an initial goodwill impairment test was

required to be performed in 2002 as of January 1, 2002. This

initial test and the company’s first annual goodwill impair-

ment test, performed as of October 1, 2002, resulted in no

goodwill impairment charges.

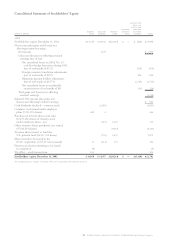

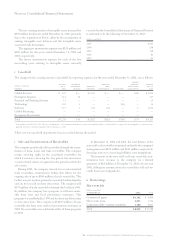

The following table presents reported Income from con-

tinuing operations and income adjusted to exclude goodwill

amortization, which is no longer recorded under SFAS No. 142

effective January 1, 2002.

(dollars in millions except per share amounts)

for the year ended december 31: 2002 2001 2000

Reported income

from continuing operations $«5,334 $«8,146 $«7,874

Add: Goodwill amortization

net of tax effects —262 436

Adjusted income from

continuing operations $«5,334 $«8,408 $«8,310

Basic earnings per share

from continuing operations:

Reported income

from continuing operations $«««3.13 $«««4.69 $«««4.45

Goodwill amortization —0.15 0.25

Adjusted basic earnings

per share from

continuing operations $«««3.13 $«««4.85*$«««4.70

Diluted earnings per share

from continuing operations:

Reported income from

continuing operations $«««3.07 $«««4.59 $«««4.32

Goodwill amortization —0.15 0.24

Adjusted diluted earnings

per share from

continuing operations $«««3.07 $«««4.74 $«««4.56

Reported net income $«3,579 $«7,723 $«8,093

Add: Goodwill amortization

net of tax effects —262 436

Adjusted net income $«3,579 $«7,985 $«8,529

Basic earnings per share:

Reported net income $«««2.10 $«««4.45 $«««4.58

Goodwill amortization —0.15 0.25

Adjusted basic earnings

per share $«««2.10 $«««4.60 $«««4.83

Diluted earnings per share:

Reported net income $«««2.06 $«««4.35 $«««4.44

Goodwill amortization —0.15 0.24

Adjusted diluted earnings

per share $«««2.06 $«««4.50 $«««4.68

*Does not total due to rounding.

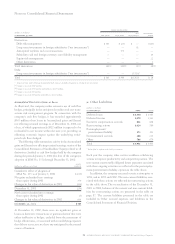

On January 1, 2001, the company adopted SFAS No. 133,

as amended. SFAS No. 133 establishes accounting and report-

ing standards for derivative instruments. As of January 1,

2001, the adoption of the new standard resulted in a cumula-

tive effect, net-of-tax increase of $219 million to Accumulated

gains and (losses) not affecting retained earnings in the

Stockholders’ equity section of the Consolidated Statement of

Financial Position and a cumulative effect net-of-tax charge

of $6 million included in Other (income) and expense in the

Consolidated Statement of Earnings.

Effective January 1, 2001, the company adopted SFAS

No. 140, “Accounting for Transfers and Servicing of Financial

Assets and Extinguishments of Liabilities

—

a replacement of

SFAS No. 125.” This statement provides accounting and

reporting standards for transfers and servicing of financial

assets and extinguishments of liabilities and revises the

accounting standards for securitizations and transfers of

financial assets and collateral. The adoption did not have a

material effect on the company’s results of operations and

financial position. The standard also requires new disclosures

that were not applicable to the company.

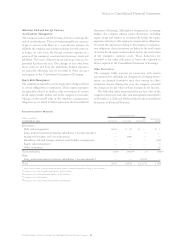

New Standards to be Implemented

In June 2001, the FASB issued SFAS No. 143, “Accounting for

Asset Retirement Obligations.” SFAS No. 143 provides

accounting and reporting guidance for legal obligations asso-

ciated with the retirement of long-lived assets that result

from the acquisition, construction or normal operation of a

long-lived asset. SFAS No. 143 requires the recording of an

asset and a liability equal to the present value of the estimated

costs associated with the retirement of long-lived assets

where a legal or contractual obligation exists. The asset is

required to be depreciated over the life of the related equip-

ment or facility, and the liability is required to be accreted

each year based on a present value interest rate. The standard

is effective for the company on January 1, 2003. The company

has reviewed the provisions of this standard, and its adoption

is not expected to have a material effect on the company’s

Consolidated Financial Statements.