IBM 2002 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

104 international business machines corporation and Subsidiary Companies

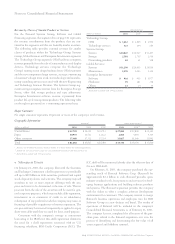

ICC shelf will be terminated shortly after the effective date of

the new IBM shelf.

On February 21, 2003, the company purchased the out-

standing stock of Rational Software Corp. (Rational) for

approximately $2.1 billion in cash. Rational provides open,

industry standard tools, best practices and services for devel-

oping business applications and building software products

and systems. The Rational acquisition provides the company

with the ability to offer a complete software development

environment for customers. The company intends to merge

Rational’s business operations and employees into the IBM

Software Group as a new division and brand. The results of

operations of Rational will be included in the company’s

Consolidated Financial Statements as of February 21, 2003.

The company has not completed the allocation of the pur-

chase price related to the Rational acquisition as it is in the

process of identifying and determining the fair value of all

assets acquired and liabilities assumed.

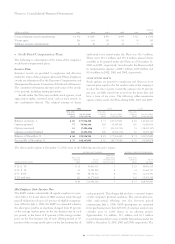

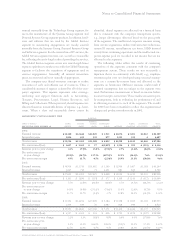

consolidated

(dollars in millions) 2002 2001*2000*

Technology Group:

OEM $«««3,612 $«««4,805 $«««4,900

Technology services 323 344 284

Systems Group:

Servers $«10,047 $«10,947 $«11,497

Storage 2,581 2,755 2,539

Networking products 18 41 158

Global Services:

Services $«31,290 $«29,953 $«28,036

Maintenance 5,070 5,003 5,116

Enterprise Investments:

Software $««««««916 $««««««913 $«««1,077

Hardware 95 181 238

Others 11 24 54

*Reclassified to conform with 2002 presentation.

Major Customers

No single customer represents 10 percent or more of the company’s total revenue.

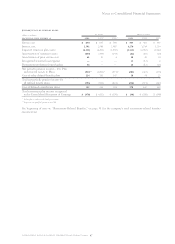

Geographic Information

revenue*long-lived assets**

(dollars in millions) 2002 2001 2000 2002 2001+2000+

United States $«32,759 $«34,233 $«35,713 $«27,889 $«22,800 $«21,449

Japan 10,939 11,512 12,122 2,814 4,034 4,319

Other countries 37,488 37,322 37,254 13,027 11,560 12,092

Total $«81,186 $«83,067 $«85,089 $«43,730 $«38,394 $«37,860

*Revenues are attributed to countries based on location of customer and are for continuing operations.

** Includes all non-current assets except non-current financial instruments and deferred tax assets.

+Reclassified to conform with 2002 presentation.

ySubsequent Events

On January 21, 2003, the company filed with the Securities

and Exchange Commission a shelf registration to periodically

sell up to $20 billion in debt securities, preferred and capital

stock, depositary shares and warrants. The company may sell

securities in one or more separate offerings with the size,

price and terms to be determined at the time of sale. The net

proceeds from the sale of the securities will be used for gen-

eral corporate purposes, which may include debt repayment,

investments in or extensions of credit to its subsidiaries,

redemption of any preferred stock the company may issue, or

financing of possible acquisitions or business expansion. The

net proceeds may be invested temporarily or applied to repay

short-term debt until they are used for their stated purpose.

Consistent with the company’s strategy to concentrate

borrowing at the IBM level, this shelf registration eliminates

the need for a shelf registration associated with its U.S.

financing subsidiary, IBM Credit Corporation (ICC). The

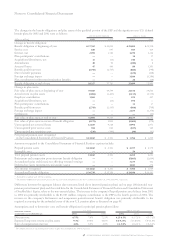

Revenue by Classes of Similar Products or Services

For the Personal Systems Group, Software and Global

Financing segments, the segment data on page 101 represents

the revenue contributions from the products that are con-

tained in the segments and that are basically similar in nature.

The following table provides external revenue for similar

classes of products within the Technology Group, Systems

Group, Global Services and Enterprise Investments segments.

The Technology Group segment’s OEM hardware comprises

revenue primarily from the sale of semiconductors and display

devices. Technology services comprise the Technology

Group’s existing circuit design business for its OEM customers

and the new component design services, strategic outsourcing

of customer’s design team work, and technology and manufac-

turing consulting services associated with the new Engineering

and Technology Services Division. The Systems Group seg-

ment’s storage comprises revenue from the Enterprise Storage

Server, other disk storage products and tape subsystems.

Enterprise Investments software revenue is primarily from

product life-cycle management products. The following table

on the right is presented on a continuing operations basis.