IBM 2002 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

54 international business machines corporation and Subsidiary Companies

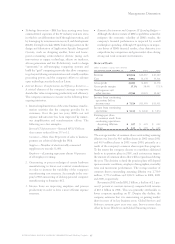

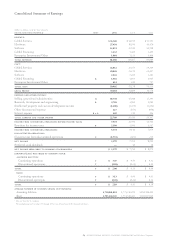

Results of Discontinued Operations

(dollars in millions)

for the year ended december 31: 2002 2001 2000

Revenue $««1,946 $«2,799 $«3,307

Pre-tax (loss)/income $«(2,037) $«««(497) $««««123

Income tax benefit (282) (74) (96)

(Loss)/income $«(1,755) $«««(423) $««««219

See the “Basis of Presentation” section in note a, “Significant

Accounting Policies” on page 70 and note c, “Acquisitions/

Divestitures” on pages 78 to 80 for a discussion of the com-

pany’s divestiture of the HDD business.

Revenue from discontinued operations in 2002 totalled

$1,946 million, a decline of 30.5 percent compared with rev-

enue of $2,799 million in 2001. Revenue from discontinued

operations decreased 15.4 percent in 2001 compared with

2000 revenue of $3,307 million. The HDD revenue declined

as the company’s ability to sell HDDs is highly dependent on

the personal computer industry, which experienced a signifi-

cant downturn beginning in 2000, as well as a result of

general industry price declines.

Loss from discontinued operations in 2002 was $1,755 mil-

lion as compared to a loss of $423 million in 2001 and income

of $219 million in 2000. The loss in 2002 was primarily

attributable to the operational loss of $1,373 million, net of

tax, and an estimated loss on disposal of the HDD business of

$382 million, net of tax. Included in the operational net loss in

2002 was a $508 million, net of tax, increase for certain actions

taken by the company in the second and fourth quarters of

2002, a $217 million, net of tax, increase for inventory write-

offs as compared to 2001 and a $57 million, net of tax, increase

in warranty costs as compared to 2001. The announcement of

the Hitachi transaction led the company to a strategic decision

to cease reworking and selling efforts for some of the company’s

older HDD products. The increase in inventory write-offs

was especially pronounced for these older products.

The second quarter actions primarily included charges for

the abandonment and associated removal costs for machinery,

equipment and tooling that are no longer needed by the com-

pany and will not be purchased by Hitachi. The fourth

quarter actions primarily included the abandonment and

associated removal costs for machinery and equipment and

tooling, workforce reduction-related charges and excess

leased space charges associated with the HDD business, all as

a result of the final agreement completed with Hitachi.

The 2002 and 2001 discontinued operations tax rates of

approximately 14 percent and 15 percent, respectively, resulted

primarily from the mix of losses in countries with low tax rates.

Additionally, the 2002 tax rate included an incremental U.S. tax

charge of $248 million attributable to the December repatria-

tion of non-U.S. transaction proceeds. The 2000 discontinued

operations tax rate was impacted by the geographic mix of

income and changes in the value of IP rights that were previ-

ously transferred to several non-U.S. subsidiaries.

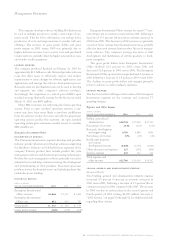

Fourth Quarter

Continuing Operations

The company’s fourth-quarter 2002 diluted earnings per

common share from continuing operations was $1.11, com-

pared with diluted earnings per common share of $1.46 in the

fourth quarter of 2001. Fourth-quarter income from contin-

uing operations was $1.9 billion compared with $2.6 billion

in fourth quarter 2001. Revenue from continuing operations

for the fourth quarter was $23.7 billion, up 7 percent (4 per-

cent at constant currency) compared with the fourth quarter

of 2001 revenue of $22.1 billion.

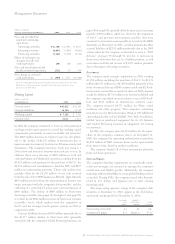

In the Americas, revenue was $10.3 billion, an increase

of 4.6 percent (7 percent at constant currency) from the

2001 period. Revenue from Europe/Middle East/Africa was

$7.8 billion, up 12.6 percent (1 percent at constant currency).

Asia-Pacific revenue grew 7.1 percent (4 percent at constant

currency) to $4.8 billion. OEM revenue decreased 11.3 per-

cent (11 percent at constant currency) to $828 million

compared with the fourth quarter of 2001.

Revenue from Global Services, including maintenance,

grew 16.7 percent (13 percent at constant currency) in the

fourth quarter to $10.6 billion, driven by the PwCC acquisi-

tion. Global Services revenue, excluding maintenance,

increased 19 percent (15 percent at constant currency). IBM

signed more than $18 billion in services contracts in the quar-

ter compared with $9 billion in the 2002 third quarter.

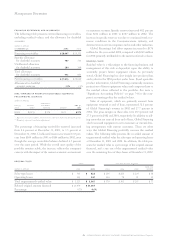

Hardware revenue increased 1.3 percent (down 1 percent

at constant currency) to $8.1 billion from the 2001 fourth

quarter. Despite continued weak IT spending, revenue at

constant currency from xSeries Intel-based servers grew with

high-end server demand particularly strong, while revenue

from pSeries UNIX-based servers was flat with fourth-quarter

2001 revenue. IBM eServer revenue from iSeries declined as

compared to the fourth quarter of 2001, due to the weak

economic environment. While zSeries revenue also declined

in the quarter from a year ago, total deliveries of zSeries com-

puting power as measured in MIPS increased 13 percent

compared with 7 percent in third-quarter 2002. Storage

products revenue declined although disk storage revenue

increased, driven by high-end products. Microelectronics

revenue decreased as compared to the fourth quarter of 2001.

The personal computer unit increased revenue as compared

to the fourth quarter of 2001 due to higher sales of desktop

and mobile products.

Software revenue was flat (down 2 percent at constant

currency) at $3.8 billion compared to the 2001 fourth quarter

due to the weak economic environment. Middleware products

declined 1 percent at constant currency in the fourth quarter

of 2002.

Operating systems revenue decreased compared with the

prior-year period due primarily to the related volume trends

of eServer hardware sales.