IBM 2002 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

81international business machines corporation and Subsidiary Companies

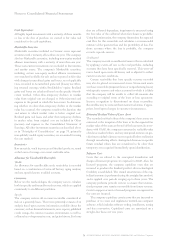

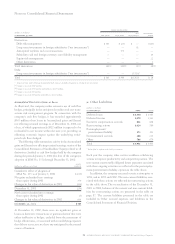

eInventories

(dollars in millions)

at december 31: 2002 2001

Finished goods $««««««960 $«««1,259

Work in process and raw materials 2,188 3,045

Total $«««3,148 $«««4,304

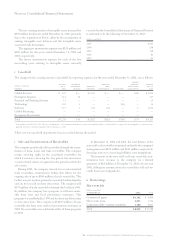

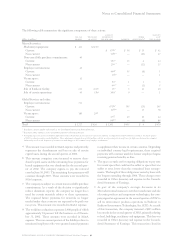

fFinancing Receivables

(dollars in millions)

at december 31: 2002 2001*

Short-term:

Net investment in sales-type leases $«««5,779 $«««6,029

Commercial financing receivables «««4,972 «««5,416

Customer loans receivable 4,462 4,225

Installment payment receivables 698 844

Other non-Global Financing related 85 142

Total $«15,996 $«16,656

Long-term:

Net investment in sales-type leases $«««6,505 $«««6,822

Customer loans receivable 4,179 4,014

Commercial financing receivables 462 1,009

Installment payment receivables 273 396

Other non-Global Financing related 21 5

Total $«11,440 $«12,246

*Reclassified to conform with 2002 presentation.

Net investment in sales-type leases is for leases that relate

principally to IBM equipment and are generally for terms

ranging from two to five years. Net investment in sales-type

leases includes unguaranteed residual values of $821 million

and $791 million at December 31, 2002 and 2001, respectively,

and is reflected net of unearned income at those dates of

$1,330 million and $1,428 million, respectively. Scheduled

maturities of minimum lease payments outstanding at

December 31, 2002, expressed as a percentage of the total,

are approximately as follows: 2003, 51 percent; 2004, 28 per-

cent; 2005, 15 percent; 2006, 4 percent; and 2007 and beyond,

2 percent.

Customer loans receivable are provided by Global

Financing to the company’s customers to finance the purchase

of the company’s software and services. Global Financing is

one of many sources of funding from which customers can

choose. Separate contractual relationships on these financing

arrangements are generally for terms ranging from one to

three years requiring straight-line payments over the term.

Each financing contract is priced independently at competi-

tive market rates. The company has a history of enforcing the

terms of these separate financing agreements.

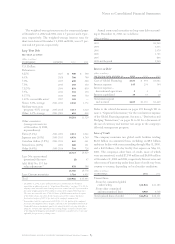

gPlant, Rental Machines and Other Property

(dollars in millions)

at december 31: 2002 2001

Land and land improvements $««««««837 $««««««859

Buildings and building improvements 8,978 10,073

Plant, laboratory and office equipment 21,416 22,369

31,231 33,301

Less: Accumulated depreciation 18,525 18,982

12,706 14,319

Rental machines 4,852 5,074

Less: Accumulated depreciation 3,118 2,889

1,734 2,185

Total $«14,440 $«16,504

hInvestments and Sundry Assets

(dollars in millions)

at december 31: 2002 2001*

Deferred taxes $«4,314 $«2,395

Alliance investments:

Equity method 562 544

Other 249 574

Software 834 833

Derivatives

—

non-current** 689 230

Intangible assets, net

(other than goodwill) 562 356

Receivable from Hitachi+356 —

Marketable securities

—

non-current 192 124

Other assets 1,076 1,361

Total $«8,834 $«6,417

*Reclassified to conform with 2002 presentation.

** See note L, “Derivatives and Hedging Transactions” on pages 84 to 86 for the fair

value of all derivatives reported in the Consolidated Statement of Financial Position.

+See note C, “Acquisitions/Divestitures” on pages 78 to 80 for additional information.

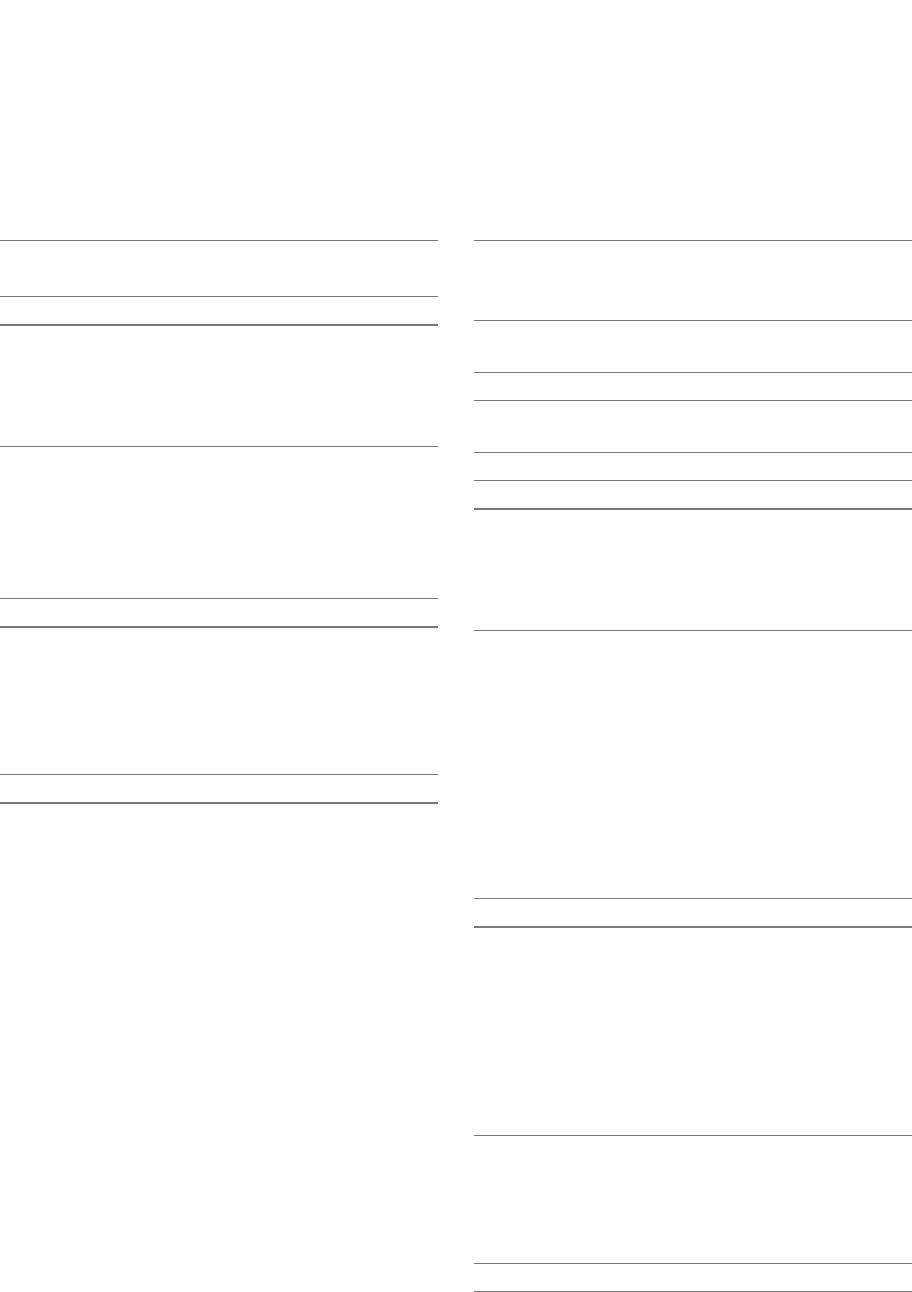

The following schedule details the company’s intangible asset

balances by major asset class:

gross net carrying

(dollars in millions) carrying accumulated amount at

intangible asset class amount amortization dec. 31, 2002

Customer-related $««««517 $«(124) $«393

Completed technology 229 (108) 121

Strategic alliances 118 (15) 103

Patents/trademarks 109 (80) 29

Other*«98 «««(7) «91

Total $«1,071 $«(334) $«737**

*Other intangibles are primarily acquired proprietary and nonproprietary business

processes, methodologies and systems.

** The $737 million comprises $175 million recorded as current assets and $562 million

recorded as non-current assets.