IBM 2002 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

71international business machines corporation and Subsidiary Companies

program. Revenue from maintenance, unspecified upgrades

and technical support is recognized over the period such

items are delivered. See “Multiple-Element Arrangements”

below for further information.

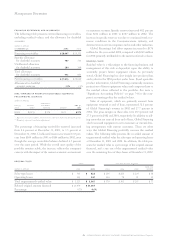

financing

Finance income attributable to sales-type leases, direct financ-

ing leases and loans is recognized at level rates of return over

the term of the leases or loans. Operating lease income is

recognized on a straight-line basis over the term of the lease.

multiple-element arrangements

The company enters into transactions that include multiple-

element arrangements, which may include any combination

of services, hardware, software and/or financing. When some

elements are delivered prior to others in an arrangement and

all of the following criteria are met, revenue for the delivered

element is recognized upon delivery of such item. Otherwise,

revenue is deferred until the delivery of the last element.

■

Vendor-specific objective evidence (VSOE) of fair value of

the undelivered elements.

■

The functionality of the delivered elements is not depend-

ent on the undelivered elements.

■

Delivery of the delivered element represents the culmina-

tion of the earnings process.

VSOE is the price charged by the company to an external

customer for the same element when such element is sold

separately.

Expense and Other Income

selling, general and administrative

Selling, general and administrative (SG&A) expense is charged

to income as incurred. Expenses of promoting and selling

products and services are classified as selling expense and

include such items as advertising, sales commissions and travel.

General and administrative expense includes such items as

officers’ salaries, office supplies, non-income taxes, insurance

and office rental. In addition, general and administrative

expense includes other operating items such as a provision for

doubtful accounts, workforce accruals for contractually

obligated payments to employees terminated in the ongoing

course of business, amortization of intangible assets and envi-

ronmental remediation costs. Certain special actions discussed

in note s“2002 Actions” on pages 90 through 92 are also

included in SG&A. The cost of internal environmental pro-

tection programs that are preventive in nature are expensed as

incurred. The company accrues for all known environmental

liabilities when it becomes probable that the company will

incur cleanup costs and those costs can be reasonably estimated.

In addition, estimated environmental costs that are associated

with post-closure activities (for example, the removal and

restoration of chemical storage facilities and monitoring) are

accrued when the decision is made to close a facility.

research, development and engineering

Research, development and engineering (RD&E) costs are

expensed as incurred.

intellectual property and custom development income

As part of the company’s ongoing business model and as a

result of the company’s ongoing investment in research and

development (R&D), the company licenses and sells the rights

to certain of its intellectual property (IP) including internally

developed patents, trade secrets and technological know-how.

Certain transfers of IP to third parties are licensing/royalty

fee based and other transfers are transaction-based sales and

other transfers. Licensing/royalty-based fees involve trans-

fers in which the company earns the income over time or the

amount of income is not fixed and determinable until the

licensee sells future related products (i.e., variable royalty,

based upon licensee’s revenue). Sales and other transfers

typically include transfers of IP whereby the company has

fulfilled its obligations and the fee received is fixed and

determinable. The company also earns income from certain

custom development projects for specific customers. The

company records the income from these projects when the

fee is earned, is not refundable, and is not dependent upon

the success of the project.

other (income)and expense

Other (income) and expense includes interest income (other

than from the company’s Global Financing business transac-

tions), gains and losses from securities and other investments,

realized gains and losses from certain real estate activity, and

foreign currency transaction gains and losses.

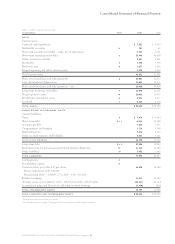

Depreciation and Amortization

Plant, rental machines and other property are carried at cost

and depreciated over their estimated useful lives using the

straight-line method.

The estimated useful lives of depreciable properties gen-

erally are as follows: buildings, 50 years; building equipment,

20 years; land improvements, 20 years; plant, laboratory and

office equipment, 2 to 15 years; and computer equipment, 1.5

to 5 years.

Capitalized software costs incurred or acquired after tech-

nological feasibility are amortized over periods up to 3 years.

See “Software Costs” on page 74 for additional information.

Other intangible assets are amortized for periods up to 7 years.

See “Standards Implemented” on pages 75 and 76 for addi-

tional information on goodwill.

Retirement-Related Benefits

See note w, “Retirement-Related Benefits,” on pages 95 to

100 for the company’s accounting policy for retirement-

related benefits.