Harley Davidson 2012 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

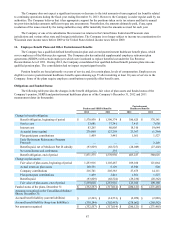

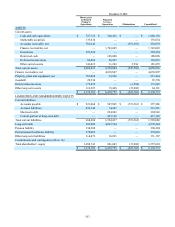

Stock Appreciation Rights (SARs)

SARs vest under the same terms and conditions as options; however, they are settled in cash equal to their settlement date

fair value. As a result, SARs are recorded in the Company’s consolidated balance sheets as a liability until the date of exercise.

The fair value of each SAR award is estimated using a lattice-based valuation model. In accordance with ASC Topic 718,

“Stock Compensation”, the fair value of each SAR award is recalculated at the end of each reporting period and the liability

and expense adjusted based on the new fair value and the percent vested.

The assumptions used to determine the fair value of the SAR awards at December 31, 2012 and 2011 were as follows:

2012 2011

Expected average term (in years) 1.3 - 5.6 2.2 - 6.2

Expected volatility 31% - 45% 40% - 49%

Expected dividend yield 1.3% 1.0%

Risk-free interest rate .1% - 1.8% 0.1% - 2.2%

The following table summarizes the SAR transactions for the year ended December 31, 2012 (in thousands except for per

share amounts):

SARs

Weighted-

Average

Price

Outstanding, beginning of period 273 $ 21

Granted 21 $ 45

Exercised (40) $ 22

Forfeited (1) $ 22

Outstanding, end of period 253 $ 23

Exercisable, end of period 160 $ 22

The weighted-average fair value of SARs granted during the years ended December 31, 2012, 2011 and 2010 was $14,

$15 and $8, respectively.

Restricted (Nonvested) Stock:

The fair value of restricted stock is determined based on the market price of the Company’s shares on the grant date. The

following table summarizes the restricted stock transactions for the year ended December 31, 2012 (in thousands except for per

share amounts):

Restricted

Shares

Grant Date

Fair Value

Per Share

Nonvested, beginning of period 1,941 $ 26

Granted 521 $ 45

Vested (687) $ 32

Forfeited (83) $ 29

Nonvested, end of period 1,692 $ 29

As of December 31, 2012, there was $24.4 million of unrecognized compensation cost related to restricted stock that is

expected to be recognized over a weighted-average period of 1.4 years.

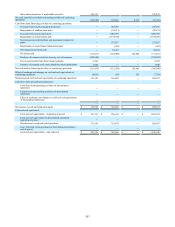

Restricted Stock Units (RSUs)

Restricted stock units vest under the same terms and conditions as restricted stock; however, they are settled in cash equal

to their settlement date fair value. As a result, RSUs are recorded in the Company’s consolidated balance sheets as a liability

until the date of vesting.