Harley Davidson 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

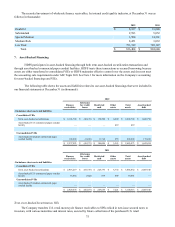

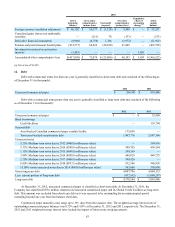

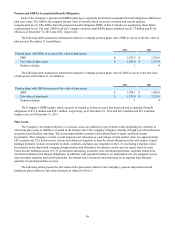

2010

AOCL

beginning

balance

Gross other

comprehensive

income (loss) Tax benefit

(expense)

Net other

comprehensive

income (loss)

Cumulative

effect of

accounting

change (a)

AOCL

ending

balance

Foreign currency translation adjustment $ 46,102 $ 10,577 $ (1,128) $ 9,449 $ — $ 55,551

Unrealized gains (losses) on marketable

securities — (211) 78 (133) — (133)

Derivative financial instruments (8,940) (4,756) 1,784 (2,972) — (11,912)

Pension and postretirement benefit plans (451,577) 66,469 (24,620) 41,849 — (409,728)

Investment in retained securitization

interests (3,483) — — — 3,483 —

Accumulated other comprehensive loss $(417,898) $ 72,079 $ (23,886) $ 48,193 $ 3,483 $ (366,222)

(a) Net of tax of $1,959

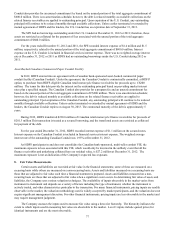

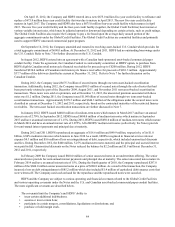

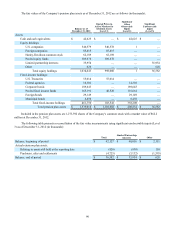

12. Debt

Debt with contractual terms less than one year is generally classified as short-term debt and consisted of the following as

of December 31 (in thousands):

2012 2011

Unsecured commercial paper $ 294,943 $ 838,486

Debt with a contractual term greater than one year is generally classified as long-term debt and consisted of the following

as of December 31 (in thousands):

2012 2011

Unsecured commercial paper $ — $ 35,800

Bank borrowings

Credit facilities — 159,794

Secured debt

Asset-backed Canadian commercial paper conduit facility 175,658 —

Term asset-backed securitization debt 1,447,776 2,087,346

Unsecured notes

5.25% Medium-term notes due in 2012 ($400.0 million par value) — 399,916

5.75% Medium-term notes due in 2014 ($500.0 million par value) 499,705 499,544

1.15% Medium-term notes due in 2015 ($600.0 million par value) 599,269 —

3.88% Medium-term notes due in 2016 ($450.0 million par value) 449,829 449,775

2.70% Medium-term notes due in 2017 ($400.0 million par value) 399,929 —

6.80% Medium-term notes due in 2018 ($933.5 million par value) 932,540 948,958

15.00% senior unsecured notes due in 2014 ($600.0 million par value) 303,000 303,000

Gross long-term debt 4,807,706 4,884,133

Less: current portion of long-term debt (437,162)(1,040,247)

Long-term debt $ 4,370,544 $ 3,843,886

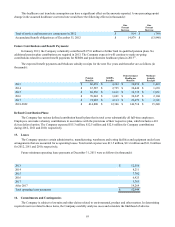

At December 31, 2012, unsecured commercial paper is classified as short-term debt. At December 31, 2011, the

Company has classified $195.6 million related to its unsecured commercial paper and its Global Credit Facilities as long-term

debt. This amount was excluded from short term debt as it was expected to be outstanding for an uninterrupted period

extending beyond one year from the balance sheet date.

Commercial paper maturities may range up to 365 days from the issuance date. The weighted-average interest rate of

outstanding commercial paper balances was 0.75% and 1.05% at December 31, 2012 and 2011, respectively. The December 31,

2012 and 2011 weighted-average interest rates include the impact of interest rate swap agreements.