Harley Davidson 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

Results of Operations 2011 Compared to 2010

Consolidated Results

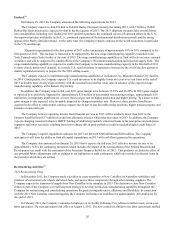

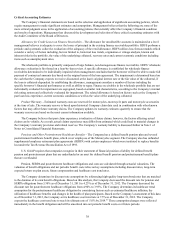

(in thousands, except earnings per share) 2011 2010 Increase

(Decrease) %

Change

Operating income from motorcycles & related products $ 561,176 $ 378,758 $ 182,418 48.2 %

Operating income from financial services 268,791 181,873 86,918 47.8

Operating income 829,967 560,631 269,336 48.0

Investment income 7,963 5,442 2,521 46.3

Interest expense 45,266 90,357 (45,091) (49.9)

Loss on debt extinguishment — 85,247 (85,247) NM

Income before income taxes 792,664 390,469 402,195 103.0

Provision for income taxes 244,586 130,800 113,786 87.0

Income from continuing operations 548,078 259,669 288,409 111.1

Income (loss) from discontinued operations, net of taxes 51,036 (113,124) 164,160 (145.1)

Net income $ 599,114 $ 146,545 $ 452,569 308.8 %

Diluted earnings per share from continuing operations $ 2.33 $ 1.11 $ 1.22 109.9 %

Diluted earnings (loss) per share from discontinued operations $ 0.22 $ (0.48) $ 0.70 (145.8)%

Diluted earnings per share $ 2.55 $ 0.62 $ 1.93 311.3 %

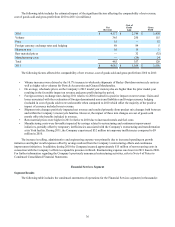

Operating income for the Motorcycles segment during 2011 improved by $182.4 million compared to 2010 primarily due

to increased motorcycle shipments and lower spending on the Company’s ongoing restructuring activities. Operating income

for the Financial Services segment improved by $86.9 million during 2011 primarily due to improved credit performance in the

retail motorcycle finance receivable portfolio. Please refer to the “Motorcycles and Related Products Segment” and “Financial

Services Segment” discussions following for a more detailed discussion of the factors affecting operating income.

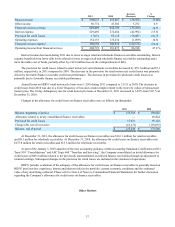

Interest expense for 2011 related to the Company’s senior unsecured notes, was approximately $45 million lower than in

2010. The decrease in interest expense on the senior unsecured notes is due to the Company’s repurchase of $297.0 million of

the $600.0 million senior unsecured notes during the fourth quarter of 2010.

During the fourth quarter of 2010, the Company repurchased $297.0 million of the $600.0 million senior unsecured notes

at a price of $380.8 million. As a result of the transaction, the Company incurred a loss on debt extinguishment of $85.2 million

which also includes $1.4 million of capitalized debt issuance costs that were written-off. The Company used cash on hand for

the repurchase and the repurchased notes were canceled.

The effective income tax rate for 2011 was 30.9% compared to 33.5% for 2010. The lower 2011 effective tax rate was

mainly driven by a change in the 2011 Wisconsin income tax law associated with certain net operating losses and a one-time

tax charge in 2010 associated with the federal healthcare legislation.

In 2011, the Company recognized a $51.0 million benefit on income from discontinued operations, driven by the

reversal of tax amounts reserved in prior years related to the divestiture of the Company’s MV Agusta subsidiaries. The

amounts had been reserved pending an agreement that was reached by the Company and the IRS on the tax treatment of the

transaction in December 2011. This compares to a $113.1 million loss from discontinued operations in 2010 due primarily to

impairment charges related to a decrease in the fair value of MV Agusta.

Motorcycles and Related Products Segment

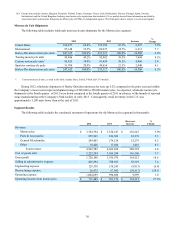

Harley-Davidson Motorcycle Retail Sales

Worldwide independent dealer retail sales of Harley-Davidson motorcycles increased 5.9% during 2011 compared to

2010. Retail sales of Harley-Davidson motorcycles increased 5.8% in the United States and 6.1% internationally in 2011. The

following table includes retail unit sales of Harley-Davidson motorcycles: