Harley Davidson 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

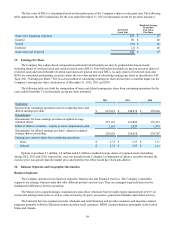

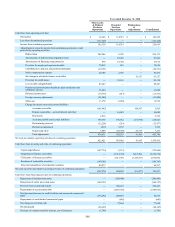

Year ended December 31, 2010

Motorcycles

& Related

Products

Operations

Financial

Services

Operations

Eliminations

&

Adjustments Consolidated

Cash flows from operating activities:

Net income $ 32,226 $ 114,319 $ — $ 146,545

Loss from discontinued operations (113,124) — — (113,124)

Income from continuing operations 145,350 114,319 — 259,669

Adjustments to reconcile income from continuing operations to cash

provided by operating activities:

Depreciation 248,246 6,925 — 255,171

Amortization of deferred loan origination costs — 87,223 — 87,223

Amortization of financing origination fees 878 18,740 — 19,618

Provision for employee long-term benefits 78,812 818 — 79,630

Contributions to pension and postretirement plans (39,391) — — (39,391)

Stock compensation expense 28,105 2,326 — 30,431

Net change in wholesale finance receivables — — 81,527 81,527

Provision for credit losses — 93,118 — 93,118

Loss on debt extinguishment 85,247 — — 85,247

Pension and postretirement healthcare plan curtailment and

settlement expense 31,824 — — 31,824

Deferred income taxes (16,774) (817) — (17,591)

Foreign currency adjustments (21,480) — — (21,480)

Other, net 13,178 (1,268) — 11,910

Change in current assets and current liabilities:

Accounts receivable (101,462) — 104,367 2,905

Finance receivables – accrued interest and other — 10,083 — 10,083

Inventories 2,516 — — 2,516

Accounts payable and accrued liabilities 196,155 170,832 (151,974) 215,013

Restructuring reserves (32,258) (219) — (32,477)

Derivative instruments (813) 6,152 — 5,339

Prepaid and other 3,888 (48,330) 47,575 3,133

Total adjustments 476,671 345,583 81,495 903,749

Net cash provided by operating activities of continuing operations 622,021 459,902 81,495 1,163,418

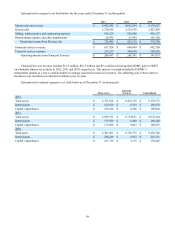

Cash flows from investing activities of continuing operations:

Capital expenditures (167,730) (3,115) — (170,845)

Origination of finance receivables — (5,319,738) 3,067,206 (2,252,532)

Collections of finance receivables — 5,817,695 (3,148,733) 2,668,962

Purchases of marketable securities (184,365) — — (184,365)

Sales and redemptions of marketable securities 84,217 — — 84,217

Net cash (used by) provided by investing activities of continuing operations (267,878) 494,842 (81,527) 145,437

Cash flows from financing activities of continuing operations:

Repayment of medium-term notes — (200,000) — (200,000)

Repayment of senior unsecured notes (380,757) — — (380,757)

Proceeds from securitization debt — 598,187 — 598,187

Repayments of securitization debt — (1,896,665) — (1,896,665)

Net (decrease)/increase in credit facilities and unsecured commercial

paper (178,292) 208,867 — 30,575

Repayments of asset-backed commercial paper — (845) — (845)

Net change in restricted cash — 77,654 — 77,654

Dividends paid (94,145) — — (94,145)

Purchase of common stock for treasury, net of issuances (1,706) — — (1,706)