Harley Davidson 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

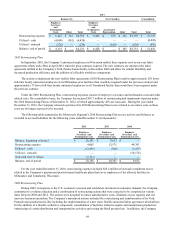

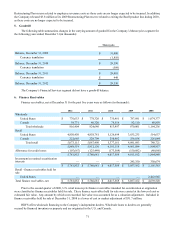

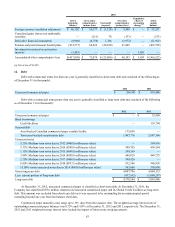

The recorded investment of wholesale finance receivables, by internal credit quality indicator, at December 31 was as

follows (in thousands):

2012 2011

Doubtful $ 8,107 $ 13,048

Substandard 2,593 5,052

Special Mention 3,504 14,361

Medium Risk 8,451 3,032

Low Risk 793,749 789,147

Total $ 816,404 $ 824,640

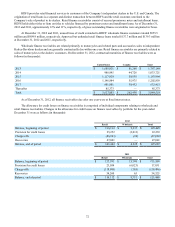

7. Asset-Backed Financing

HDFS participates in asset-backed financing through both term asset-backed securitization transactions and

through asset-backed commercial paper conduit facilities. HDFS treats these transactions as secured borrowing because

assets are either transferred to consolidated VIEs or HDFS maintains effective control over the assets and does not meet

the accounting sale requirements under ASC Topic 860. See Note 1 for more information on the Company's accounting

for asset-backed financings and VIEs.

The following table shows the assets and liabilities related to our asset-backed financings that were included in

our financial statements at December 31 (in thousands):

2012

Finance

receivables

Allowance

for credit

losses Restricted

cash Other

assets Total

assets Asset-backed

debt

On-balance sheet assets and liabilities

Consolidated VIEs

Term asset-backed securitizations $ 2,143,708 $ (42,139) $ 176,290 $ 4,869 $ 2,282,728 $ 1,447,776

Asset-backed U.S. commercial paper conduit

facility — — — 419 419 —

Unconsolidated VIEs

Asset-backed Canadian commercial paper

conduit facility 194,285 (3,432) 11,718 255 202,826 175,658

$ 2,337,993 $ (45,571) $ 188,008 $ 5,543 $ 2,485,973 $ 1,623,434

2011

Finance

receivables

Allowance

for credit

losses Restricted

cash Other

assets Total

assets Asset-backed

debt

On-balance sheet assets and liabilities

Consolidated VIEs

Term asset-backed securitizations $ 2,916,219 $ (65,735) $ 228,776 $ 6,772 $ 3,086,032 $ 2,087,346

Asset-backed U.S. commercial paper conduit

facility 13,455 (302) 879 449 14,481 —

Unconsolidated VIEs

Asset-backed Canadian commercial paper

conduit facility — — — — — —

$ 2,929,674 $ (66,037) $ 229,655 $ 7,221 $ 3,100,513 $ 2,087,346

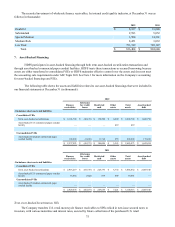

Term Asset-Backed Securitization VIEs

The Company transfers U.S. retail motorcycle finance receivables to SPEs which in turn issue secured notes to

investors, with various maturities and interest rates, secured by future collections of the purchased U.S. retail