Harley Davidson 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

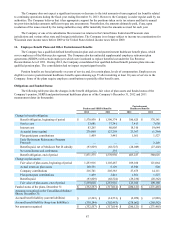

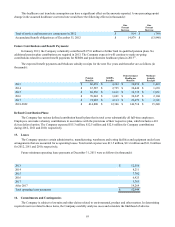

Assumptions used in calculating the lattice-based fair value of options granted during 2012, 2011 and 2010 were as

follows:

2012 2011 2010

Expected average term (in years) 6.3 6.5 6.9

Expected volatility 32% - 50% 39% - 52% 42% - 60%

Weighted average volatility 41% 43% 48%

Expected dividend yield 1.1% 1.0% 1.8%

Risk-free interest rate 0.1% - 2.1% 0.1% - 3.7% 0.1% - 3.7%

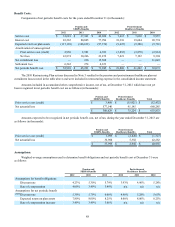

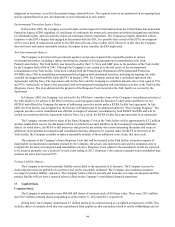

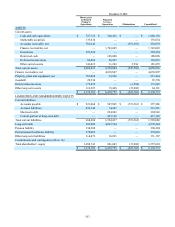

The following table summarizes the stock option transactions for the year ended December 31, 2012 (in thousands except

for per share amounts):

Options

Weighted-

Average

Price

Options outstanding, beginning of period 6,311 $ 37

Options granted 480 $ 45

Options exercised (1,666) $ 28

Options forfeited (665) $ 52

Options outstanding, end of period 4,460 $ 38

Exercisable, end of period 3,065 $ 42

The weighted-average fair value of options granted during the years ended December 31, 2012, 2011 and 2010 was $14,

$15 and $8, respectively.

As of December 31, 2012, there was $2.3 million of unrecognized compensation cost related to stock options that is

expected to be recognized over a weighted-average period of 1.5 years.

The following table summarizes the aggregate intrinsic value related to options outstanding, exercisable and exercised as

of and for the years ended December 31 (in thousands):

2012 2011 2010

Exercised $ 34,443 $ 7,919 $ 12,710

Outstanding $ 60,963 $ 55,701 $ 53,249

Exercisable $ 35,873 $ 22,926 $ 8,545

The Company’s policy is to issue new shares of common stock upon the exercise of employee stock options. The

Company has a continuing authorization from its Board of Directors to repurchase shares to offset dilution caused by the

exercise of stock options which is discussed in Note 17.

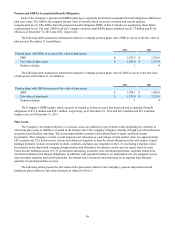

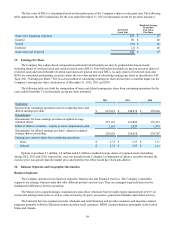

Stock options outstanding at December 31, 2012 (options in thousands):

Price Range Weighted-Average

Contractual Life Options Weighted-Average

Exercise Price

$10.01 to $20 6.0 910 $ 13

$20.01 to $30 6.9 695 $ 23

$30.01 to $40 4.7 503 $ 39

$40.01 to $50 8.0 910 $ 43

$50.01 to $60 1.6 706 $ 52

$60.01 to $70 2.5 736 $ 65

Options outstanding 5.1 4,460 $ 38

Options exercisable 7.6 3,065 $ 42