Harley Davidson 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

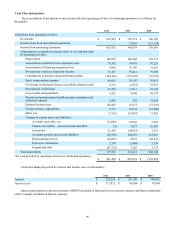

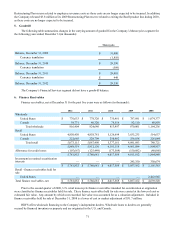

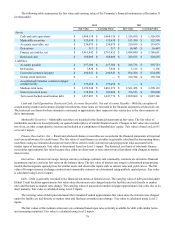

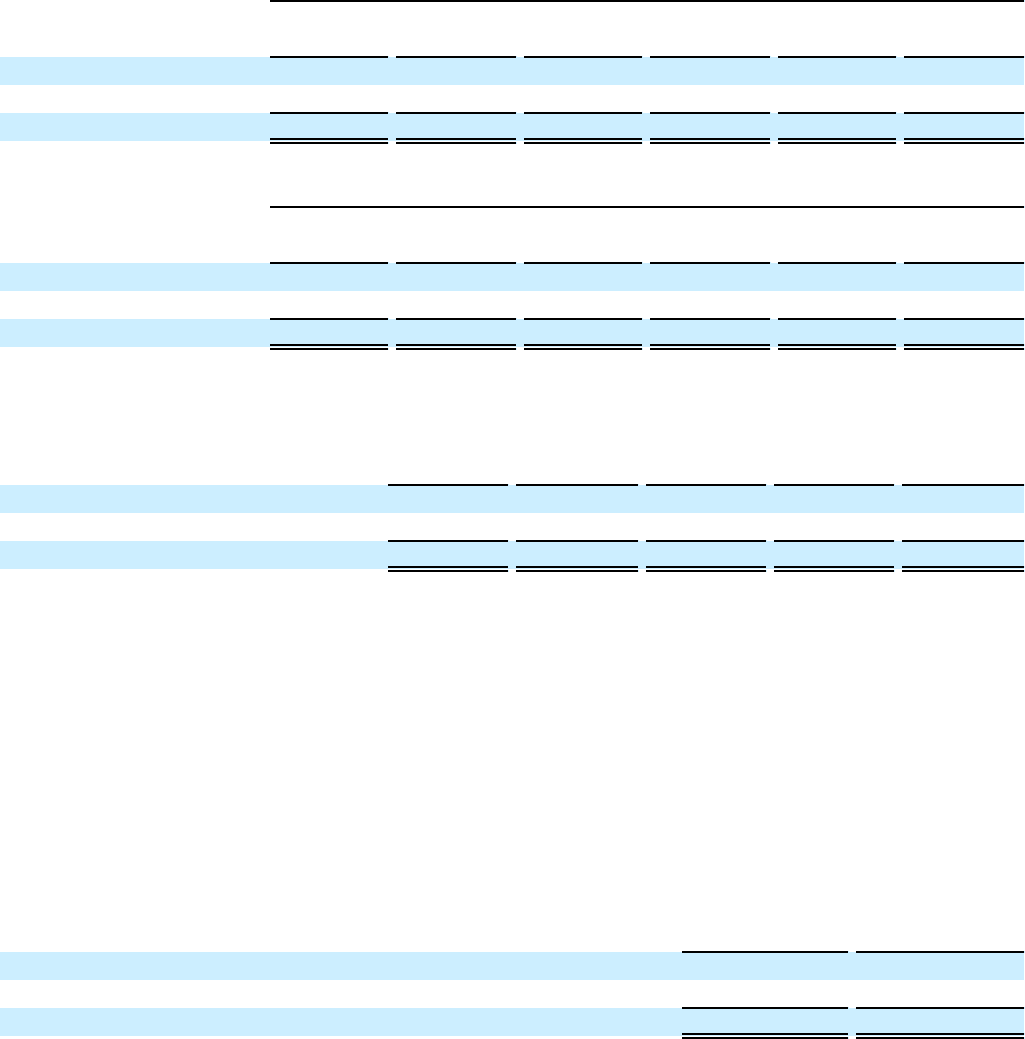

An analysis of the aging of past due finance receivables at December 31 was as follows (in thousands):

2012

Current 31-60 Days

Past Due 61-90 Days

Past Due

Greater than

90 Days

Past Due Total

Past Due

Total

Finance

Receivables

Retail $ 4,894,675 $ 113,604 $ 37,239 $ 27,597 $ 178,440 $ 5,073,115

Wholesale 814,706 984 278 436 1,698 816,404

Total $ 5,709,381 $ 114,588 $ 37,517 $ 28,033 $ 180,138 $ 5,889,519

2011

Current 31-60 Days

Past Due 61-90 Days

Past Due

Greater than

90 Days

Past Due Total

Past Due

Total

Finance

Receivables

Retail $ 4,915,711 $ 107,373 $ 36,937 $ 27,469 $ 171,779 $ 5,087,490

Wholesale 822,610 777 344 909 2,030 824,640

Total $ 5,738,321 $ 108,150 $ 37,281 $ 28,378 $ 173,809 $ 5,912,130

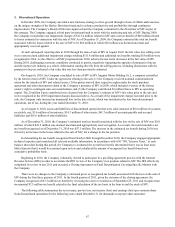

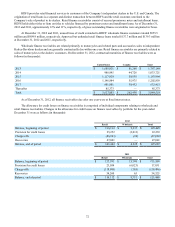

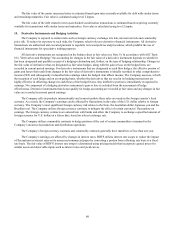

The recorded investment of retail and wholesale finance receivables, excluding non-accrual status finance receivables,

that are contractually past due 90 days or more at December 31 for the past five years was as follows (in thousands):

2012 2011 2010 2009 2008

United States $ 26,500 $ 27,171 $ 34,391 $ 24,629 $ 23,678

Canada 1,533 1,207 1,351 2,161 1,275

Total $ 28,033 $ 28,378 $ 35,742 $ 26,790 $ 24,953

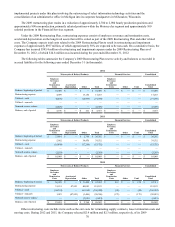

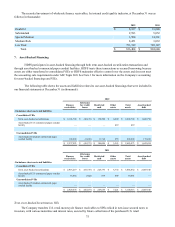

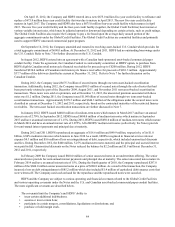

A significant part of managing HDFS’ finance receivable portfolios includes the assessment of credit risk associated with

each borrower. As the credit risk varies between the retail and wholesale portfolios, HDFS utilizes different credit risk

indicators for each portfolio.

HDFS manages retail credit risk through its credit approval policy and ongoing collection efforts. HDFS uses FICO

scores, a standard credit rating measurement, to differentiate the expected default rates of retail credit applicants enabling the

Company to better evaluate credit applicants for approval and to tailor pricing according to this assessment. Retail loans with a

FICO score of 640 or above at origination are considered prime, and loans with a FICO score below 640 are considered sub-

prime. These credit quality indicators are determined at the time of loan origination and are not updated subsequent to the loan

origination date.

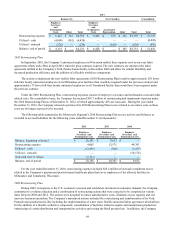

The recorded investment of retail finance receivables, by credit quality indicator, at December 31 was as follows (in

thousands):

2012 2011

Prime $ 4,035,584 $ 4,097,048

Sub-prime 1,037,531 990,442

Total $ 5,073,115 $ 5,087,490

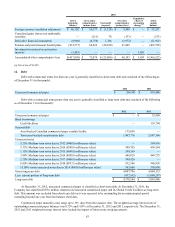

HDFS’ credit risk on the wholesale portfolio is different from that of the retail portfolio. Whereas the retail portfolio

represents a relatively homogeneous pool of retail finance receivables that exhibit more consistent loss patterns, the wholesale

portfolio exposures are less consistent. HDFS utilizes an internal credit risk rating system to manage credit risk exposure

consistently across wholesale borrowers and individually evaluates credit risk factors for each borrower. HDFS uses the

following internal credit quality indicators, based on the Company’s internal risk rating system, listed from highest level of risk

to lowest level of risk for the wholesale portfolio: Doubtful, Substandard, Special Mention, Medium Risk and Low Risk. Based

upon management’s review, the dealers classified in the Doubtful category are the dealers with the greatest likelihood of being

charged-off, while the dealers classified as Low Risk are least likely to be charged-off. The internal rating system considers

factors such as the specific borrowers’ ability to repay and the estimated value of any collateral. Dealer risk rating

classifications are reviewed and updated on a quarterly basis.