Harley Davidson 2012 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

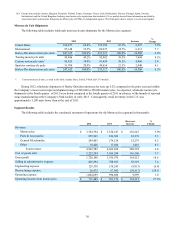

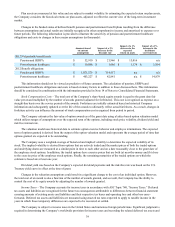

2011 2010 Increase

(Decrease) %

Change

Interest income $ 598,675 $ 635,207 $ (36,532) (5.8)%

Other income 50,774 47,502 3,272 6.9

Financial services revenue 649,449 682,709 (33,260) (4.9)

Interest expense 229,492 272,484 (42,992) (15.8)

Provision for credit losses 17,031 93,118 (76,087) (81.7)

Operating expenses 134,135 135,234 (1,099) (0.8)

Financial services expense 380,658 500,836 (120,178) (24.0)

Operating income from financial services $ 268,791 $ 181,873 $ 86,918 47.8 %

Interest income decreased during 2011 due to lower average retail and wholesale finance receivables outstanding. Interest

expense benefited from lower debt levels related to lower average retail and wholesale finance receivables outstanding and a

more favorable cost of funds, partially offset by a $9.6 million loss on the extinguishment of debt.

The provision for credit losses related to retail motorcycle and wholesale receivables decreased by $70.1 million and $7.1

million, respectively, in 2011 compared to 2010. The decrease in the provision for retail motorcycle credit losses was primarily

driven by favorable finance receivable credit loss performance. The decrease in provision for wholesale credit losses was

primarily due to favorable finance receivable performance.

Annual losses on HDFS’ retail motorcycle loans were 1.20% during 2011 compared to 2.11% in 2010. The decrease in

credit losses from 2010 was due to a lower frequency of loss and a modest improvement in the recovery values of repossessed

motorcycles. The 30-day delinquency rate for retail motorcycle loans at December 31, 2011 decreased to 3.85% from 5.07 % at

December 31, 2010.

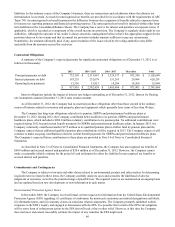

Changes in the allowance for credit losses on finance receivables were as follows (in thousands):

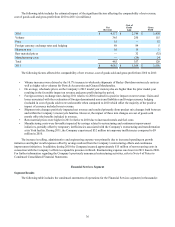

2011 2010

Balance, beginning of period $ 173,589 $ 150,082

Allowance related to newly consolidated finance receivables — 49,424

Provision for credit losses 17,031 93,118

Charge-offs, net of recoveries (65,171)(119,035)

Balance, end of period $ 125,449 $ 173,589

At December 31, 2011, the allowance for credit losses on finance receivables was $116.1 million for retail receivables

and $9.3 million for wholesale receivables. At December 31, 2010, the allowance for credit losses on finance receivables was

$157.8 million for retail receivables and $15.8 million for wholesale receivables.

As part of the January 1, 2010 adoption of the new accounting guidance within Accounting Standards Codification (ASC)

Topic 810 “Consolidations” and ASC Topic 860 “Transfers and Servicing”, the Company consolidated an initial allowance for

credit losses of $49.4 million related to the previously unconsolidated securitized finance receivables through an adjustment to

retained earnings. Subsequent changes in the provision for credit losses are included in the statement of operations.

HDFS’ periodic evaluation of the adequacy of the allowance for credit losses on finance receivables is generally based on

HDFS’ past loan loss experience, known and inherent risks in the portfolio, current economic conditions and the estimated

value of any underlying collateral. Please refer to Note 6 of Notes to Consolidated Financial Statements for further discussion

regarding the Company’s allowance for credit losses on finance receivables.

Other Matters