Harley Davidson 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.45

revolving asset-backed U.S. commercial paper conduit facility (U.S. Conduit) which provides for a total aggregate

commitment of $600.0 million. The agreement has terms that are similar to those of the prior agreement and is for the same

amount. At December 31, 2012 and 2011, HDFS had no outstanding borrowings under the U.S. Conduit.

This debt provides for interest on outstanding principal based on prevailing commercial paper rates, or LIBOR plus a

specified margin to the extent the advance is not funded by a conduit lender through the issuance of commercial paper. The U.S

Conduit also provides for an unused commitment fee based on the unused portion of the total aggregate commitment of $600.0

million. There is no amortization schedule; however, the debt is reduced monthly as available collections on the related finance

receivable collateral are applied to outstanding principal. Upon expiration of the U.S. Conduit, any outstanding principal will

continue to be reduced monthly through available collections. Unless earlier terminated or extended by mutual agreement of

HDFS and the lenders, as of December 31, 2012, the U.S. Conduit expires September 13, 2013.

HDFS is considered to have the power over the significant activities of the U.S. Conduit VIE due to its role as servicer.

Servicing fees are typically not considered potentially significant variable interests in a VIE. However, HDFS retains a residual

interest in the VIE in the form of a debt security, which gives HDFS the right to receive benefits that could be potentially

significant to the VIE. Therefore, the Company is the primary beneficiary and consolidates this VIE within its consolidated

financial statements.

Asset-Backed Canadian Commercial Paper Conduit Facility – In August 2012, HDFS entered into an agreement with

a Canadian bank-sponsored asset-backed commercial paper conduit facility (Canadian Conduit). Under the agreement, the

Canadian Conduit is contractually committed, at HDFS' option, to purchase from HDFS eligible Canadian retail motorcycle

finance receivables for proceeds up to C$200 million. The terms for this facility provide for interest on the outstanding

principal based on prevailing market interest rates plus a specified margin. The Canadian Conduit also provides for a program

fee and an unused commitment fee based on the unused portion of the total aggregate commitment of C$200 million. There is

no amortization schedule; however, the debt is reduced monthly as available collections on the related finance receivables are

applied to outstanding principal. Upon expiration of the Canadian Conduit, any outstanding principal will continue to be

reduced monthly through available collections. Unless earlier terminated or extended by mutual agreement of HDFS and the

lenders, as of December 31, 2012, the Canadian Conduit has an expiration date of August 30, 2013. The contractual maturity of

the debt is approximately 5 years.

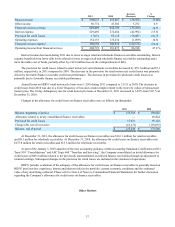

During 2012, HDFS transferred $230.0 million of Canadian retail motorcycle finance receivables to the Canadian

Conduit for proceeds of $201.3 million. HDFS maintains effective control over the transferred assets and therefore the

transaction does not meet accounting sale requirements under ASC Topic 860, "Transfers and Servicing". As such, this

transaction is treated as a secured borrowing. The transferred assets are restricted as collateral for the payment of the debt. At

December 31, 2012, $194.3 million of finance receivables and $11.7 million of cash were restricted as collateral for the

payment of $175.7 million of debt. Approximately $37.7 million of the debt was classified as current at December 31, 2012.

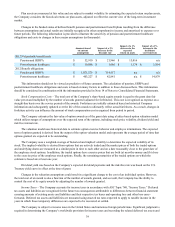

Term Asset-Backed Securitization VIEs – For all of its term asset-backed securitization transactions, HDFS transferred

U.S. retail motorcycle finance receivables to separate VIEs, which in turn issued secured notes, with various maturities and

interest rates to investors. All of the notes held by the VIEs are secured by future collections of the purchased U.S. retail

motorcycle finance receivables. The U.S. retail motorcycle finance receivables included in the term asset-backed securitization

transactions are not available to pay other obligations or claims of HDFS’ creditors until the associated debt and other

obligations are satisfied. Cash and cash equivalent balances held by the VIEs are used only to support the securitizations. There

is no amortization schedule for the secured notes; however, the debt is reduced monthly as available collections on the related

retail motorcycle finance receivables are applied to outstanding principal. The secured notes’ contractual lives have various

maturities ranging from 2013 to 2019.

HDFS is considered to have the power over the significant activities of its term asset-backed securitization VIEs due to

its role as servicer. Servicing fees are typically not considered potentially significant variable interests in a VIE. However,

HDFS retains a residual interest in the VIEs in the form of a debt security, which gives HDFS the right to receive benefits that

could be potentially significant to the VIE. Therefore, the Company is the primary beneficiary and consolidates all of these

VIEs within its consolidated financial statements.

During the third quarter of 2012, the Company issued $675.3 million of secured notes through one term asset-backed

securitization transaction. Additionally, during the second quarter of 2012, the Company issued $89.5 million of secured notes

through the sale of notes that had been previously retained as part of the December 2009, August 2011, and November 2011

term asset-backed securitization transactions. These notes were sold at a premium, and at December 31, 2012, the unaccreted