Harley Davidson 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

implemented projects under this plan involving the outsourcing of select information technology activities and the

consolidation of an administrative office in Michigan into its corporate headquarters in Milwaukee, Wisconsin.

The 2009 restructuring plan results in a reduction of approximately 2,700 to 2,900 hourly production positions and

approximately 800 non-production, primarily salaried positions within the Motorcycles segment and approximately 100

salaried positions in the Financial Services segment.

Under the 2009 Restructuring Plan, restructuring expenses consist of employee severance and termination costs,

accelerated depreciation on the long-lived assets that will be exited as part of the 2009 Restructuring Plan and other related

costs. The Company expects total costs related to the 2009 Restructuring Plan to result in restructuring and impairment

expenses of approximately $397 million, of which approximately 30% are expected to be non-cash. On a cumulative basis, the

Company has incurred $395.4 million of restructuring and impairment expense under the 2009 Restructuring Plan as of

December 31, 2012, of which $14.8 million was incurred during the year ended December 31, 2012.

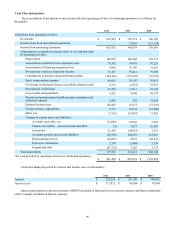

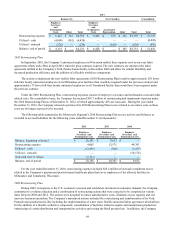

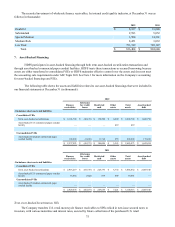

The following tables summarize the Company’s 2009 Restructuring Plan reserve activity and balances as recorded in

accrued liabilities for the following years ended December 31 (in thousands):

2012

Motorcycles & Related Products Financial Services Consolidated

Employee

Severance

and

Termination

Costs Accelerated

Depreciation Other Total

Employee

Severance

and

Termination

Costs Other Total Consolidated

Total

Balance, beginning of period $ 10,089 $ — $ — $ 10,089 $ — $ — $ — $ 10,089

Restructuring expense 4,099 — 13,154 17,253 — — — 17,253

Utilized – cash (6,566) — (12,993) (19,559) — — — (19,559)

Utilized – noncash — — — — — — — —

Noncash reserve release (2,426) — — (2,426) — — — (2,426)

Balance, end of period $ 5,196 $ — $ 161 $ 5,357 $ — $ — $ — $ 5,357

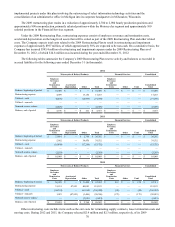

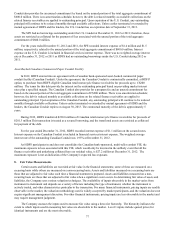

2011

Motorcycles & Related Products Financial Services Consolidated

Employee

Severance

and

Termination

Costs Accelerated

Depreciation Other Total

Employee

Severance

and

Termination

Costs Other Total Consolidated

Total

Balance, beginning of period $ 23,818 $ — $ 2,764 $ 26,582 $ — $ — $ — $ 26,582

Restructuring expense 5,062 — 34,470 39,532 — — — 39,532

Utilized – cash (16,498) — (37,234) (53,732) — — — (53,732)

Utilized – noncash — — — — — — — —

Noncash reserve release (2,293) — — (2,293) — — — (2,293)

Balance, end of period $ 10,089 $ — $ — $ 10,089 $ — $ — $ — $ 10,089

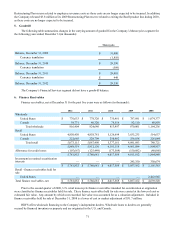

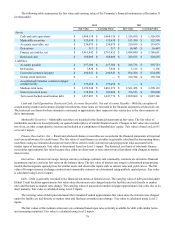

2010

Motorcycles & Related Products Financial Services Consolidated

Employee

Severance

and

Termination

Costs Accelerated

Depreciation Other Total

Employee

Severance

and

Termination

Costs Other Total Consolidated

Total

Balance, beginning of period $ 36,070 $ — $ 31,422 $ 67,492 $ 219 $ — $ 219 $ 67,711

Restructuring expense 31,119 47,923 40,083 119,125 — — — 119,125

Utilized – cash (44,394) — (61,514) (105,908) (44) — (44) (105,952)

Utilized – noncash 1,023 (47,923) (3,406) (50,306) (175) — (175) (50,481)

Noncash reserve release — — (3,821) (3,821) — — — (3,821)

Balance, end of period $ 23,818 $ — $ 2,764 $ 26,582 $ — $ — $ — $ 26,582

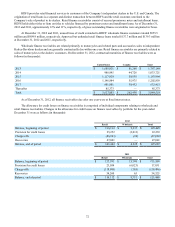

Other restructuring costs include items such as the exit costs for terminating supply contracts, lease termination costs and

moving costs. During 2012 and 2011, the Company released $2.4 million and $2.3 million, respectively, of its 2009