Harley Davidson 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

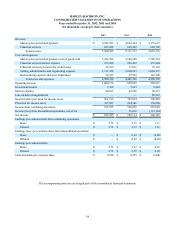

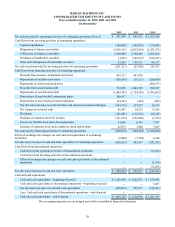

HARLEY-DAVIDSON, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Years ended December 31, 2012, 2011 and 2010

(In thousands)

2012 2011 2010

Net income $ 623,925 $ 599,114 $ 146,545

Other comprehensive income, net of tax

Foreign currency translation adjustment 1,400 (5,616) 9,449

Derivative financial instruments:

Unrealized net gains (losses) arising during the period (513)(966)(7,852)

Net losses (gains) reclassified into net income (9,631) 19,185 4,880

Total derivative financial instruments (10,144) 18,219 (2,972)

Marketable securities:

Unrealized gains (losses) on marketable securities 350 460 (133)

Net (gains) losses reclassified into net income — — —

Total marketable securities 350 460 (133)

Pension and postretirement benefit plans:

Amortization of net prior service (credit) cost (563)(564) 925

Amortization of actuarial loss 32,295 23,584 20,944

Pension and postretirement healthcare funded status adjustment (158,213)(146,768) 18,431

Actuarial loss reclassified into net income due to settlement 3,930 173 2,942

Prior service credit (cost) reclassified into net income due

to net curtailment loss — 1 (1,393)

Total pension and postretirement benefit plans $ (122,551) $ (123,574) $ 41,849

Total other comprehensive (loss) income, net of tax $ (130,945) $ (110,511) $ 48,193

Comprehensive income $ 492,980 $ 488,603 $ 194,738

The accompanying notes are an integral part of the consolidated financial statements.