Harley Davidson 2012 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

Outlook(1)

On January 29, 2013 the Company announced the following expectations for 2013.

The Company expects to ship 259,000 to 264,000 Harley-Davidson motorcycles during 2013, with 71,000 to 76,000

Harley-Davidson motorcycles expected to ship in the first quarter of 2013. The 2013 shipment estimates take several factors

into consideration, including new model-year 2013 and 2014 products, the continued success of outreach efforts in the U.S.,

the improved product availability in the U.S., continued expansion of the international distribution network and the strong

appeal of the Harley-Davidson brand. At the same time, the Company remains cautious on the world economies, in particular

in the U.S. and Europe.

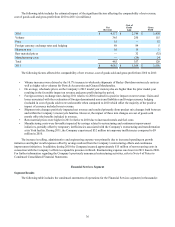

Shipment expectations for the first quarter of 2013 reflect an increase of approximately 10% to 18% compared to the

first quarter of 2012. This increase is expected to be supported by the new surge manufacturing capability launched at the

York, Pennsylvania (York) facility at the start of 2013. The surge manufacturing capabilities at York will rely on a new seasonal

workforce and will be supported by similar efforts at the Company's Wisconsin manufacturing facilities that supply York. The

surge manufacturing capability is expected to enable the Company to increase manufacturing capacity in the first half of 2013

to more closely match retail demand. As a result, U.S. retail inventory is expected to increase by the end of the first quarter as

dealers replenish inventory to prepare for the 2013 selling season.

The Company expects to implement surge manufacturing capabilities at its Kansas City, Missouri (Kansas City) facility

in 2014. Consequently, the Company expects U.S. retail inventory to be slightly lower on a year over year basis at the end of

2013 as dealers more closely align inventory with the seasonal low point for retail sales in advance of the expected surge

manufacturing capability at the Kansas City facility.

In addition, the Company expects full year 2013 gross margin to be between 35.25% and 36.25%. In 2013 gross margin

is expected to be positively impacted by approximately $25 million in incremental restructuring savings, approximately $16

million less in temporary inefficiencies, a lower fixed cost per unit on higher production and higher pricing. To a lesser extent,

gross margin is also expected to be favorably impacted by changes in product mix. However, these positive benefits are

expected to be offset by unfavorable currency impacts due in part to less favorable hedge positions, higher pension expense and

pressure on material costs.

The Company believes operating income from financial services in 2013 will be modestly lower than 2012 as the

business benefited from $17 million in credit loss allowance releases which may not repeat in 2013. In addition, the Company

expects changing consumer behavior, HDFS' funding of additional prudently structured loans in the near-prime and sub-prime

segments and lower recoveries resulting from lower charge-offs in prior periods to result in modestly higher credit losses in

2013.

The Company’s capital expenditure estimates for 2013 are between $200 million and $220 million. The Company

anticipates it will have the ability to fund all capital expenditures in 2013 with cash flows generated by operations.

The Company also announced on January 29, 2013 that it expects the full year 2013 effective income tax rate to be

approximately 34.8% for continuing operations which includes the impact of the reinstatement of the Federal Research and

Development tax credit with the enactment of the American Taxpayer Relief Act of 2012. This guidance excludes the effect of

any potential future adjustments such as changes in tax legislation or audit settlements which are recorded as discrete items in

the period in which they are settled.

Restructuring Activities(1)

2011 Restructuring Plans

In December 2011, the Company made a decision to cease operations at New Castalloy, its Australian subsidiary and

producer of cast motorcycle wheels and wheel hubs, and source those components through other existing suppliers. The

Company expects the transition of supply from New Castalloy to be complete in 2013. The decision to close New Castalloy

comes as part of the Company’s overall long term strategy to develop world-class manufacturing capability throughout the

Company by restructuring and consolidating operations for greater competitiveness, efficiency and flexibility. In connection

with the 2011 New Castalloy restructuring plan, the Company will reduce its workforce by approximately 200 employees by

the end of 2013.

In February 2011, the Company’s unionized employees at its facility in Kansas City, Missouri ratified a new seven-year

labor agreement. The new agreement took effect on August 1, 2011. The new contract is similar to the labor agreements ratified