Harley Davidson 2012 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

Under the financial covenants of the Global Credit Facilities, the consolidated debt to equity ratio of HDFS cannot

exceed 10.0 to 1.0. In addition, the Company must maintain a minimum interest coverage ratio of 2.25 to 1.0 for each fiscal

quarter ended through June 2013 and 2.5 to 1.0 for each fiscal quarter thereafter. No financial covenants are required under the

Notes or the U.S. or Canadian asset-backed commercial paper conduit facilities.

At December 31, 2012 and 2011, HDFS and the Company remained in compliance with all of these covenants.

13. Income Taxes

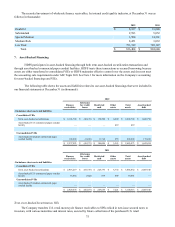

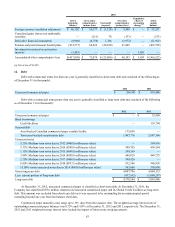

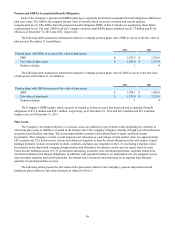

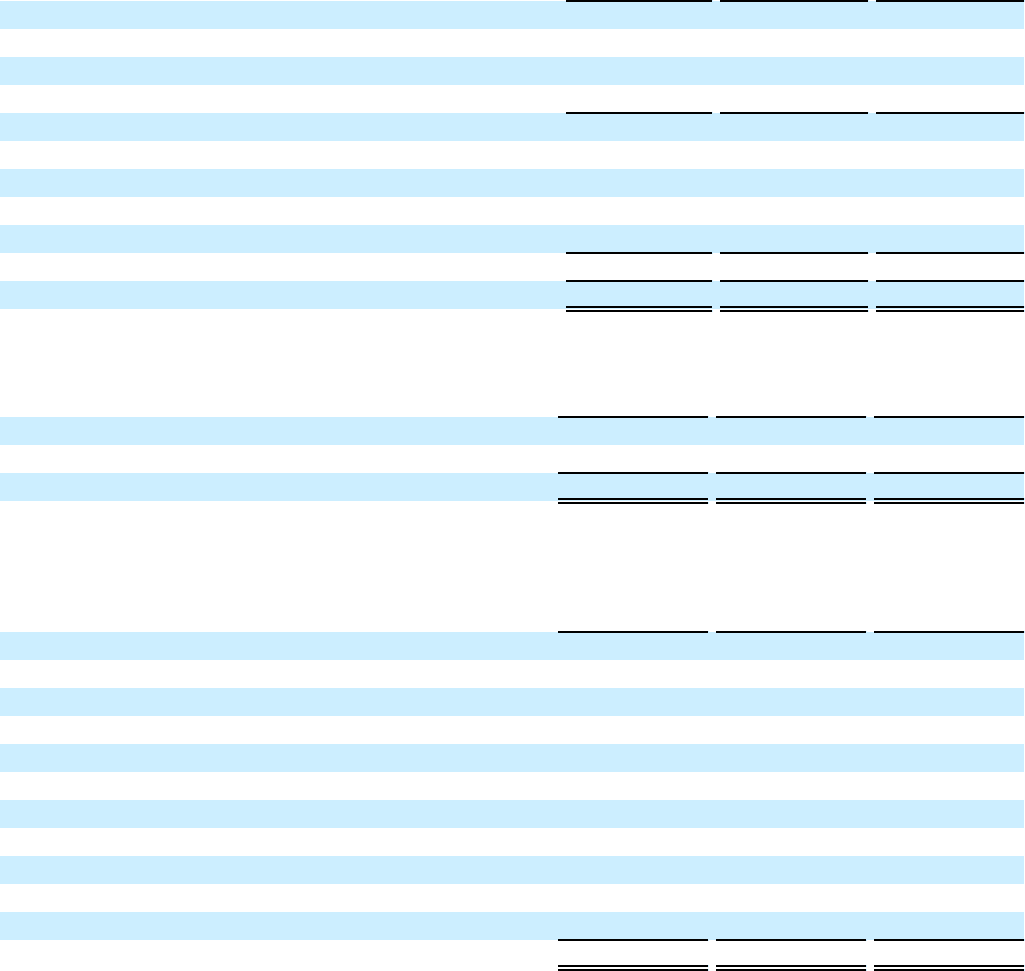

Provision for income taxes for the years ended December 31 consists of the following (in thousands):

2012 2011 2010

Current:

Federal $ 191,006 $ 135,232 $ 138,221

State 4,221 12,177 6,919

Foreign 13,189 5,776 4,486

208,416 153,185 149,626

Deferred:

Federal 121,934 104,723 (18,428)

State 7,697 (12,201)(1,361)

Foreign (460)(1,121) 963

129,171 91,401 (18,826)

Total $ 337,587 $ 244,586 $ 130,800

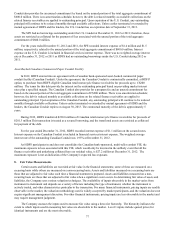

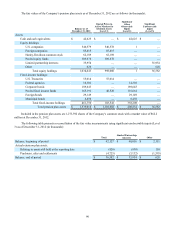

The components of income before income taxes for the years ended December 31 were as follows (in thousands):

2012 2011 2010

Domestic $ 946,592 $ 782,896 $ 377,416

Foreign 14,920 9,768 13,053

$ 961,512 $ 792,664 $ 390,469

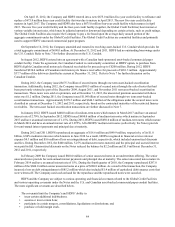

The provision for income taxes differs from the amount that would be provided by applying the statutory U.S. corporate

income tax rate due to the following items for the years ended December 31:

2012 2011 2010

Provision at statutory rate 35.0% 35.0% 35.0%

State taxes, net of federal benefit 1.6 1.6 1.0

Domestic manufacturing deduction (1.6)(1.8)(3.2)

Research and development credit — (0.6)(1.0)

Unrecognized tax benefits including interest and penalties 0.1 (1.1)(0.2)

Valuation allowance adjustments (0.3)(2.0) 0.7

Medicare Part D — — 3.4

Tax audit settlements (0.1)(1.1)(0.4)

Investments in low-income housing partnerships — — 0.6

Adjustments for previously accrued taxes (0.4) 0.3 (2.8)

Other 0.8 0.6 0.4

Provision for income taxes 35.1% 30.9% 33.5%