Harley Davidson 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

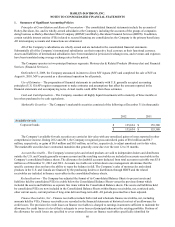

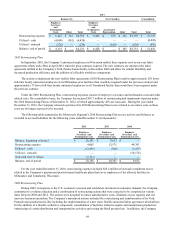

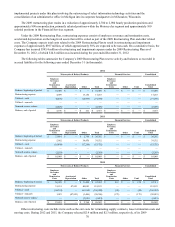

value adjusted for vested awards. Total share-based award compensation expense recognized by the Company during 2012,

2011 and 2010 was $40.8 million, $38.2 million and $30.4 million, respectively, or $25.7 million, $24.0 million and $19.2

million net of taxes, respectively.

Income Tax Expense – The Company recognizes interest and penalties related to unrecognized tax benefits in the

provision for income taxes.

New Accounting Standards

Accounting Standards Recently Adopted

In May 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No.

2011-4. "Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRS."

ASU No. 2011-04 clarifies the application of the existing guidance within Accounting Standards Codification (ASC) Topic 820,

"Fair Value Measurement", to ensure consistency between U.S. GAAP and International Financial Reporting Standards. ASU

No. 2011-04 also requires new disclosures about purchases, sales, issuances, and settlements related to Level 3 measurements

and also requires new disclosures around transfers into and out of Level 1 and 2 in the fair value hierarchy. The Company

adopted ASU No. 2011-04 on January 1, 2012. The required new disclosures are presented in Note 9.

In June 2011, the FASB issued ASU No. 2011-05, “Presentation of Comprehensive Income”. ASU No. 2011-05 amends

the guidance within ASC Topic 220, “Comprehensive Income”, to eliminate the option to present the components of other

comprehensive income as part of the statement of shareholders’ equity. ASU No. 2011-05 requires that all nonowner changes in

shareholders’ equity be presented either in a single continuous statement of comprehensive income or in two separate but

consecutive statements. The Company decided to present comprehensive income in two separate but consecutive statements.

The Company adopted ASU No. 2011-05 on January 1, 2012. The adoption of ASU No. 2011-05 and the Company’s decision

to present comprehensive income in two separate but consecutive statements required the presentation of an additional financial

statement, consolidated statements of comprehensive income, for all periods presented.

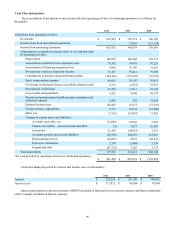

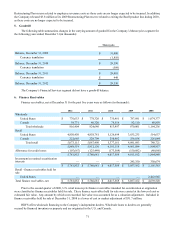

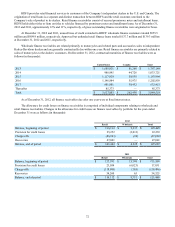

2. Additional Balance Sheet and Cash Flow Information

The following information represents additional detail for selected line items included in the consolidated balance sheets

at December 31 and the statements of cash flows for the years ended December 31.

Balance Sheet Information:

Inventories, net (in thousands):

2012 2011

Components at the lower of FIFO cost or market

Raw materials and work in process $ 111,335 $ 113,932

Motorcycle finished goods 205,660 226,261

Parts and accessories and general merchandise 122,418 121,340

Inventory at lower of FIFO cost or market 439,413 461,533

Excess of FIFO over LIFO cost (45,889)(43,527)

$ 393,524 $ 418,006

Inventory obsolescence reserves deducted from FIFO cost were $22.9 million and $24.8 million as of December 31, 2012

and 2011, respectively.