Harley Davidson 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.113

The material features of the union employees’ stock option awards are the same as those of the management employees’

stock option awards. Under the Company’s management and union plans, stock options have an exercise price equal to the fair

market value of the underlying stock at the date of grant and expire ten years from the date of grant. Beginning with awards

granted in 2010, stock options vest ratably over a three-year period with the first one-third of the grant becoming exercisable

one year after the date of grant. Awards granted prior to 2010 generally vested ratably over a four-year period, with the first 25

percent becoming exercisable one year after the date of grant.

The Director Compensation Policy provides non-employee Directors with compensation that includes an annual retainer

as well as a grant of share units. The payment of share units is deferred until a director ceases to serve as a director and the

share units are payable at that time in actual shares of Common Stock. The Director Compensation Policy also provides that a

non-employee Director may elect to receive 50% or 100% of the annual retainer to be paid in each calendar year in the form of

Common Stock based upon the fair market value of the Common Stock at the time of the annual meeting of shareholders. Each

Director must receive a minimum of one-half of his or her annual retainer in Common Stock until the Director reaches the

Director stock ownership guidelines defined below.

In August 2002, the Board approved “Director and Senior Executive Stock Ownership Guidelines” (Ownership

Guidelines) which were most recently revised in September 2012. The Ownership Guidelines stipulate that all Directors hold

15,000 shares of Common Stock and senior executives hold from 15,000 to 200,000 shares of the Common Stock depending on

their level. The Directors and senior executives have five years from the date they are elected a Director or promoted to a senior

executive to accumulate the appropriate number of shares of the Common Stock. Restricted stock, restricted stock units, shares

held in 401(k) accounts, vested unexercised stock options and stock appreciation rights, and shares of common stock held

directly count toward satisfying the guidelines.

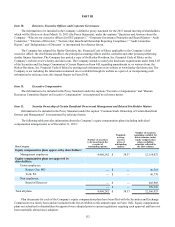

Item 13. Certain Relationships and Related Transactions, and Director Independence

The information to be included in the Proxy Statement under the caption “Certain Transactions” and “Corporate

Governance Principles and Board Matters – Independence of Directors” is incorporated by reference herein.

Item 14. Principal Accounting Fees and Services

The information to be included in the Proxy Statement under the caption “Ratification of Selection of Independent

Registered Public Accounting Firm – Fees Paid to Ernst & Young LLP” is incorporated by reference herein.