Harley Davidson 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

Restructuring Plan reserve related to employee severance costs as these costs are no longer expected to be incurred. In addition,

the Company released $3.8 million of its 2009 Restructuring Plan reserve related to exiting the Buell product line during 2010,

as these costs are no longer expected to be incurred.

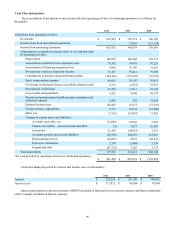

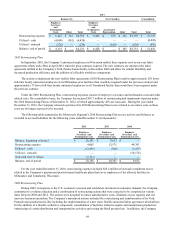

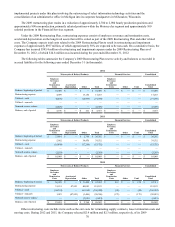

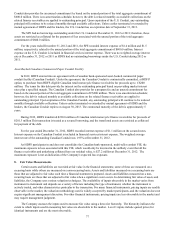

5. Goodwill

The following table summarizes changes in the carrying amount of goodwill in the Company’s Motorcycles segment for

the following years ended December 31(in thousands):

Motorcycles

Balance, December 31, 2009 $ 31,400

Currency translation (1,810)

Balance, December 31, 2010 $ 29,590

Currency translation (509)

Balance, December 31, 2011 $ 29,081

Currency translation $ 449

Balance, December 31, 2012 $ 29,530

The Company’s Financial Services segment did not have a goodwill balance.

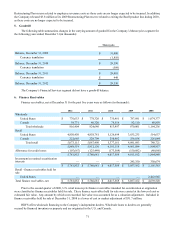

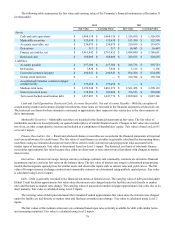

6. Finance Receivables

Finance receivables, net at December 31 for the past five years were as follows (in thousands):

2012 2011 2010 2009 2008

Wholesale

United States $ 776,633 $ 778,320 $ 735,481 $ 787,891 $ 1,074,377

Canada 39,771 46,320 78,516 82,110 89,859

Total wholesale 816,404 824,640 813,997 870,001 1,164,236

Retail

United States 4,850,450 4,858,781 5,126,699 3,835,235 514,637

Canada 222,665 228,709 250,462 256,658 226,084

Total retail 5,073,115 5,087,490 5,377,161 4,091,893 740,721

5,889,519 5,912,130 6,191,158 4,961,894 1,904,957

Allowance for credit losses (107,667) (125,449)(173,589)(150,082)(40,068)

5,781,852 5,786,681 6,017,569 4,811,812 1,864,889

Investment in retained securitization

interests — — — 245,350 330,674

$ 5,781,852 $ 5,786,681 $ 6,017,569 $ 5,057,162 $ 2,195,563

Retail - finance receivables held for

sale

United States — — — — 2,443,965

Total finance receivables, net $ 5,781,852 $ 5,786,681 $ 6,017,569 $ 5,057,162 $ 4,639,528

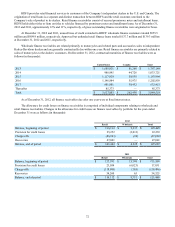

Prior to the second quarter of 2009, U.S. retail motorcycle finance receivables intended for securitization at origination

were classified as finance receivables held for sale. These finance receivables held for sale were carried at the lower of cost or

estimated fair value. Any amount by which cost exceeded fair value was accounted for as a valuation adjustment. Included in

finance receivables held for sale at December 31, 2008 is a lower of cost or market adjustment of $31.7 million.

HDFS offers wholesale financing to the Company’s independent dealers. Wholesale loans to dealers are generally

secured by financed inventory or property and are originated in the U.S. and Canada.