Harley Davidson 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

premium associated with these notes was $1.2 million. During 2011, the Company issued $1.09 billion of secured notes

through two term asset-backed securitization transactions.

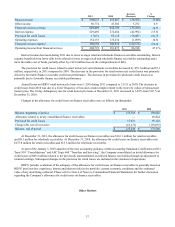

As of December 31, 2012, the assets of the VIEs totaled $2.28 billion, of which $2.10 billion of finance receivables and

$176.3 million of cash were restricted as collateral for the payment of $1.45 billion secured notes. Approximately $399.5

million of the obligations under the secured notes were classified as current at December 31, 2012, based on the contractual

maturities of the restricted finance receivables.

Intercompany Borrowings – HDFS has a revolving credit line with the Company whereby HDFS may borrow up to

$210.0 million from the Company at a market interest rate. As of December 31, 2012, 2011 and 2010, HDFS had no

outstanding borrowings owed to the Company under this agreement.

During the fourth quarter of 2012, HDFS and the Company entered into a $400.0 million Term Loan Agreement which

provides for monthly interest payments based on the prevailing commercial paper rates and principal due at maturity in January

2013 or upon earlier demand by the Company.

Intercompany loan balances and related interest are eliminated in the Company’s consolidated financial statements.

Support Agreeement - The Company has a support agreement with HDFS whereby, if required, the Company agrees to

provide HDFS with financial support in order to maintain HDFS’ fixed-charge coverage at 1.25 and minimum net worth of

$40.0 million. Support may be provided at the Company’s option as capital contributions or loans. Accordingly, certain debt

covenants may restrict the Company’s ability to withdraw funds from HDFS outside the normal course of business. No amount

has ever been provided to HDFS under the support agreement.

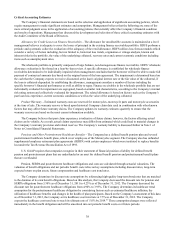

Operating and Financial Covenants – HDFS and the Company are subject to various operating and financial covenants

related to the Global Credit Facilities and various operating covenants under the Notes and the U.S. and Canadian asset-backed

commercial paper conduit facilities. The more significant covenants are described below.

The covenants limit the Company’s and HDFS’ ability to:

• incur certain additional indebtedness;

• assume or incur certain liens;

• participate in certain mergers, consolidations, liquidations or dissolutions; and

• purchase or hold margin stock.

Under the financial covenants of the Global Credit Facilities, the consolidated debt to equity ratio of HDFS cannot

exceed 10.0 to 1.0. In addition, the Company must maintain a minimum interest coverage ratio of 2.25 to 1.0 for each fiscal

quarter through June 2013 and 2.5 to 1.0 for each fiscal quarter thereafter. No financial covenants are required under the Notes

or the U.S. or Canadian asset-backed commercial paper conduit facilities.

At December 31, 2012, 2011 and 2010, HDFS and the Company remained in compliance with all of the existing

covenants.

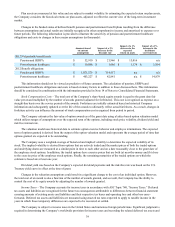

Cash Flows from Discontinued Operations

There were no cash flows from discontinued operations during 2012 and 2011. During the year ended December 31,

2010, cash flows from discontinued operations were a net cash outflow of $72.3 million.

Cautionary Statements

The Company’s ability to meet the targets and expectations noted depends upon, among other factors, the Company’s

ability to:

(i) execute its business strategy,

(ii) adjust to fluctuations in foreign currency exchange rates, interest rates and commodity prices,

(iii) manage through inconsistent economic conditions, including changing capital, credit and retail markets,