Harley Davidson 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

3. Discontinued Operations

In October 2009, the Company unveiled a new business strategy to drive growth through a focus of efforts and resources

on the unique strengths of the Harley-Davidson brand and to enhance productivity and profitability through continuous

improvement. The Company’s Board of Directors approved and the Company committed to the divestiture of MV as part of

this strategy. The Company engaged a third party investment bank to assist with the marketing and sale of MV. During 2009,

the Company recorded pre-tax impairment charges of $115.4 million related to MV and a net tax benefit of $40 million related

to losses estimated in connection with the sale of MV. As of December 31, 2009, the Company estimated the total tax benefit

associated with the losses related to the sale of MV to be $66 million of which $26 million was deemed uncertain and

appropriately reserved against.

At each subsequent reporting date in 2010 through the date of sale of MV in August 2010, the fair value less selling costs

was re-assessed and additional impairment charges totaling $111.8 million and additional tax benefits totaling $18 million were

recognized in 2010. As the effort to sell MV progressed into 2010, adverse factors led to decreases in the fair value of MV.

During 2010, challenging economic conditions continued to persist, negatively impacting the appetite of prospective buyers

and the motorcycle industry as a whole. Information coming directly from the selling process, including discussions with the

prospective buyers, indicated a fair value that was less than previously estimated.

On August 6, 2010, the Company concluded its sale of MV to MV Augusta Motor Holding S.r.l., a company controlled

by the former owner of MV. Under the agreement relating to the sale, (1) the Company received nominal consideration in

return for the transfer of MV and related assets; (2) the parties waived their respective rights under the stock purchase

agreement and other documents related to the Company’s purchase of MV in 2008, which included a waiver of the former

owner’s right to contingent earn-out consideration; and (3) the Company contributed 20 million Euros to MV as operating

capital. The 20 million Euros contributed were factored into the Company’s estimate of MV’s fair value prior to the sale and

were recognized in the 2010 impairment charges discussed above. As a result of the impairment charges recorded prior to the

sale, the Company only incurred an immaterial loss on the date of sale, which was included in the loss from discontinued

operations, net of tax, during the year ended December 31, 2010.

As of August 6, 2010, assets and liabilities of discontinued operations that were sold consisted of $0.6 million of accounts

receivable, net; $3.6 million of inventories; $14.3 million of other assets; $41.7 million of accounts payable and accrued

liabilities and $16.6 million of other liabilities.

As of December 31, 2010, the Company’s estimated total tax benefit associated with the loss on the sale of MV was $101

million, of which $43.5 million was deemed uncertain and appropriately reserved against. As a result, the total cumulative net

tax benefit recognized as of December 31, 2010 was $57.5 million. The increase in the estimated tax benefit during 2010 was

driven by an increase in the losses related to the sale of MV, not a change in the tax position.

In determining the tax benefit recognized from October 2009 through December 2010, the Company engaged appropriate

technical expertise and considered all relevant available information. In accordance with ASC 740, “Income Taxes,” at each

balance sheet date during this period, the Company re-evaluated the overall tax benefit, determined that it was at least more

likely than not that it would be sustained upon review and calculated the amount of recognized tax benefit based on a

cumulative probability basis.

Beginning in 2010, the Company voluntarily elected to participate in a pre-filing agreement process with the Internal

Revenue Service (IRS) in order to accelerate the IRS' review of the Company’s tax position related to MV. The IRS effectively

completed its review in late 2011 and executed a Closing Agreement on Final Determination Covering Specific Matters with

the Company.

There were no changes to the Company’s estimated gross or recognized tax benefit associated with the loss on the sale of

MV during the first three quarters of 2011. In the fourth quarter of 2011, given the outcome of the closing agreement, the

Company recognized a $43.5 million tax benefit by reversing the reserve recorded as of September 25, 2011 and recognized an

incremental $7.5 million tax benefit related to the final calculation of the tax basis in the loan to and the stock of MV.

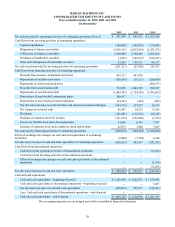

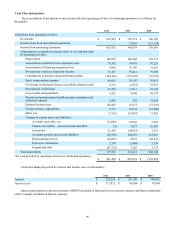

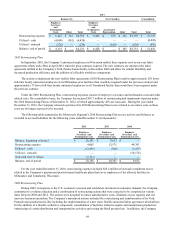

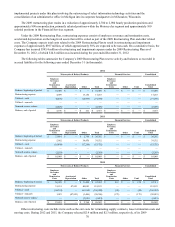

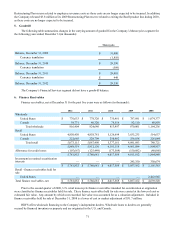

The following table summarizes the net revenue, pre-tax loss, net income (loss) and earnings (loss) per common share

from discontinued operations for the following years ended December 31 (in thousands except per share amounts):