Harley Davidson 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

Level 2 inputs include quoted prices for similar assets and observable inputs such as interest rates, foreign currency

exchange rates, commodity rates and yield curves. The Company uses the market approach to derive the fair value for its level

2 fair value measurements. Foreign currency exchange contracts are valued using publicly quoted spot and forward prices;

commodity contracts are valued using publicly quoted prices, where available, or dealer quotes; interest rate swaps are valued

using publicized swap curves; and investments in marketable debt and equity securities are valued using publicly quoted prices.

Level 3 inputs are not observable in the market and include management's judgments about the assumptions market

participants would use in pricing the asset or liability. The use of observable and unobservable inputs is reflected in the

hierarchy assessment disclosed in the following tables.

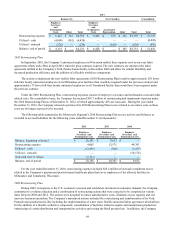

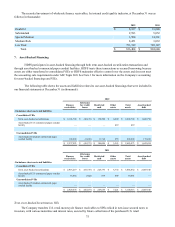

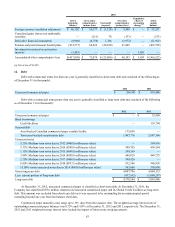

Recurring Fair Value Measurements

The following tables present information about the Company’s assets and liabilities measured at fair value on a recurring

basis as of December 31 (in thousands):

Balance as of

2012

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Assets:

Cash equivalents $ 852,979 $ 690,691 $ 162,288 $ —

Marketable securities 135,634 — 135,634 —

Derivatives 317 — 317 —

$ 988,930 $ 690,691 $ 298,239 $ —

Liabilities:

Derivatives $ 7,920 $ — $ 7,920 $ —

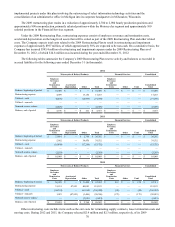

Balance as of

2011

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Assets:

Cash equivalents $ 1,302,367 $ 1,122,375 $ 179,992 $ —

Marketable securities 153,380 — 153,380 —

Derivatives 16,443 — 16,443 —

$ 1,472,190 $ 1,122,375 $ 349,815 $ —

Liabilities:

Derivatives $ 5,136 $ — $ 5,136 $ —

The hierarchy classification for cash equivalents, in 2011, totaling $180 million has been revised from level 1 to level 2.

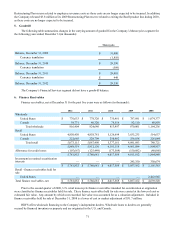

9. Fair Value of Financial Instruments

The Company’s financial instruments consist primarily of cash and cash equivalents, marketable securities, trade

receivables, finance receivables, net, trade payables, debt, foreign currency contracts and interest rate swaps (derivative

instruments are discussed further in Note 10). Under U.S. GAAP certain of these items are required to be recorded in the

financial statements at fair value, while others are required to be recorded at historical cost.