Harley Davidson 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.61

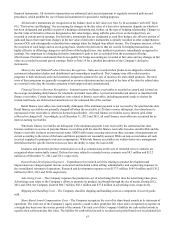

impairment. The unspecified portion of the allowance covers estimated losses on finance receivables which are collectively

reviewed for impairment. Finance receivables are considered impaired when management determines it is probable that the

Company will be unable to collect all amounts due according to the terms of the loan agreement.

The retail portfolio primarily consists of a large number of small balance, homogeneous finance receivables. HDFS

performs a periodic and systematic collective evaluation of the adequacy of the retail allowance for credit losses. HDFS utilizes

loss forecast models which consider a variety of factors including, but not limited to, historical loss trends, origination or

vintage analysis, known and inherent risks in the portfolio, the value of the underlying collateral, recovery rates and current

economic conditions including items such as unemployment rates. Retail finance receivables are not evaluated individually for

impairment prior to charge-off and therefore are not reported as impaired loans.

The wholesale portfolio is primarily composed of large balance, non-homogeneous loans. The Company’s wholesale

allowance evaluation is first based on a loan-by-loan review. A specific allowance for credit losses is established for wholesale

finance receivables determined to be individually impaired when management concludes that the borrower will not be able to

make full payment of contractual amounts due based on the original terms of the loan agreement. The impairment is determined

based on the cash that the Company expects to receive discounted at the loan’s original interest rate or the fair value of the

collateral, if the loan is collateral-dependent. In establishing the allowance, management considers a number of factors

including the specific borrower’s financial performance as well as ability to repay. As described below in the Financial Services

Revenue Recognition policy, the accrual of interest on such finance receivables is discontinued when the collection of the

account becomes doubtful. While a finance receivable is considered impaired, all cash received is applied to principal or

interest as appropriate.

Finance receivables in the wholesale portfolio that are not individually evaluated for impairment are segregated, based on

similar risk characteristics, according to the Company’s internal risk rating system and collectively evaluated for impairment.

The related allowance is based on factors such as the Company’s past loan loss experience, current economic conditions as well

as the value of the underlying collateral.

Impaired finance receivables also include loans that have been modified in troubled debt restructurings as a concession to

borrowers experiencing financial difficulty. Generally, it is the Company’s policy not to change the terms and conditions of

finance receivables. However, to minimize the economic loss the Company may modify certain impaired finance receivables in

troubled debt restructurings. Total restructured finance receivables are not significant.

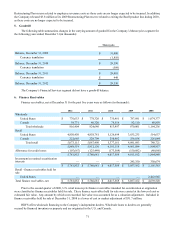

Repossessed inventory is recorded at the lower of cost or net realizable value and is reclassified from finance receivables

to other current assets with any related loss recognized as a charge against the allowance for credit losses on finance receivables

in the period during which the asset was transferred. Repossessed inventory was $11.9 million and $14.5 million at

December 31, 2012 and 2011, respectively.

Asset-Backed Financing – HDFS participates in asset-backed financing through both term asset-backed securitization

transactions and through asset-backed commercial paper conduit facilities. HDFS treats these transactions as secured borrowing

because either they are transferred to consolidated VIEs or HDFS maintains effective control over the assets and does not meet

the accounting sale requirements under ASC Topic 860, "Transfers and Servicing." In HDFS' asset-backed financing programs,

HDFS transfers retail motorcycle finance receivables to special purpose entities (SPE), which are considered VIEs under U.S.

GAAP. Each SPE then converts those assets into cash, through the issuance of debt.

HDFS is required to consolidate any VIEs in which it is deemed to be the primary beneficiary through having power over

the significant activities of the entity and having an obligation to absorb losses or the right to receive benefits from the VIE

which are potentially significant to the VIE. HDFS is considered to have the power over the significant activities of its term

asset-backed securitization and asset-backed U.S. commercial paper conduit facility VIEs due to its role as servicer. Servicing

fees are typically not considered potentially significant variable interests in a VIE. However, HDFS retains a residual interest in

the VIEs in the form of a debt security, which gives HDFS the right to receive benefits that could be potentially significant to

the VIE. Therefore, the Company is the primary beneficiary and consolidates all of these VIEs within its consolidated financial

statements.

HDFS is not the primary beneficiary of the asset-backed Canadian commercial paper conduit facility VIE; therefore,

HDFS does not consolidate the VIE. However, HDFS treats the conduit facility as a secured borrowing as it maintains

effective control over the assets transferred to the VIE and therefore does not meet the requirements for sale accounting under

ASC Topic 860. As such, the Company retains the transferred assets and the related debt within its Consolidated Balance

Sheet.