Harley Davidson 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

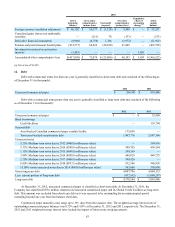

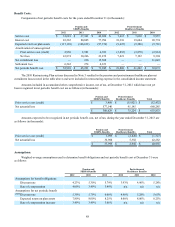

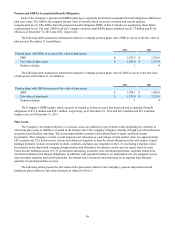

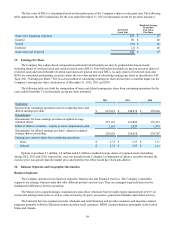

This healthcare cost trend rate assumption can have a significant effect on the amounts reported. A one-percentage-point

change in the assumed healthcare cost trend rate would have the following effects (in thousands):

One

Percent

Increase

One

Percent

Decrease

Total of service and interest cost components in 2012 $ 814 $ (789)

Accumulated benefit obligation as of December 31, 2012 $ 14,879 $ (13,948)

Future Contributions and Benefit Payments:

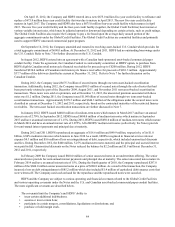

In January 2013, the Company voluntarily contributed $175.0 million to further fund its qualified pension plans. No

additional pension plan contributions are required in 2013. The Company expects it will continue to make on-going

contributions related to current benefit payments for SERPA and postretirement healthcare plans in 2013(1).

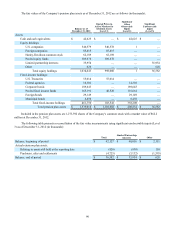

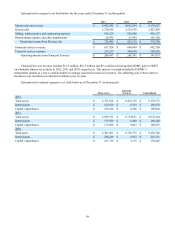

The expected benefit payments and Medicare subsidy receipts for the next five years and thereafter are as follows (in

thousands):

Pension

Benefits SERPA

Benefits

Postretirement

Healthcare

Benefits

Medicare

Subsidy

Receipts

2013 $ 66,638 $ 2,262 $ 30,054 $ 1,418

2014 $ 67,587 $ 2,725 $ 30,449 $ 1,639

2015 $ 68,536 $ 1,611 $ 30,735 $ 1,851

2016 $ 70,042 $ 1,691 $ 30,247 $ 2,104

2017 $ 72,095 $ 2,113 $ 29,679 $ 2,301

2018-2022 $ 414,800 $ 12,346 $ 146,714 $ 15,240

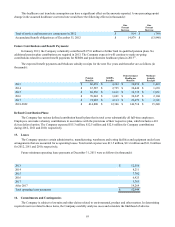

Defined Contribution Plans:

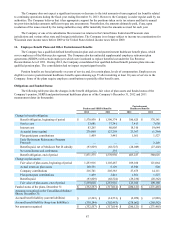

The Company has various defined contribution benefit plans that in total cover substantially all full-time employees.

Employees can make voluntary contributions in accordance with the provisions of their respective plan, which includes a 401

(k) tax deferral option. The Company expensed $15.3 million, $12.5 million and $12.6 million for Company contributions

during 2012, 2011 and 2010, respectively.

15. Leases

The Company operates certain administrative, manufacturing, warehouse and testing facilities and equipment under lease

arrangements that are accounted for as operating leases. Total rental expense was $13.5 million, $11.6 million and $11.0 million

for 2012, 2011 and 2010, respectively.

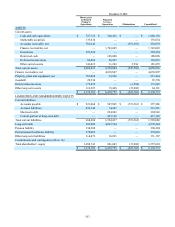

Future minimum operating lease payments at December 31, 2011 were as follows (in thousands):

2013 $ 12,556

2014 8,211

2015 7,702

2016 6,423

2017 3,783

After 2017 14,269

Total operating lease payments $ 52,944

16. Commitments and Contingencies

The Company is subject to lawsuits and other claims related to environmental, product and other matters. In determining

required reserves related to these items, the Company carefully analyzes cases and considers the likelihood of adverse