Harley Davidson 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

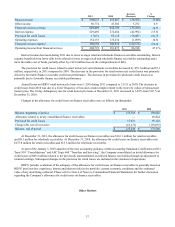

liabilities. In the ordinary course of the Company’s business, there are transactions and calculations where the ultimate tax

determination is uncertain. Accruals for unrecognized tax benefits are provided for in accordance with the requirements of ASC

Topic 740. An unrecognized tax benefit represents the difference between the recognition of benefits related to exposure items

for income tax reporting purposes and financial reporting purposes. The unrecognized tax benefit is included within other long-

term liabilities in the Consolidated Balance Sheets. The Company has a reserve for interest and penalties on exposure items, if

applicable, which is recorded as a component of the overall income tax provision. The Company is regularly under audit by tax

authorities. Although the outcome of tax audits is always uncertain, management believes that it has appropriate support for the

positions taken on its tax returns and that its annual tax provision includes amounts sufficient to pay any assessments.

Nonetheless, the amounts ultimately paid, if any, upon resolution of the issues raised by the taxing authorities may differ

materially from the amounts accrued for each year.

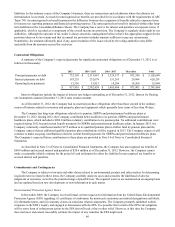

Contractual Obligations

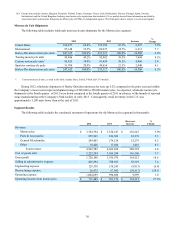

A summary of the Company’s expected payments for significant contractual obligations as of December 31, 2012 is as

follows (in thousands):

2013 2014 - 2015 2016 - 2017 Thereafter Total

Principal payments on debt $ 732,105 $ 2,113,867 $ 1,324,137 $ 932,540 $ 5,102,649

Interest payments on debt 193,255 252,679 151,263 29,094 626,291

Operating lease payments 12,556 15,913 10,206 14,269 52,944

$ 937,916 $ 2,382,459 $ 1,485,606 $ 975,903 $ 5,781,884

Interest obligations include the impact of interest rate hedges outstanding as of December 31, 2012. Interest for floating

rate instruments assumes December 31, 2012 rates remain constant.

As of December 31, 2012, the Company had no material purchase obligations other than those created in the ordinary

course of business related to inventory and property, plant and equipment which generally have terms of less than 90 days.

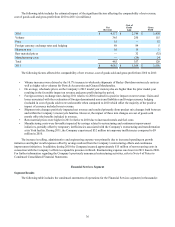

The Company has long-term obligations related to its pension, SERPA and postretirement healthcare plans at

December 31, 2012. During 2012, the Company contributed $244.4 million to its pension, SERPA and postretirement

healthcare plans, which included a $200.0 million voluntary contribution to its pension plan. No additional contributions were

required during 2012 beyond current benefit payments for SERPA and postretirement healthcare plans. In January 2013, the

Company voluntarily contributed another $175 million to its qualified pension plan to further fund its pension plan and the

Company expects that no additional qualified pension plan contributions will be required in 2013. The Company expects it will

continue to make on-going contributions related to current benefit payments for SERPA and postretirement healthcare plans.

The Company’s expected future contributions to these plans are provided in Note 14 of Notes to Consolidated Financial

Statements.

As described in Note 13 of Notes to Consolidated Financial Statements, the Company has unrecognized tax benefits of

$48.8 million and accrued interest and penalties of $20.6 million as of December 31, 2012. However, the Company cannot

make a reasonably reliable estimate for the period of cash settlement for either the liability for unrecognized tax benefits or

accrued interest and penalties.

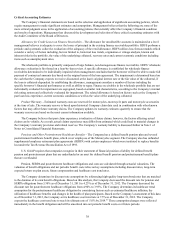

Commitments and Contingencies

The Company is subject to lawsuits and other claims related to environmental, product and other matters. In determining

required reserves related to these items, the Company carefully analyzes cases and considers the likelihood of adverse

judgments or outcomes, as well as the potential range of possible loss. The required reserves are monitored on an ongoing basis

and are updated based on new developments or new information in each matter.

Environmental Protection Agency Notice

In December 2009, the Company received formal, written requests for information from the United States Environmental

Protection Agency (EPA) regarding: (i) certificates of conformity for motorcycle emissions and related designations and labels,

(ii) aftermarket parts, and (iii) warranty claims on emissions related components. The Company promptly submitted written

responses to the EPA’s inquiry and engaged in discussions with the EPA. It is possible that a result of the EPA’s investigation

will be some form of enforcement action by the EPA that will seek a fine or other relief. However, at this time the Company

does not know and cannot reasonably estimate the impact of any remedies the EPA might seek.