Harley Davidson 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

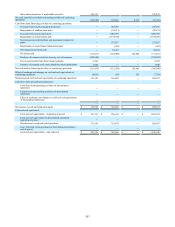

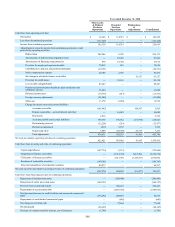

Sales and redemptions of marketable securities 130,121 — — 130,121

Net cash (used by) provided by investing activities of continuing

operations (192,520) 126,643 2,335 (63,542)

Cash flows from financing activities of continuing operations:

Proceeds from issuance medium-term notes — 447,076 — 447,076

Repayments of medium-term notes — (59,211) — (59,211)

Proceeds from securitization debt — 1,082,599 — 1,082,599

Repayments of securitization debt — (1,754,568) — (1,754,568)

Net increase in credit facilities and unsecured commercial

paper — 237,827 — 237,827

Repayments of asset-backed commercial paper — (483) — (483)

Net change in restricted cash — 59,232 — 59,232

Dividends paid (111,011) (125,000) 125,000 (111,011)

Purchase of common stock for treasury, net of issuances (224,548) — — (224,548)

Excess tax benefits from share based payments 6,303 — — 6,303

Issuance of common stock under employee stock option plans 7,840 — — 7,840

Net cash used by financing activities of continuing operations (321,416) (112,528) 125,000 (308,944)

Effect of exchange rate changes on cash and cash equivalents of

continuing operations (8,021) (85) 318 (7,788)

Net decrease in cash and cash equivalents of continuing operations 151,539 353,478 — 505,017

Cash flows from discontinued operations:

Cash flows from operating activities of discontinued

operations ————

Cash flows from investing activities of discontinued

operations ————

Effect of exchange rate changes on cash and cash equivalents

of discontinued operations ————

————

Net increase in cash and cash equivalents $ 151,539 $ 353,478 $ — $ 505,017

Cash and cash equivalents:

Cash and cash equivalents – beginning of period $ 791,791 $ 230,142 $ — $ 1,021,933

Cash and cash equivalents of discontinued operations –

beginning of period ————

Net decrease in cash and cash equivalents 151,539 353,478 — 505,017

Less: Cash and cash equivalents of discontinued operations –

end of period ————

Cash and cash equivalents – end of period $ 943,330 $ 583,620 $ — $ 1,526,950