Harley Davidson 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10

Financial Services

HDFS is engaged in the business of financing and servicing wholesale inventory receivables and retail consumer loans,

primarily for the purchase of Harley-Davidson motorcycles. HDFS is an agent for certain unaffiliated insurance companies

providing property/casualty insurance and also sells extended service contracts, gap coverage and debt protection products to

motorcycle owners. HDFS conducts business principally in the United States and Canada, and primarily through certain

subsidiaries such as Harley-Davidson Credit Corp., Eaglemark Savings Bank, Harley-Davidson Insurance Services, Inc., and

Harley-Davidson Financial Services Canada, Inc.

Wholesale Financial Services – HDFS provides wholesale financial services to Harley-Davidson dealers and distributors,

including floorplan and open account financing of motorcycles and motorcycle parts and accessories. HDFS offers wholesale

financial services to Harley-Davidson dealers in the United States and Canada, and during 2012 approximately 97% of such

dealers utilized those services. HDFS also offers financial services to the Harley-Davidson distributor in Canada. The

wholesale finance operations of HDFS are located in Plano, Texas.

Retail Financial Services – HDFS provides retail financing to consumers, consisting primarily of installment lending for

the purchase of new and used Harley-Davidson motorcycles. HDFS’ retail financial services are available through most Harley-

Davidson dealers in the United States and Canada. HDFS’ retail finance operations are principally located in Carson City,

Nevada and Plano, Texas.

Insurance Services – HDFS operates an insurance agency that offers point-of-sale protection products to Harley-

Davidson dealers in both the U.S. and Canada, including motorcycle insurance, extended service contracts, credit protection

and motorcycle maintenance protection. HDFS also direct-markets motorcycle insurance to owners of Harley-Davidson

motorcycles. In addition, HDFS markets a comprehensive package of business insurance coverages and services to owners of

Harley-Davidson dealerships. The HDFS insurance operations are located in Carson City, Nevada and Chicago, Illinois.

Funding – The Company believes a diversified and cost effective funding strategy is important to meet HDFS’ goal of

providing credit while delivering appropriate returns and profitability. Financial Services operations have been funded with

unsecured debt, unsecured commercial paper, asset-backed commercial paper conduit facilities, committed unsecured bank

facilities, term asset-backed securitizations and intercompany borrowings.

Competition – The Company regards its ability to offer a package of wholesale and retail financial services in the U.S.

and Canada as a significant competitive advantage. Competitors in the financial services industry compete for business based

largely on price and, to a lesser extent, service. HDFS competes on convenience, service, brand association, dealer relations,

industry experience, terms and price.

In the United States, HDFS financed 50.9% of the new Harley-Davidson motorcycles retailed by independent dealers

during 2012, as compared to 51.0% in 2011. In Canada, HDFS financed 28.6% of the new Harley-Davidson motorcycles

retailed by independent dealers during 2012, as compared to 30.4% in 2011. Competitors for retail motorcycle finance business

are primarily banks, credit unions and other financial institutions. In the motorcycle insurance business, competition primarily

comes from national insurance companies and from insurance agencies serving local or regional markets. For insurance-related

products such as extended service contracts, HDFS faces competition from certain regional and national industry participants as

well as dealer in-house programs. Competition for the wholesale motorcycle finance business primarily consists of banks and

other financial institutions providing wholesale financing to Harley-Davidson dealers in their local markets.

Trademarks – HDFS uses various trademarks and trade names for its financial services and products which are licensed

from H-D U.S.A., LLC, including HARLEY-DAVIDSON, H-D and the Bar & Shield logo.

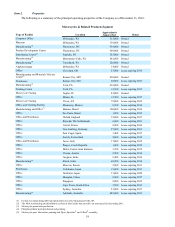

Seasonality – In the U.S. and Canada, motorcycles are primarily used during warmer months. Accordingly, HDFS

experiences seasonal variations in wholesale and retail financing activities. In general, from mid-March through August, retail

financing volume increases while wholesale financing volume decreases as dealer inventories decline. From September through

mid-March, there is generally a decrease in retail financing volume while dealer inventories generally build and turn over more

slowly, thereby increasing wholesale finance receivables. As discussed under Motorcycle and Related - Products Seasonality,

the Company is implementing flexible production capabilities which may reduce the seasonality of dealer inventory levels.

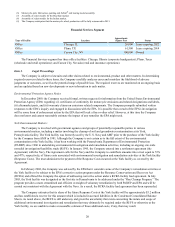

Regulation – The operations of HDFS (both U.S. and foreign) are subject, in certain instances, to supervision and

regulation by state and federal administrative agencies and various foreign governmental authorities. Many of the statutory and

regulatory requirements imposed by such entities are in place to provide consumer protection as it pertains to the selling and

ongoing servicing of financial products and services. Therefore, operations may be subject to various regulations, laws and

judicial and/or administrative decisions imposing requirements and restrictions, which among other things: (a) regulate credit