Harley Davidson 2012 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

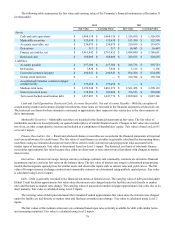

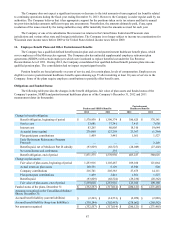

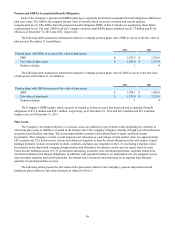

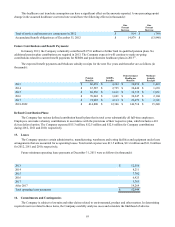

Pension and SERPA Accumulated Benefit Obligation:

Each of the Company’s pension and SERPA plans has a separately determined accumulated benefit obligation (ABO) and

plan asset value. The ABO is the actuarial present value of benefits based on service rendered and current and past

compensation levels. This differs from the projected benefit obligation (PBO) in that it includes no assumption about future

compensation levels. The total ABO for all the Company’s pension and SERPA plans combined was $1.73 billion and $1.46

billion as of December 31, 2012 and 2011, respectively.

The following table summarizes information related to Company pension plans with a PBO in excess of the fair value of

plan assets at December 31 (in millions):

2012 2011

Pension plans with PBOs in excess of fair value of plan assets:

PBO $ 1,833.8 $ 1,530.0

Fair value of plan assets $ 1,539.0 $ 1,253.9

Number of plans 1 4

The following table summarizes information related to Company pension plans with an ABO in excess of the fair value

of plan assets at December 31 (in millions):

2012 2011

Pension plans with ABOs in excess of fair value of plan assets:

ABO $ 1,708.1 $ 1,436.8

Fair value of plan assets $ 1,539.0 $ 1,253.9

Number of plans 1 4

The Company’s SERPA plans, which can only be funded as claims are paid, had projected and accumulated benefit

obligations of $37.8 million and $20.1 million, respectively, as of December 31, 2012 and $41.0 million and $27.4 million,

respectively, as of December 31, 2011.

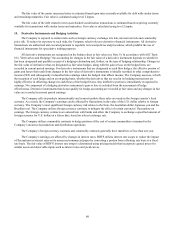

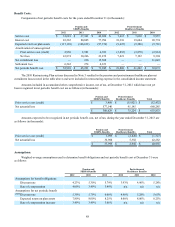

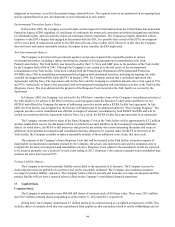

Plan Assets:

The Company’s investment objective is to ensure assets are sufficient to pay benefits while mitigating the volatility of

retirement plan assets or liabilities recorded in the balance sheet. The company mitigates volatility through asset diversification

and partial asset/liability matching. The investment portfolio contains a diversified blend of equity and fixed-income

investments. The Company’s current overall targeted asset allocation as a percentage of total market value was approximately

68% equities and 32% fixed-income. Assets are rebalanced regularly to keep the actual allocation in line with targets. Equity

holdings primarily include investments in small-, medium- and large-cap companies in the U.S. (including Company stock),

investments in developed and emerging foreign markets and alternative investments such as private equity and real estate.

Fixed-income holdings consist of U.S. government and agency securities, state and municipal bonds, corporate bonds from

diversified industries and foreign obligations. In addition, cash equivalent balances are maintained at levels adequate to meet

near-term plan expenses and benefit payments. Investment risk is measured and monitored on an ongoing basis through

quarterly investment portfolio reviews.

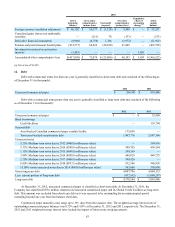

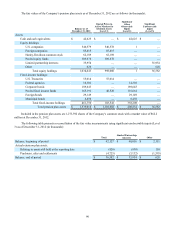

The following tables present the fair values of the plan assets related to the Company’s pension and postretirement

healthcare plans within the fair value hierarchy as defined in Note 8.