Harley Davidson 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

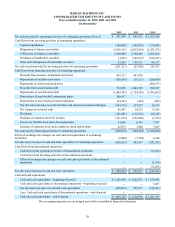

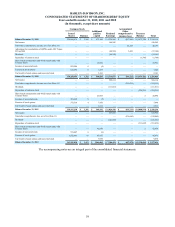

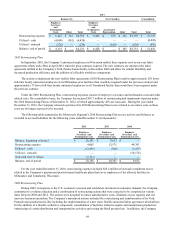

HARLEY-DAVIDSON, INC.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Years ended December 31, 2012, 2011 and 2010

(In thousands, except share amounts)

Common Stock Additional

paid-in

capital Retained

Earnings

Accumulated

Other

comprehensive

income (loss) Treasury

Balance Total

Issued

Shares Balance

Balance December 31, 2009 336,800,970 $ 3,368 $ 871,100 $ 6,324,268 $ (417,898) $(4,672,720) $ 2,108,118

Net Income — — — 146,545 — — 146,545

Total other comprehensive income, net of tax (Note 11) — — — — 48,193 — 48,193

Adjustment for consolidation of QSPEs under ASC Topics

810 and 860 — — — (40,591) 3,483 — (37,108)

Dividends — — — (94,145) — — (94,145)

Repurchase of common stock — — — — — (1,706)(1,706)

Share-based compensation and 401(k) match made with

Treasury shares — — 26,961 — — — 26,961

Issuance of nonvested stock 823,594 8 (8) — — — —

Exercise of stock options 635,892 6 7,839 — — — 7,845

Tax benefit of stock options and nonvested stock — — 2,163 — — — 2,163

Balance December 31, 2010 338,260,456 $ 3,382 $ 908,055 $ 6,336,077 $ (366,222) $(4,674,426) $ 2,206,866

Net Income — — — 599,114 — — 599,114

Total other comprehensive income, net of tax (Note 11) — — — — (110,511) — (110,511)

Dividends — — — (111,011) — — (111,011)

Repurchase of common stock — — — — — (224,551)(224,551)

Share-based compensation and 401(k) match made with

Treasury shares — — 49,993 — — 3 49,996

Issuance of nonvested stock 473,240 5 (5) — — — —

Exercise of stock options 373,534 4 7,836 — — — 7,840

Tax benefit of stock options and nonvested stock — — 2,513 — — — 2,513

Balance December 31, 2011 339,107,230 $ 3,391 $ 968,392 $ 6,824,180 $ (476,733) $(4,898,974) $ 2,420,256

Net Income — — — 623,925 — — 623,925

Total other comprehensive loss, net of tax (Note 11) — — — — (130,945) — (130,945)

Dividends — — — (141,681) — — (141,681)

Repurchase of common stock — — — — — (311,632)(311,632)

Share-based compensation and 401(k) match made with

Treasury shares — — 42,056 — — 2 42,058

Issuance of nonvested stock 535,807 6 (6) — — — —

Exercise of stock options 1,622,801 16 45,957 — — — 45,973

Tax benefit of stock options and nonvested stock — — 9,670 — — — 9,670

Balance December 31, 2012 341,265,838 $ 3,413 $ 1,066,069 $ 7,306,424 $ (607,678) $(5,210,604) $ 2,557,624

The accompanying notes are an integral part of the consolidated financial statements.