Harley Davidson 2012 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.8

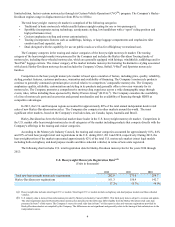

Seasonality – The timing of retail sales made by the Company’s independent dealers tracks closely with regional riding

seasons.

The Company has historically produced and shipped motorcycles at wholesale to its North America region dealers at

approximately the same level throughout the year. Consequently, the Company’s independent dealers in the North America

region typically built their inventory levels in the late fall and winter in anticipation of the spring and summer selling

season. As a result of new manufacturing capabilities, discussed more fully below, beginning in the first half of 2013, the

Company plans to more closely correlate the timing of motorcycle production and wholesale shipments to the riding season. In

advance of the new manufacturing capabilities, wholesale motorcycle shipments in the fourth quarter of 2012 were down

compared to the fourth quarter of 2011 and retail inventory of independent dealers in the U.S. was approximately 1,200 units

lower than at the end of 2011.

In markets outside of the North America region , the Company typically distributes motorcycles through its local

warehouses. This allows the dealers in those markets to carry fewer motorcycles in stock as compared to dealers in the North

America region. Consequently, independent dealers and distributors in markets outside of the North America region typically

do not build inventory levels in the non-riding season, and as a result, the Company’s wholesale shipments to these markets are

generally lower in the non-riding season than in the riding season.

Motorcycle Manufacturing – The Company’s manufacturing strategy is designed to continuously improve product quality

and productivity while reducing costs and increasing flexibility to respond to continuously changing customer expectations and

preferences.

The Company believes that flexible manufacturing processes and flexible supply chains combined with cost-competitive

and flexible labor agreements are critical to enabling the Company to respond to customers in a cost effective manner. The

restructuring of the Company’s U.S. manufacturing plants, which commenced in 2009, supports the Company’s efforts to

become more flexible and cost competitive allowing it to more effectively get the right product at the right time to the

customer. Significant restructuring accomplishments include: consolidation of motorcycle production onto a single production

line at the Company's motorcycle manufacturing facility in York, Pennsylvania; consolidation of the Wisconsin powertrain

production facilities into the Menomonee Falls location; and the ratification of new more flexible labor agreements at all of the

Company’s U.S. manufacturing locations. In the first half of 2013, the Company began implementing flexible production

capabilities at the York facility by adding flexible workers thus enabling the Company to increase manufacturing production in

the first half of 2013 to more closely match retail demand. The Company expects to implement flexible production capabilities

at its motorcycle manufacturing facility in Kansas City, Missouri in 2014.

To support the Company’s international growth initiatives, the Company operates two CKD (Complete Knock Down)

assembly plants. A CKD plant assembles motorcycles from component kits produced by the Company's U.S. plants and by the

Company's suppliers. The Company's first CKD plant is in Brazil and has been in operation since 1999, and its second CKD

plant is in India and has been in operation since 2011.

Raw Materials and Purchased Components – The Company continues to establish and reinforce long-term, mutually

beneficial relationships with its suppliers. Through these collaborative relationships, the Company gains access to technical and

commercial resources for application directly to product design, development and manufacturing initiatives. This strategy has

generated improved product quality, technical integrity, application of new features and innovations and faster manufacturing

ramp-up of new vehicle introductions. Through a continued focus on collaboration and strong supplier relationships, the

Company believes it will be positioned to achieve strategic objectives and deliver cost and quality improvement over the long-

term.

The Company purchases all of its raw materials, principally steel and aluminum castings, forgings, steel sheets and bars.

The Company also purchases certain motorcycle components, including, but not limited to, electronic fuel injection systems,

batteries, tires, seats, electrical components and instruments. In 2011, the Company announced that it will close New Castalloy,

its Australian facility that currently manufactures the majority of the wheels for its motorcycles. The Company is in the process

of sourcing these components through existing suppliers, and it anticipates this transition will be completed in 2013. The

Company closely monitors the overall viability of its supply base. At this time, the Company does not anticipate difficulties in

obtaining raw materials or components.

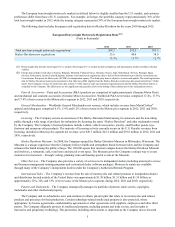

Research and Development – The Company is executing a strategy that it commenced in 2011 to transform product

development with the objectives of reducing cost and time to market and ensuring the Company delivers relevant products for

an increasingly diverse customer base. The objectives of the strategy include implementing a new product development

methodology and organization structure that support greater innovation, flexibility, capacity and focus on consumer insight.

The Company incurred research and development expenses of $137.3 million, $145.4 million and $136.2 million during 2012,

2011 and 2010, respectively.