Harley Davidson 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2012

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 1-9183

Harley-Davidson, Inc.

(Exact name of registrant as specified in its charter)

Wisconsin 39-1382325

(State of organization) (I.R.S. Employer Identification No.)

3700 West Juneau Avenue

Milwaukee, Wisconsin 53208

(Address of principal executive offices) (Zip code)

Registrants telephone number: (414) 342-4680

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

COMMON STOCK, $.01 PAR VALUE PER SHARE NEW YORK STOCK EXCHANGE

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such requirements for the past 90 days. Yes No

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every

Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not

be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of

this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company as defined in Rule 12b-2 of the Exchange Act (check one).

Large accelerated filer Accelerated filer

Non-accelerated filer Smaller reporting company

Indicate by check mark whether the registrant is a shell company, as defined in Rule 12b-2 of the Exchange Act. Yes No

Aggregate market value of the voting stock held by non-affiliates of the registrant at July 1, 2012: $10,329,347,573

Number of shares of the registrant’s common stock outstanding at January 31, 2013: 226,249,774 shares

Documents Incorporated by Reference

Part III of this report incorporates information by reference from registrant’s Proxy Statement for the annual meeting of its shareholders

to be held on April 27, 2013.

Table of contents

-

Page 1

... Milwaukee, Wisconsin (Address of principal executive offices) 53208 (Zip code) Registrants telephone number: (414) 342-4680 Securities registered pursuant to Section 12(b) of the Act: Title of each class COMMON STOCK, $.01 PAR VALUE PER SHARE Name of each exchange on which registered NEW YORK... -

Page 2

... Director Independence Principal Accountant Fees and Services 112 112 112 113 113 Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Selected Financial Data Management's Discussion and Analysis of Financial Condition and Results of Operations... -

Page 3

...651+cc) Harley-Davidson motorcycles as well as a line of motorcycle parts, accessories, general merchandise and related services. The Company's products are sold to retail customers through a network of independent dealers. The Company conducts business on a global basis, with sales in North America... -

Page 4

... 62% of the total U.S. motorcycle market (street legal models including both on-highway and dual purpose models and three-wheeled vehicles) in terms of new units registered. The following chart includes U.S. retail registration data for Harley-Davidson motorcycles for the years 2010 through 2012... -

Page 5

... of the Harley-Davidson brand among its customers and the non-riding public through a wide range of products for enthusiasts by licensing the name "Harley-Davidson" and other trademarks owned by the Company. The Company's licensed products include t-shirts, vehicle accessories, jewelry, small... -

Page 6

...-cultural marketing strategy; the Company measures the success of this strategy by monitoring market shares (where available) across its various customer definitions, as well as monitoring brand health in various markets. U.S. retail purchasers of new Harley-Davidson motorcycles include both core... -

Page 7

... system can affect the number of units of particular models that dealers are able to order and the timing of shipments to dealers. In Canada, the Company sells its motorcycles and related products at wholesale to a single independent distributor, Deeley Harley-Davidson Canada/Fred Deeley Imports... -

Page 8

... new manufacturing capabilities, wholesale motorcycle shipments in the fourth quarter of 2012 were down compared to the fourth quarter of 2011 and retail inventory of independent dealers in the U.S. was approximately 1,200 units lower than at the end of 2011. In markets outside of the North America... -

Page 9

... and Analysis of Financial Condition and Results of Operations" for further discussion of the Company's restructuring activities and the impact on the number of employees. Internet Access - The Company's internet website address is www.harley-davidson.com. The Company makes available free of charge... -

Page 10

...purchase of new and used Harley-Davidson motorcycles. HDFS' retail financial services are available through most HarleyDavidson dealers in the United States and Canada. HDFS' retail finance operations are principally located in Carson City, Nevada and Plano, Texas. Insurance Services - HDFS operates... -

Page 11

..., regulatory and business climate could have a material adverse effect on the Company's net sales, financial condition, profitability or cash flows. The Company sells its products at wholesale and must rely on a network of independent dealers and distributors to manage the retail distribution... -

Page 12

... prices). Ultimately, reduced demand among retail purchasers for new Harley-Davidson motorcycles leads to reduced shipments by the Company. The Company may not be able to successfully execute its manufacturing strategy. The Company's manufacturing strategy is designed to continuously improve product... -

Page 13

... services operations. Credit losses are influenced by general business and economic conditions, including unemployment rates, bankruptcy filings and other factors that negatively affect household incomes, as well as contract terms, customer credit profiles and the new and used motorcycle market... -

Page 14

... of operations. The Company's marketing strategy of appealing to and growing sales to multi-generational and multi-cultural customers worldwide may not continue to be successful. The Company has been successful in marketing its products in large part by promoting the experience of motorcycling. To... -

Page 15

... and the legal systems of foreign courts or tribunals. These laws and policies governing operations of foreign-based companies may result in increased costs or restrictions on the ability of the Company to sell its products in certain countries. The Company's international sales operations may also... -

Page 16

... limit the number of loans eligible for HDFS securitization programs and have a material adverse effect on HDFS' business and results of operations. In addition, the Company is also subject to policies and actions of the New York Stock Exchange ("NYSE"). Many major competitors of the Company are not... -

Page 17

... to product development and manufacturing processes to ensure high quality products are shipped to dealers. If product designs or manufacturing processes are defective, the Company could experience delays in new model launches, product recalls, conventional warranty claims, and product liability... -

Page 18

... class actions. While the Company uses reasonable methods to estimate the cost of warranty, recall and product liability costs and appropriately reflect those in the financial statements, there is a risk the actual costs could exceed estimates. Further, shipping products with poor quality may also... -

Page 19

...the principal operating properties of the Company as of December 31, 2012: Motorcycles & Related Products Segment Type of Facility Corporate Office Museum Manufacturing Product Development Center Distribution Center Manufacturing(3) Manufacturing(4) Airplane hangar Office Manufacturing and Materials... -

Page 20

...market. Assembly of select models for the Indian market. The Company anticipates that the motorcycle wheel production will be fully outsourced in 2013. ® Financial Services Segment Approximate Square Feet Type of Facility Location Status Office Office Office Chicago, IL Plano, TX Carson City... -

Page 21

... the Company's consolidated financial statements. Item 4. Mine Safety Disclosures Not Applicable PART II Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchase of Equity Securities Harley-Davidson, Inc. common stock is traded on the New York Stock Exchange... -

Page 22

...As of December 31, 2012, 14.5 million shares remained under this authorization. From time to time, the Company may enter into a Rule 10b5-1 trading plan for the purpose of repurchasing shares under either the 1997 or 2007 authorization. The Harley-Davidson, Inc. 2009 Incentive Stock Plan (exhibit 10... -

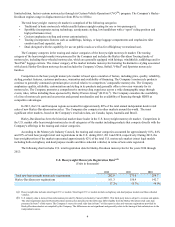

Page 23

2007 ($) 2008 ($) 2009 ($) 2010 ($) 2011 ($) 2012 ($) Harley-Davidson, Inc. Standard & Poor's MidCap 400 Index Standard & Poor's 500 Index 100 100 100 38 64 63 58 88 80 81 111 92 92 109 94 117 129 109 23 -

Page 24

...Earnings per common share from continuing operations: Basic Diluted Earnings (loss) per common share from discontinued operations: Basic Diluted Earnings (loss) per common share: Basic Diluted Dividends paid per common share Balance sheet data: Total assets Total debt Total equity (1) (2) 4,942,582... -

Page 25

...and retail financing and insurance programs primarily to Harley-Davidson dealers and customers. The Company operates in two business segments: Motorcycles & Related Products (Motorcycles) and Financial Services (Financial Services). The Company's reportable segments are strategic business units that... -

Page 26

... capabilities at its Kansas City, Missouri (Kansas City) facility in 2014. Consequently, the Company expects U.S. retail inventory to be slightly lower on a year over year basis at the end of 2013 as dealers more closely align inventory with the seasonal low point for retail sales in advance of... -

Page 27

... full-time hourly unionized employees in its Kansas City facility than would be required under the previous contract. 2010 Restructuring Plan In September 2010, the Company's unionized employees in Wisconsin ratified three separate new seven-year labor agreements which took effect in April 2012 when... -

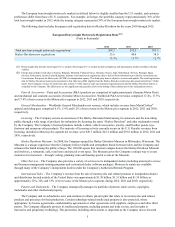

Page 28

Results of Operations 2012 Compared to 2011 Consolidated Results Increase (Decrease) % Change (in thousands, except earnings per share) 2012 2011 Operating income from motorcycles & related products Operating income from financial services Operating income Investment income Interest expense ... -

Page 29

... 2012 compared to 2011. Retail sales of Harley-Davidson motorcycles increased 6.6% in the United States and 5.6% internationally in 2012. International retail sales as a percent of total retail sales were down slightly compared to 2011 reflecting the tough market conditions in Europe. International... -

Page 30

... motorcycle shipments in the fourth quarter of 2012 were down compared to the fourth quarter of 2011 in advance of the launch of seasonal surge manufacturing at the Company's York facility in early 2013. Consequently, retail inventory in the U.S. was approximately 1,200 units lower than at the end... -

Page 31

... goods sold and gross profit from 2011 to 2012 Volume increases were driven by the increase in wholesale shipments of motorcycle units as well as higher sales volumes for Parts & Accessories and General Merchandise. On average, wholesale prices on the Company's 2012 and 2013 model year motorcycles... -

Page 32

... dealer performance-related allowance releases in 2011 as compared to 2012. The wholesale and retail motorcycle provision increases were offset by decreases in the provision for credit losses related to other retail receivables. Annual losses on HDFS' retail motorcycle loans were 0.79% during 2012... -

Page 33

... of Operations 2011 Compared to 2010 Consolidated Results Increase (Decrease) % Change (in thousands, except earnings per share) 2011 2010 Operating income from motorcycles & related products Operating income from financial services Operating income Investment income Interest expense Loss on... -

Page 34

... 5.9% Data source for retail sales figures shown above is new sales warranty and registration information provided by Harley-Davidson dealers and compiled by the Company. The Company must rely on information that its dealers supply concerning retail sales and this information is subject to revision... -

Page 35

....5)% * Custom motorcycle units, as used in this table, include Dyna, Softail, V-Rod and CVO models. During 2011, wholesale shipments of Harley-Davidson motorcycles were up 10.7% compared to the prior year. Temporary production constraints resulting from restructuring efforts at the Company's York... -

Page 36

... goods sold and gross profit from 2010 to 2011 Volume increases were driven by the 10.7% increase in wholesale shipments of Harley-Davidson motorcycle units as well as higher sales volumes for Parts & Accessories and General Merchandise. On average, wholesale prices on the Company's 2012 model year... -

Page 37

... for credit losses on finance receivables is generally based on HDFS' past loan loss experience, known and inherent risks in the portfolio, current economic conditions and the estimated value of any underlying collateral. Please refer to Note 6 of Notes to Consolidated Financial Statements for... -

Page 38

... accounting policies that currently affect the Company's financial condition and results of operations. Management has discussed the development and selection of these critical accounting estimates with the Audit Committee of the Board of Directors. Allowance for Credit Losses on Finance Receivables... -

Page 39

... considered in combination with the information provided in Note 14 of Notes to Consolidated Financial Statements. Stock Compensation Costs - The total cost of the Company's share-based equity awards is equal to the grant date fair value per award multiplied by the number of awards granted (adjusted... -

Page 40

... expects it will continue to make on-going contributions related to current benefit payments for SERPA and postretirement healthcare plans. The Company's expected future contributions to these plans are provided in Note 14 of Notes to Consolidated Financial Statements. As described in Note 13 of... -

Page 41

... opportunities and return value to shareholders.(1) The Company believes the Motorcycles operations will continue to be primarily funded through cash flows generated by operations. The Company's Financial Services operations have been funded with unsecured debt, unsecured commercial paper, asset... -

Page 42

... the cash flow activity of continuing operations for the years ended December 31, 2012, 2011 and 2010 (in thousands): 2012 2011 2010 Net cash provided by operating activities (a) Net cash (used) provided by investing activities Net cash (used) provided by financing activities (a) Effect of exchange... -

Page 43

..., impacting operating cash flow in both years. The decrease in operating cash flow for 2011 compared to 2010 was due primarily to the $200.0 million voluntary contribution to the Company's qualified pension plan in 2011 and higher cash outflows related to an increase in wholesale finance receivables... -

Page 44

... under the Global Credit Facilities, borrowing under its asset-backed U.S. commercial paper conduit facility or through the use of operating cash flow.(1) Medium-Term Notes - The Company has the following medium-term notes (collectively, the Notes) issued and outstanding at December 31, 2012 (in... -

Page 45

... HDFS the right to receive benefits that could be potentially significant to the VIE. Therefore, the Company is the primary beneficiary and consolidates this VIE within its consolidated financial statements. Asset-Backed Canadian Commercial Paper Conduit Facility - In August 2012, HDFS entered into... -

Page 46

... for monthly interest payments based on the prevailing commercial paper rates and principal due at maturity in January 2013 or upon earlier demand by the Company. Intercompany loan balances and related interest are eliminated in the Company's consolidated financial statements. Support Agreeement... -

Page 47

... sales plans to create demand for the motorcycles and related products and services they purchase from the Company. In addition, the Company's independent dealers and distributors may experience difficulties in operating their businesses and selling Harley-Davidson motorcycles and related products... -

Page 48

... currency contracts are entered into with banks and allow the Company to exchange a specified amount of foreign currency for U.S. dollars at a future date, based on a fixed exchange rate. At December 31, 2012, the notional U.S. dollar value of outstanding Euro, Australian dollar and Japanese yen... -

Page 49

... Registered Public Accounting Firm Consolidated statements of operations Consolidated statements of comprehensive income 50 51 53 54 55 Consolidated balance sheets Consolidated statements of cash flows Consolidated statements of shareholders' equity Notes to consolidated financial statements... -

Page 50

...management has concluded that the Company's internal control over financial reporting was effective as of December 31, 2012. Ernst & Young LLP, an independent registered public accounting firm, has audited the Consolidated Financial Statements included in this Annual Report on Form 10-K and, as part... -

Page 51

... requirements of the New York Stock Exchange, Inc. The Audit Committee of the Board of Directors has reviewed and discussed with management its assessment of the effectiveness of the Company's internal control system over financial reporting as of December 31, 2012. Management has concluded that... -

Page 52

...of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Harley-Davidson, Inc. as of December 31, 2012 and 2011, and the related consolidated statements of operations, comprehensive income, shareholders' equity and cash flows for each of the three years in... -

Page 53

... statements taken as a whole, presents fairly in all material respects the information set forth therein. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Harley-Davidson, Inc.'s internal control over financial reporting... -

Page 54

HARLEY-DAVIDSON, INC. CONSOLIDATED STATEMENTS OF OPERATIONS Years ended December 31, 2012, 2011 and 2010 (In thousands, except per share amounts) 2012 2011 2010 Revenue: Motorcycles and related products Financial services Total revenue Costs and expenses: Motorcycles and related products cost of ... -

Page 55

HARLEY-DAVIDSON, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Years ended December 31, 2012, 2011 and 2010 (In thousands) 2012 2011 2010 Net income Other comprehensive income, net of tax Foreign currency translation adjustment Derivative financial instruments: Unrealized net gains (losses) ... -

Page 56

HARLEY-DAVIDSON, INC. CONSOLIDATED BALANCE SHEETS December 31, 2012 and 2011 (In thousands, except share amounts) 2012 2011 ASSETS Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Finance receivables, net Inventories Restricted cash Deferred income taxes ... -

Page 57

2012 2011 Balances held by consolidated variable interest entities (Note 7) Current finance receivables, net Other assets Non-current finance receivables, net Restricted cash Current portion of long-term debt Long-term debt $ $ $ $ $ $ 470,134 5,288 1,631,435 176,290 399,477 1,048,299 $ $ $ $ $... -

Page 58

...and unsecured commercial paper Net change in restricted cash Dividends Purchase of common stock for treasury Excess tax benefits from share-based payments Issuance of common stock under employee stock option plans Net cash used by financing activities of continuing operations Effect of exchange rate... -

Page 59

HARLEY-DAVIDSON, INC. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY Years ended December 31, 2012, 2011 and 2010 (In thousands, except share amounts) Common Stock Issued Shares Balance December 31, 2009 Net Income Total other comprehensive income, net of tax (Note 11) Adjustment for consolidation ... -

Page 60

... 36 months. Accounts Receivable - The Company's motorcycles and related products are sold to independent dealers and distributors outside the U.S. and Canada generally on open account and the resulting receivables are included in accounts receivable in the Company's consolidated balance sheets. The... -

Page 61

... experience, current economic conditions as well as the value of the underlying collateral. Impaired finance receivables also include loans that have been modified in troubled debt restructurings as a concession to borrowers experiencing financial difficulty. Generally, it is the Company's policy... -

Page 62

... three-year limited warranty on all new motorcycles sold. In addition, the Company started offering a one-year warranty for Parts & Accessories (P&A) in 2012. The warranty coverage for the retail customer generally begins when the product is sold to a retail customer. The Company maintains reserves... -

Page 63

... shipped to wholesale customers (independent dealers and distributors) and ownership is transferred. The Company may offer sales incentive programs to both wholesale and retail customers designed to promote the sale of motorcycles and related products. The total costs of these programs are generally... -

Page 64

... the statements of cash flows for the years ended December 31. Balance Sheet Information: Inventories, net (in thousands): 2012 2011 Components at the lower of FIFO cost or market Raw materials and work in process Motorcycle finished goods Parts and accessories and general merchandise Inventory at... -

Page 65

Property, plant and equipment, at cost (in thousands): 2012 2011 Land and related improvements Buildings and related...2012 2011 Payroll, employee benefits and related expenses Restructuring reserves Warranty and recalls Sales incentive programs Tax-related accruals Fair value of derivative financial... -

Page 66

... of deferred loan origination costs Amortization of financing origination fees Provision for employee long-term benefits Contributions to pension and postretirement plans Stock compensation expense Net change in wholesale finance receivables related to sales Provision for credit losses Loss on debt... -

Page 67

... Operations In October 2009, the Company unveiled a new business strategy to drive growth through a focus of efforts and resources on the unique strengths of the Harley-Davidson brand and to enhance productivity and profitability through continuous improvement. The Company's Board of Directors... -

Page 68

... the year ended December 31, 2012, the Company released a portion of its Kansas City Restructuring Plan reserve related to severance costs as these costs are no longer expected to be incurred. The following table summarizes the Motorcycle Segment's 2011 Kansas City Restructuring Plan and 2011 New... -

Page 69

... and 2012. The actions were designed to reduce administrative costs, eliminate excess capacity and exit non-core business operations. The Company's announced actions included the restructuring and transformation of its York, Pennsylvania production facility including the implementation of a new more... -

Page 70

...the following years ended December 31 (in thousands): 2012 Motorcycles & Related Products Employee Severance and Termination Costs Financial Services Employee Severance and Termination Costs Consolidated Accelerated Depreciation Other Total Other Total Consolidated Total Balance, beginning of... -

Page 71

...The Company's Financial Services segment did not have a goodwill balance. 6. Finance Receivables Finance receivables, net at December 31 for the past five years were as follows (in thousands): 2012 2011 2010 2009 2008 Wholesale United States Canada Total wholesale Retail United States Canada Total... -

Page 72

... finance loans totaled $137.7 million and $139.3 million at December 31, 2012 and 2011, respectively. Wholesale finance receivables are related primarily to motorcycles and related parts and accessories sales to independent Harley-Davidson dealers and are generally contractually due within one year... -

Page 73

... fair value of the collateral, if the loan is collateral-dependent. In establishing the allowance, management considers a number of factors including the specific borrower's financial performance as well as ability to repay. At December 31, 2012 and 2011, there were no wholesale finance receivables... -

Page 74

...): 2012 2011 2010 2009 2008 United States Canada Total $ $ 26,500 1,533 28,033 $ $ 27,171 1,207 28,378 $ $ 34,391 1,351 35,742 $ $ 24,629 2,161 26,790 $ $ 23,678 1,275 24,953 A significant part of managing HDFS' finance receivable portfolios includes the assessment of credit risk... -

Page 75

... information on the Company's accounting for asset-backed financings and VIEs. The following table shows the assets and liabilities related to our asset-backed financings that were included in our financial statements at December 31 (in thousands): 2012 Finance receivables On-balance sheet assets... -

Page 76

...May 2015 May 2008 - August 2015 There are no amortization schedules for the secured notes; however, the debt is reduced monthly as available collections on the related U.S. retail motorcycle finance receivables are applied to outstanding principal. For the year ended December 31, 2012 and 2011, the... -

Page 77

... the valuation does not require significant management discretion. For other financial instruments, pricing inputs are less observable in the market and may require management judgment. The Company assesses the inputs used to measure fair value using a three-tier hierarchy. The hierarchy indicates... -

Page 78

... yield curves. The Company uses the market approach to derive the fair value for its level 2 fair value measurements. Foreign currency exchange contracts are valued using publicly quoted spot and forward prices; commodity contracts are valued using publicly quoted prices, where available, or dealer... -

Page 79

...): 2012 Fair Value Carrying Value Fair Value 2011 Carrying Value Assets: Cash and cash equivalents Marketable securities Accounts receivable, net Derivatives Finance receivables, net Restricted cash Liabilities: Accounts payable Derivatives Unsecured commercial paper Global credit facilities Asset... -

Page 80

...its unsecured commercial paper by converting a portion from a floating rate basis to a fixed rate basis. The fair value of HDFS' interest rate swaps is determined using pricing models that incorporate quoted prices for similar assets and observable inputs such as interest rates and yield curves. 80 -

Page 81

... (AOCI) to income is included in cost of goods sold. Gain/(loss) reclassified from AOCI to income is included in financial services interest expense. For the years ended December 31, 2012 and 2011, the cash flow hedges were highly effective and, as a result, the amount of hedge ineffectiveness... -

Page 82

... following tables summarize the amount of gains and losses for the years ended December 31 related to derivative financial instruments designated as fair value hedges (in thousands): Amount of (Loss) Recognized in Income on Derivative 2012 2011 2010 Fair Value Hedges Interest rate swaps - medium... -

Page 83

... to its unsecured commercial paper and its Global Credit Facilities as long-term debt. This amount was excluded from short term debt as it was expected to be outstanding for an uninterrupted period extending beyond one year from the balance sheet date. Commercial paper maturities may range up to 365... -

Page 84

... daily unused portion of the aggregate commitments under the Global Credit Facilities. The Global Credit Facilities are committed facilities and primarily used to support HDFS' unsecured commercial paper program. On September 14, 2012, the Company amended and restated its revolving asset-backed... -

Page 85

...items for the years ended December 31: 2012 2011 2010 Provision at statutory rate State taxes, net of federal benefit Domestic manufacturing deduction Research and development credit Unrecognized tax benefits including interest and penalties Valuation allowance adjustments Medicare Part D Tax audit... -

Page 86

...state net operating loss carry-forwards expiring in 2031. At December 31, 2012 the Company also had Wisconsin research and development credit carryforwards of $15.3 million expiring in 2026. The Company had a deferred tax asset of $31.8 million as of December 31, 2012 for the benefit of these losses... -

Page 87

...Change in plan assets: Fair value of plan assets, beginning of period Actual return on plan assets Company contributions Plan participant contributions Benefits paid Fair value of plan assets, end of period Funded status of the plans, December 31 Amounts recognized in the Consolidated Balance Sheets... -

Page 88

... years ended December 31 (in thousands): Pension and SERPA Benefits 2012 2011 2010 2012 Postretirement Healthcare Benefits 2011 2010 Service cost Interest cost Expected return on plan assets Amortization of unrecognized: Prior service cost (credit) Net loss Net curtailment loss Settlement loss Net... -

Page 89

...): 2012 2011 Pension plans with ABOs in excess of fair value of plan assets: ABO Fair value of plan assets Number of plans $ $ 1,708.1 1,539.0 1 $ $ 1,436.8 1,253.9 4 The Company's SERPA plans, which can only be funded as claims are paid, had projected and accumulated benefit obligations... -

Page 90

... of the fair value measurements using significant unobservable inputs (Level 3) as of December 31, 2012 (in thousands): Limited Partnership Interests Total Other Balance, beginning of period Actual return on plan assets: Relating to assets still held at the reporting date Purchases, sales and... -

Page 91

... Inputs (Level 2) Balance as of December 31, 2011 Quoted Prices in Active Markets for Identical Assets (Level 1) Significant Unobservable Inputs (Level 3) Assets: Cash and cash equivalents Equity holdings: U.S. companies Foreign companies Harley-Davidson common stock Pooled equity funds Limited... -

Page 92

... Balance, beginning of period Actual return on plan assets: Relating to assets still held at the reporting date Purchases, sales and settlements Balance, end of period $ 42,632 $ 40,421 $ 2,211 130 (230) 2,111 $ (2,888) 2,383 42,127 $ (3,018) 2,613 40,016 $ The fair values of the Company... -

Page 93

...,449 30,735 30,247 29,679 146,714 $ $ $ $ $ $ 1,418 1,639 1,851 2,104 2,301 15,240 The Company has various defined contribution benefit plans that in total cover substantially all full-time employees. Employees can make voluntary contributions in accordance with the provisions of their respective... -

Page 94

... consolidated financial statements. 17. Capital Stock Common Stock: The Company is authorized to issue 800,000,000 shares of common stock of $0.01 par value. There were 226.1 million and 230.5 million common shares outstanding as of December 31, 2012 and 2011, respectively. During 2012, the Company... -

Page 95

... stock and dividend equivalents are paid on RSUs. At December 31, 2012, there were 12.1 million shares of common stock available for future awards under the Plan. Stock Options: The Company estimates the grant date fair value of its option awards granted using a lattice-based option valuation model... -

Page 96

...the years ended December 31 (in thousands): 2012 2011 2010 Exercised Outstanding Exercisable $ $ $ 34,443 60,963 35,873 $ $ $ 7,919 55,701 22,926 $ $ $ 12,710 53,249 8,545 The Company's policy is to issue new shares of common stock upon the exercise of employee stock options. The Company has... -

Page 97

... in the Company's consolidated balance sheets as a liability until the date of exercise. The fair value of each SAR award is estimated using a lattice-based valuation model. In accordance with ASC Topic 718, "Stock Compensation", the fair value of each SAR award is recalculated at the end of each... -

Page 98

...Company's reportable segments are strategic business units that offer different products and services. They are managed separately based on the fundamental differences in their operations. The Motorcycles segment designs, manufactures and sells at wholesale heavyweight (engine displacement of 651+cc... -

Page 99

... for the years ended December 31 (in thousands): 2012 2011 2010 Motorcycles net revenue Gross profit Selling, administrative and engineering expense Restructuring expense and other impairments Operating income from Motorcycles Financial services revenue Financial services expense Operating income... -

Page 100

Geographic Information: Included in the consolidated financial statements are the following amounts relating to geographic locations for the years ended December 31 (in thousands): 2012 2011 2010 Revenue from Motorcycles : United States Europe Japan Canada Australia Other foreign countries Revenue ... -

Page 101

...506 Year Ended December 31, 2011 Motorcycles & Related Products Operations Financial Services Operations Eliminations Consolidated Revenue: Motorcycles and related products Financial services Total revenue Costs and expenses: Motorcycles and related products cost of goods sold Financial services... -

Page 102

... Financial Services Operations Eliminations Consolidated Revenue: Motorcycles and related products Financial services Total revenue Costs and expenses: Motorcycles and related products cost of goods sold Financial services interest expense Financial services provision for credit losses Selling... -

Page 103

... Products Operations Financial Services Operations Eliminations Consolidated ASSETS Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Finance receivables, net Inventories Restricted cash Deferred income taxes Other current assets Total current assets Finance... -

Page 104

... Products Operations Financial Services Operations Eliminations Consolidated ASSETS Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Finance receivables, net Inventories Restricted cash Deferred income taxes Other current assets Total current assets Finance... -

Page 105

...of asset-backed commercial paper Net (decrease) increase in credit facilities and unsecured commercial paper Net change in restricted cash Dividends Purchase of common stock for treasury Excess tax benefits from share-based payments Issuance of common stock under employee stock option plans - - (400... -

Page 106

... liabilities: Accounts receivable Finance receivables - accrued interest and other Inventories Accounts payable and accrued liabilities Restructuring reserves Derivative instruments Prepaid and other Total adjustments Net cash provided by operating activities of continuing operations Cash flows from... -

Page 107

... asset-backed commercial paper Net change in restricted cash Dividends paid Purchase of common stock for treasury, net of issuances Excess tax benefits from share based payments Issuance of common stock under employee stock option plans Net cash used by financing activities of continuing operations... -

Page 108

... of finance receivables Collections of finance receivables Purchases of marketable securities Sales and redemptions of marketable securities Net cash (used by) provided by investing activities of continuing operations (267,878) Cash flows from financing activities of continuing operations: Repayment... -

Page 109

...based payments Issuance of common stock under employee stock option plans Net cash used by financing activities of continuing operations Effect of exchange rate changes on cash and cash equivalents of continuing operations Net decrease in cash and cash equivalents of continuing operations Cash flows... -

Page 110

...of the end of the period covered by this Annual Report on Form 10-K, the Company's management evaluated, with the participation of the Company's Chairman, President and Chief Executive Officer and the Senior Vice President and Chief Financial Officer, the effectiveness of the design and operation of... -

Page 111

...over Financial Reporting The report of management required under this Item 9A is contained in Item 8 of Part II of this Annual Report on Form 10-K under the heading "Management's Report on Internal Control over Financial Reporting." Attestation Report of Independent Registered Public Accounting Firm... -

Page 112

... options Weightedaverage exercise price of outstanding options Equity compensation plans approved by shareholders: Management employees Equity compensation plans not approved by shareholders: Union employees: Kansas City, MO York, PA Non employees: Board of Directors Total all plans 4,460,242... -

Page 113

...the share units are payable at that time in actual shares of Common Stock. The Director Compensation Policy also provides that a non-employee Director may elect to receive 50% or 100% of the annual retainer to be paid in each calendar year in the form of Common Stock based upon the fair market value... -

Page 114

...each of the three years in the period ended December 31, 2012 Consolidated balance sheets at December 31, 2012 and December 31, 2011 Consolidated statements of cash flows for each of the three years in the period ended December 31, 2012 Consolidated statements of shareholders' equity for each of the... -

Page 115

...II HARLEY-DAVIDSON, INC. CONSOLIDATED VALUATION AND QUALIFYING ACCOUNTS Years ended December 31, 2012, 2011 and 2010 (In thousands) 2012 2011 2010 Accounts receivable - allowance for doubtful accounts Balance at beginning of period Provision charged to expense Reserve adjustments Write-offs, net of... -

Page 116

..., on February 22, 2013. HARLEY-DAVIDSON, INC. By: /S/ Keith E. Wandell Keith E. Wandell Chairman, President and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and... -

Page 117

... (Principal executive officer) Senior Vice President and Chief Financial Officer (Principal financial officer) Chief Accounting Officer (Principal accounting officer) Director Director Presiding Director Director Director Director Director Director Director Director Director Director 117 -

Page 118

... to the Registrant's Current Report on Form 8-K dated May 12, 2009 (File No. 1-9183)) Indenture, dated as of March 4, 2011, among Harley-Davidson Financial Services, Inc., Issuer, HarleyDavidson Credit Corp., Guarantor, and Bank of New York Mellon Trust Company, N.A., Trustee (incorporated herein by... -

Page 119

...)) Harley-Davidson, Inc. Short-Term Incentive Plan for Senior Executives (incorporated herein by reference to Appendix D to the Company's definitive proxy statement on Schedule 14A for the Company's Annual Meeting of Shareholders held April 30, 2011 (File No. 1-9183)) Harley-Davidson Pension Benefit... -

Page 120

... and Option Agreement of Harley-Davidson, Inc. under the HarleyDavidson Inc. 1995 Stock Option Plan and the Harley-Davidson, Inc. 2004 Incentive Stock Plan (incorporated herein by reference to Exhibit 10.21 to the Registrant's Annual Report of Form 10-K for the year ended December 31, 2005 (File... -

Page 121

... pursuant to Rule 13a-14(a) Written Statement of the Chief Executive Officer and the Chief Financial Officer pursuant to 18 U.S.C. §1350 Financial statements from the annual report on Form 10-K of Harley-Davidson, Inc. for the year ended December 31, 2012, filed on February 22, 2013 formatted... -

Page 122

BY-LAWS OF HARLEY-DAVIDSON, INC. (a Wisconsin corporation) (as amended through December 4, 2012) ARTICLE I. SHAREHOLDERS 1.01 Annual Meeting. (a) The annual meeting of the shareholders of the corporation (the "Annual Meeting") shall be held at such time and date as may be fixed by or under the ... -

Page 123

...within 10 days after the date on which a valid request to fix a Demand Record Date is received, adopt a resolution fixing the Demand Record Date and shall make a public announcement of such Demand Record Date. If no Demand Record Date has been fixed by the Board of Directors within 10 days after the... -

Page 124

... the name and address, as they appear in the corporation's books, of each shareholder signing such demand and the Share Information with respect to each such shareholder, shall be sent to the Secretary by hand or by certified or registered mail, return receipt requested, and shall be received by the... -

Page 125

... of such Soliciting Shareholder's "group" for purposes of Rule 13d-5(b) under the Exchange Act, and any other Affiliate of such a Soliciting Shareholder, if a majority of the directors then in office determine, reasonably and in good faith, that such Affiliate should be required to sign the written... -

Page 126

... pursuant Section 1.06 may be reconvened at any place designated by vote of the Board of Directors or by the Chairman of the Board or the Chief Executive Officer. Notice of Meeting. Written notice stating the place, day and hour of any Annual Meeting or Special Meeting shall be delivered not less... -

Page 127

...any business set forth in the statement of purpose of the demands received by the corporation in accordance with Section 1.02 of these by-laws. 1.05 Fixing of Record Date. The Board of Directors may fix in advance a date not less than 10 days and not more than 70 days prior to the date of any Annual... -

Page 128

... in number) or such other persons as the chairman of the meeting shall determine; (iv) restrictions on entry to the meeting after the time fixed for the commencement thereof; and (v) limitations on the time allotted to questions or comments by participants. ARTICLE II. BOARD OF DIRECTORS 2.01... -

Page 129

... Executive Officer of the corporation, whose position of principal employment, occupation or affiliation changes substantially, and each director who develops a conflict of interest with the corporation as a result of changes in the business of the corporation, such director's personal interests... -

Page 130

...information and factors the Board of Directors believes to be relevant. Following the Board of Directors' decision, the corporation will promptly publicly disclose in a Current Report on Form 8-K filed with or furnished to, as applicable, the Securities and Exchange Commission the Board of Directors... -

Page 131

... day the service undertakes to make delivery; if given by facsimile, at the time transmitted to a facsimile number the recipient has provided; and if given by telegraph, when delivered to the telegraph company. Fiscal Year. The fiscal year of the corporation shall be fixed by the Board of Directors... -

Page 132

...the Statute; provided, that, for purposes of this Article V, (i) "Director or Officer" shall include a director or officer of a Subsidiary (whether or not otherwise serving as a Director of Officer), (ii) the term "employee benefit plan" as used in Section 180.0850(2)(c) of the Statute shall include... -

Page 133

...majority vote thereof, determines that the Director or Officer requesting indemnification engaged in misconduct constituting a Breach of Duty or (ii) a Disinterested Quorum cannot be obtained. In case of nonpayment pursuant to Section 5.03(b), the Board shall immediately authorize by resolution that... -

Page 134

...case of subsection (i) above (but not subsection (ii)), indemnification by the Corporation of the requested amount of Liabilities shall be paid to the Director or Officer immediately. 5.04 Determination of Indemnification. (a) If the Board.... The Authority shall make its determination within sixty... -

Page 135

... that the Director or Officer engaged in a Breach of Duty. All Expenses incurred in the determination process under this Section 5.04 by either the Corporation or the Director or Officer, including, without limitation, all Expenses of the selected Authority, shall be paid by the Corporation... -

Page 136

... to indemnification against Liabilities or allowance of Expenses which the Director or Officer or employee of the Corporation (or such other person) may be entitled to under any written agreement, Board resolution, vote of shareholders of the Corporation or otherwise, including, without limitation... -

Page 137

...Contractual Nature of Article V; Repeal or Limitation of Rights. This Article V shall be deemed to be a contract between the Corporation and each Director or Officer and employee of the Corporation and any repeal or other limitation of this Article V or any repeal or limitation of the Statute or any... -

Page 138

...LLC Harley-Davidson Motor Company, Inc. Harley-Davidson Museum, LLC Buell Distribution Company, LLC H-D F&R, LLC Harley-Davidson Latin America, LLC Harley-Davidson Asia Pacific, LLC H-D Group LLC Buell Motorcycle Company, LLC HDWA, LLC HDMC, LLC Harley-Davidson Dealer Systems, Inc. H-D International... -

Page 139

... Trust 2011-2 Harley-Davidson Motorcycle Trust 2012-1 Eaglemark Savings Bank Harley-Davidson Leasing, Inc. Harley-Davidson Warehouse Funding Corp. Harley-Davidson Financial Services International, Inc. Harley-Davidson Financial Services Europe Limited Harley-Davidson Financial Services Canada, Inc... -

Page 140

... Savings Plan for York Hourly Bargaining Unit Employees, and the Harley-Davidson Financial Services, Inc. 401(k) Profit Sharing Plan of our reports dated February 22, 2013, with respect to the consolidated financial statements and schedule of Harley-Davidson, Inc. and the effectiveness of internal... -

Page 141

...'s board of directors: a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and... -

Page 142

...'s board of directors: a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and... -

Page 143

... the year ended December 31, 2012 (the "Report") fully complies with the requirements of Section 13(a) of the Securities Exchange Act of 1934 and that information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. Date...