Delta Airlines 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

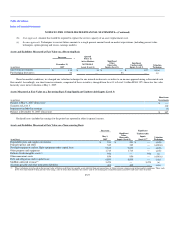

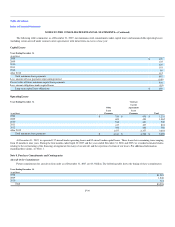

We used the proceeds from the issuance of the Equipment Notes for the prepayment or repurchase of $961 million of existing financings, which were

collectively secured by the 36 aircraft, and for general corporate purposes. The existing financings that were prepaid or repurchased include (1) our Series

2001-2 EETC, (2) the Aircraft Loan (as defined in the table above in this Note) and (3) bond issues that were backed by a letter of credit facility provided by

GECC pursuant to a reimbursement agreement between us and GECC.

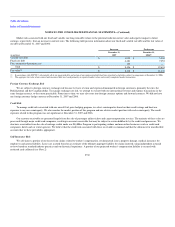

The 2007-1 Certificates were sold in a private placement to qualified institutional buyers under Rule 144A of the Securities Act of 1933, as amended.

Pursuant to a registration rights agreement, which we entered into upon the issuance of the 2007-1 Certificates, we expect to file an exchange offer

registration statement or, under specific circumstances, a shelf registration statement with respect to the 2007-1 Certificates.

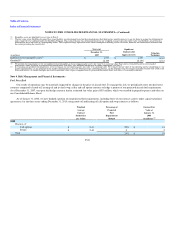

Pre-Delivery Deposits Financing

On December 19, 2007, we entered into a Loan and Security Agreement (the "PDP Financing Facility") to borrow up to $233 million to finance certain

pre-delivery payments ("PDP's") payable by us to The Boeing Company ("Boeing") with respect to future deliveries of 10 B-737-700 aircraft and eight

B-777-200LR aircraft (collectively, the "PDP Aircraft"). As of December 31, 2007, $156 million of borrowings were outstanding under this facility.

The PDP Financing Facility consists of 18 separate loans, one loan for each PDP Aircraft. The separate loan for each PDP Aircraft matures upon the

delivery of that aircraft to us by Boeing. Therefore, the loans under the PDP Financing Facility will have various maturity dates, beginning in February 2008

through August 2009.

Our obligations under the PDP Financing Facility are secured primarily by a first priority lien on our rights and interests under the purchase agreements

between us and Boeing for the purchase of the PDP Aircraft. Our obligations are also secured by a first priority lien on certain deposits, equipment and other

personal property that are directly attributable to the PDP Aircraft and corresponding purchase agreements.

The PDP Financing Facility contains affirmative and negative covenants and events of default that are typical in the industry for similar financings. The

PDP Financing Facility does not contain any financial covenants.

GECC Agreements

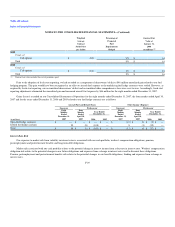

As of December 31, 2007, we have two outstanding financing arrangements with GECC as referenced in the table above in this Note and referred to as

the Spare Engines Loan and the Spare Parts Loan. As described above, in 2007, we prepaid an additional financing arrangement with GECC referred to as the

Aircraft Loan with the proceeds from the issuance of the 2007-1 Certificates. In addition, we terminated a reimbursement agreement with GECC under which

letters of credit were issued to support certain special facility bonds.

The Spare Engines Loan is secured by 93 spare Mainline aircraft engines ("Engine Collateral") and a portion of the Mainline aircraft spare parts that we

own ("Spare Parts Collateral"). The Spare Engines Loan is not repayable at our election prior to maturity.

During 2007, we amended the Spare Parts Loan to, among other things, increase the outstanding principal amount and reduce the interest rate. The

Spare Parts Loan is secured by the Spare Parts Collateral and the Engine Collateral.

The Engine Collateral and Spare Parts Collateral also secure leases for up to 22 CRJ-200 aircraft and, on a subordinated basis, certain other existing

debt and aircraft lease obligations to GECC and its affiliates.

F-37