Delta Airlines 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

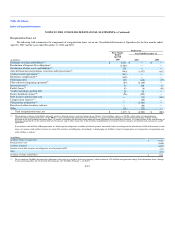

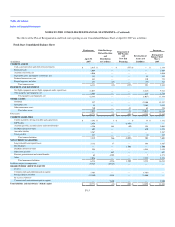

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

amounts. For long-lived assets held for sale, we record impairment losses when the carrying amount is greater than the fair value less the cost to sell. We

discontinue depreciation of long-lived assets when these assets are classified as held for sale.

To determine impairments for aircraft used in operations, we group assets at the fleet-type level (the lowest level for which there are identifiable cash

flows) and then estimate future cash flows based on projections of capacity, passenger yield, fuel costs, labor costs and other relevant factors. If impairment

occurs, the impairment loss recognized is the amount by which the aircraft's carrying amount exceeds its estimated fair value. We estimate aircraft fair values

using published sources, appraisals and bids received from third parties, as available.

Goodwill and Other Intangible Assets

Goodwill reflects the excess of the reorganization value of the Successor over the fair value of tangible and identifiable intangible assets, net of

liabilities, from the adoption of fresh start reporting. We recorded $12.3 billion of goodwill upon emergence from bankruptcy.

Identifiable intangible assets consist primarily of trade name, takeoff and arrival slots, SkyTeam alliance agreements, marketing agreements, customer

relationships and certain contracts. These intangible assets, excluding marketing agreements, customer relationships and certain contracts, are indefinite-lived

assets and are not amortized. Marketing agreements, customer relationships and certain contracts are definite-lived intangible assets and are amortized over

the estimated economic life of the respective agreements and contracts.

In accordance with SFAS No. 142, "Goodwill and Other Intangible Assets," we apply a fair value-based impairment test to the net book value of

goodwill and indefinite-lived intangible assets on an annual basis and, if certain events or circumstances indicate that an impairment loss may have been

incurred, on an interim basis. The annual impairment test date for our goodwill and indefinite-lived intangible assets is October 1 (see Note 5).

In evaluating our goodwill for impairment, we first compare our one reporting unit's fair value to its carrying value. We estimate the fair value of our

reporting unit by considering (1) our market capitalization, (2) any premium to our market capitalization an investor would pay for a controlling interest

("Control Premium"), (3) the potential value of synergies and other benefits that could result from such interest, (4) market multiple and recent transaction

values of peer companies and (5) projected discounted future cash flows, if reasonably estimable. If the reporting unit's fair value exceeds its carrying value,

no further testing is required. If, however, the reporting unit's carrying value exceeds its fair value, we then determine the amount of the impairment charge, if

any. We recognize an impairment charge if the carrying value of the reporting unit's goodwill exceeds its implied fair value.

Prior to adoption of fresh start reporting, we estimated the fair value of our reporting unit by considering (1) market multiple and recent transaction

values of peer companies and (2) projected discounted future cash flows, if reasonably estimable. In applying the projected discounted future cash flow

methodology, we (1) estimated the reporting unit's future cash flows based on capacity, passenger yield, fuel costs, labor costs and other relevant factors and

(2) discounted those cash flows based on the reporting unit's weighted average cost of capital.

We perform the impairment test for our indefinite-lived intangible assets by comparing the asset's fair value to its carrying value. Fair value is estimated

based on recent market transactions where available or projected discounted future cash flows. We recognize an impairment charge if the asset's carrying

value exceeds its estimated fair value.

For both goodwill and indefinite-lived intangible assets, changes in assumptions or circumstances, including, but not limited to, (1) long-term negative

trends in our market capitalization, (2) continued escalation of fuel prices,

F-22