Delta Airlines 2007 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

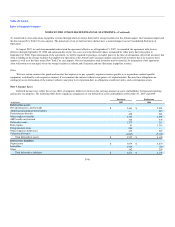

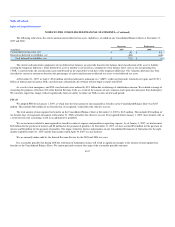

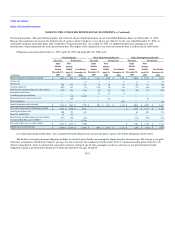

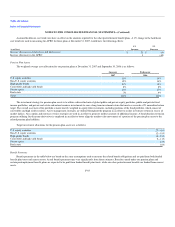

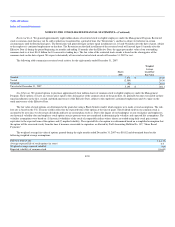

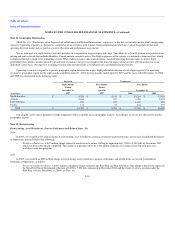

Net periodic (benefit) cost for the eight months ended December 31, 2007, the four months ended April 30, 2007 and the years ended December 31,

2006 and 2005 included the following components:

Pension Benefits

Successor Predecessor

(in millions)

Eight Months

Ended

December 31,

2007

Four Months

Ended

April 30,

2007

Year Ended December 31,

2006 2005

Service cost $ — $ — $ 34 $ 155

Interest cost 296 145 712 715

Expected return on plan assets (281) (129) (520) (598)

Amortization of prior service cost — — 1 3

Recognized net actuarial loss — 19 226 179

Amortization of net transition obligation — — — 6

Settlement (gain) charge, net — (30) (1,282) 388

Curtailment loss — — — 434

Revaluation of liability — (143) — —

Net periodic (benefit) cost $ 15 $ (138) $ (829) $ 1,282

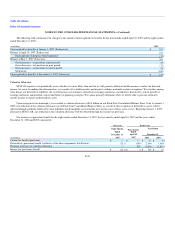

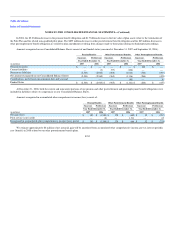

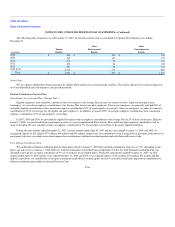

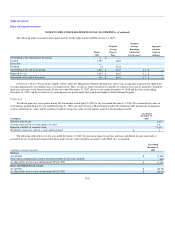

Other Postretirement Benefits

Successor Predecessor

(in millions)

Eight Months

Ended

December 31,

2007

Four Months

Ended

April 30,

2007

Year Ended December 31,

2006 2005

Service cost $ 8 $ 4 $ 17 $ 17

Interest cost 42 21 97 114

Amortization of prior service benefit — (31) (44) (41)

Recognized net actuarial loss — 8 8 13

Revaluation of liability — 49 — —

Net periodic cost $ 50 $ 51 $ 78 $ 103

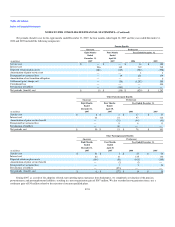

Other Postemployment Benefits

Successor Predecessor

(in millions)

Eight Months

Ended

December 31,

2007

Four Months

Ended

April 30,

2007

Year Ended December 31,

2006 2005

Service cost $ 21 $ 8 $ 45 $ 64

Interest cost 82 41 125 136

Expected return on plan assets (104) (51) (163) (165)

Amortization of prior service benefit — (2) (2) —

Recognized net actuarial loss — 5 9 20

Revaluation of liability — (273) — —

Net periodic (benefit) cost $ (1) $ (272) $ 14 $ 55

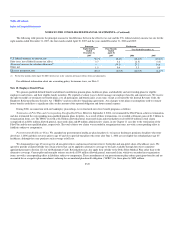

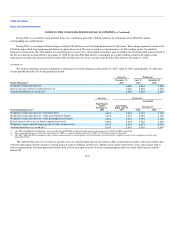

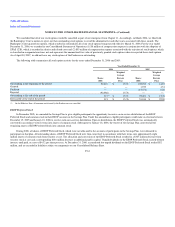

During 2007, as a result of the adoption of fresh start reporting upon emergence from bankruptcy, we completed a revaluation of the pension,

postretirement, and postemployment liabilities, resulting in a net reorganization gain of $367 million. We also recorded in reorganization items, net, a

settlement gain of $30 million related to the rejection of our non-qualified plans.

F-53