Delta Airlines 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

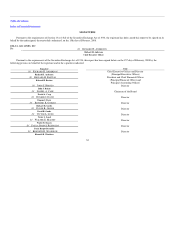

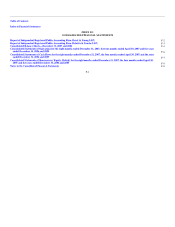

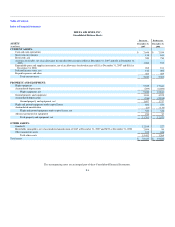

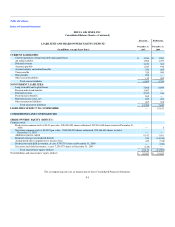

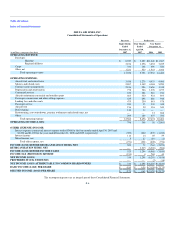

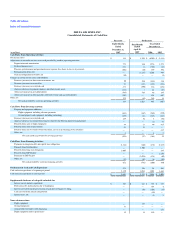

DELTA AIR LINES, INC.

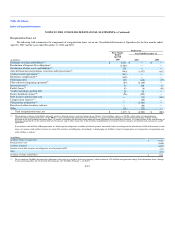

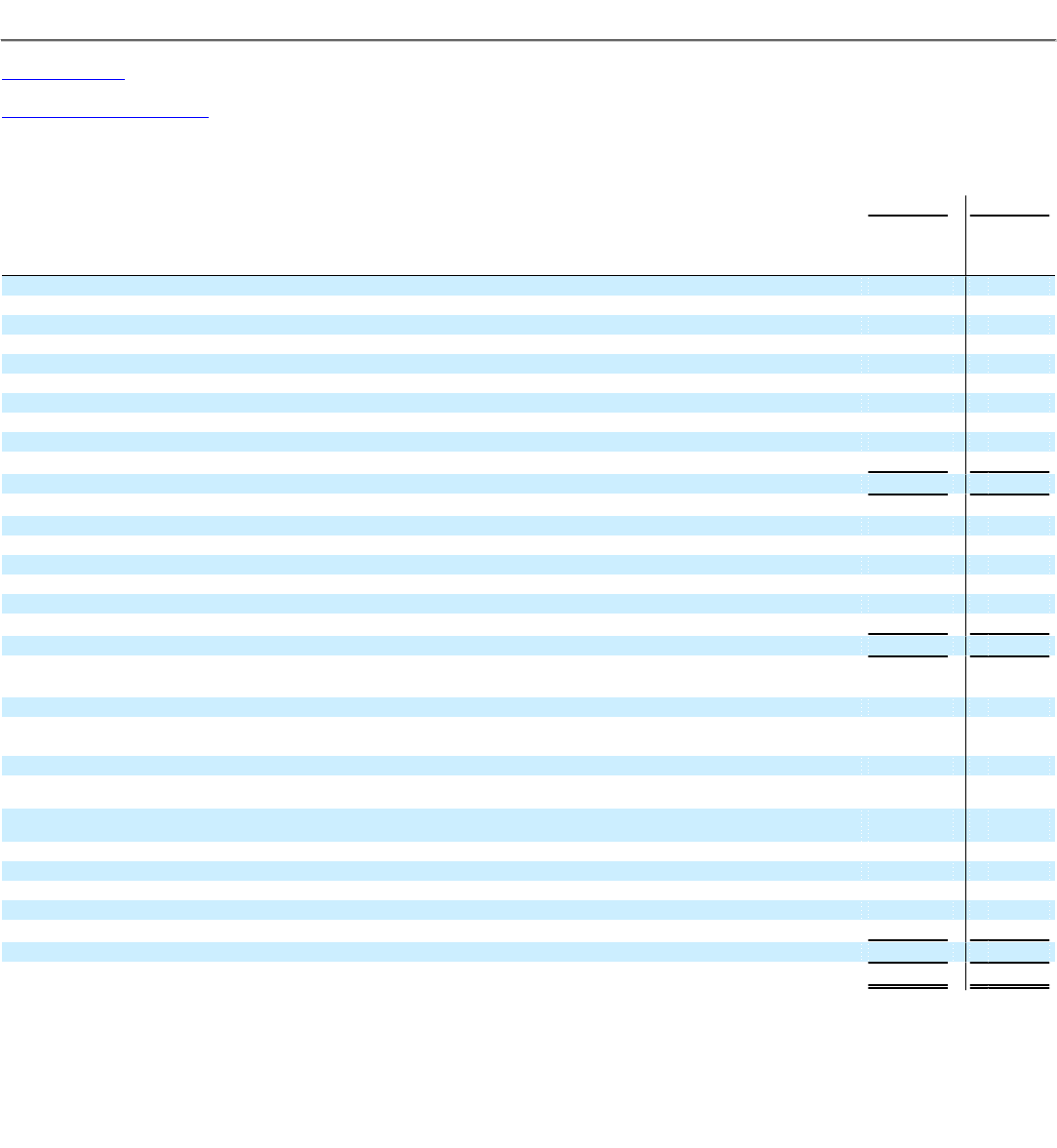

Consolidated Balance Sheets—(Continued)

Successor Predecessor

LIABILITIES AND SHAREOWNERS' EQUITY (DEFICIT)

(in millions, except share data)

December 31,

2007

December 31,

2006

CURRENT LIABILITIES:

Current maturities of long-term debt and capital leases $ 1,014 $ 1,503

Air traffic liability 1,982 1,797

Deferred revenue 1,100 363

Accounts payable 1,045 936

Accrued salaries and related benefits 734 405

Taxes payable 320 500

Note payable 295 —

Other accrued liabilities 115 265

Total current liabilities 6,605 5,769

NONCURRENT LIABILITIES:

Long-term debt and capital leases 7,986 6,509

Pension and related benefits 3,002 —

Deferred revenue 2,532 346

Postretirement benefits 865 —

Deferred income taxes, net 855 406

Other noncurrent liabilities 465 368

Total noncurrent liabilities 15,705 7,629

LIABILITIES SUBJECT TO COMPROMISE — 19,817

COMMITMENTS AND CONTINGENCIES

SHAREOWNERS' EQUITY (DEFICIT):

Common stock:

Predecessor common stock at $0.01 par value; 900,000,000 shares authorized, 202,081,648 shares issued at December 31,

2006 — 2

Successor common stock at $0.0001 par value; 1,500,000,000 shares authorized, 299,464,669 shares issued at

December 31, 2007 — —

Additional paid-in capital 9,512 1,561

Retained earnings (accumulated deficit) 314 (14,414)

Accumulated other comprehensive income (loss) 435 (518)

Predecessor stock held in treasury, at cost, 4,745,710 shares at December 31, 2006 — (224)

Successor stock held in treasury, at cost, 7,238,973 shares at December 31, 2007 (148) —

Total shareowners' equity (deficit) 10,113 (13,593)

Total liabilities and shareowners' equity (deficit) $ 32,423 $ 19,622

The accompanying notes are an integral part of these Consolidated Financial Statements.

F-5