Delta Airlines 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

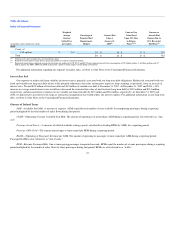

Defined Benefit Pension Plans ("DB Plans"). During 2007, we contributed approximately $116 million to our DB Plans. Under our settlement

agreement with the PBGC, the Pilot Plan was terminated effective September 2, 2006. In addition, our non-qualified defined benefit pension plans for pilots

were terminated effective September 2, 2006.

Effective December 31, 2005, future pay and service accruals under the Non-Pilot Plan were frozen. Effective April 1, 2007, we elected the alternative

funding schedule under Section 402(a)(1) of the Pension Protection Act of 2006 with respect to the Non-Pilot Plan. We also rejected in bankruptcy our non-

qualified defined benefit plans for non-pilot employees. As a result, no further benefits will be paid from these non-qualified plans. The Pension Protection

Act of 2006 allows us to reduce the funding obligations for the Non-Pilot Plan over the next several years. While this legislation makes our funding

obligations for the Non-Pilot Plan more predictable, factors outside our control will continue to have an impact on the funding requirements for that plan.

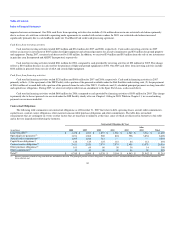

Estimates of future funding requirements for the Non-Pilot Plan are based on various assumptions, including, among other things, the actual and

projected market performance of assets of the Non-Pilot Plan; statutory requirements; the terms of the Non-Pilot Plan; and demographic data for participants

in the Non-Pilot Plan, including the number of participants and the rate of participant attrition.

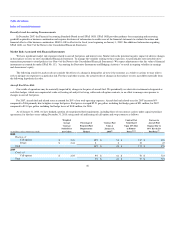

Assuming current funding rules, we estimate that the funding requirements under the Non-Pilot Plan for 2008 to 2012 will aggregate approximately

$500 million.

Contract Carrier Agreements. We have long-term capacity purchase agreements with several regional air carriers. Under these agreements, the carriers

operate some or all of their aircraft using our flight code, and we schedule those aircraft, sell the seats on those flights and retain the related revenue. We pay

those airlines an amount, as defined in the applicable agreement, which is based on a determination of their cost of operating those flights and other factors

intended to approximate market rates for those services.

Under these long-term capacity purchase agreements, we are obligated to pay certain minimum fixed obligations, which are included in the table above.

The remaining estimated expense is not included in the table because this expense is contingent based on the costs associated with the operation of contract

carrier flights by those air carriers as well as rates that are unknown at this time. We cannot reasonably estimate at this time our expense under the contract

carrier agreements in 2008 and thereafter.

For information regarding payments we may be required to make in connection with certain terminations of our capacity purchase agreements with

Chautauqua and Shuttle America, see "Contingencies Related to Termination of Contract Carrier Agreements" in Note 8 of the Notes to the Consolidated

Financial Statements.

FIN 48. We adopted FIN 48 on January 1, 2007. The total amount of unrecognized tax benefits on the Consolidated Balance Sheet at December 31,

2007 is $143 million. We have accrued $54 million for the payment of interest and $8 million for the payment of penalties related to these unrecognized tax

benefits.

We are currently under audit by the Internal Revenue Service for the 2005 and 2006 tax years.

41