Delta Airlines 2007 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

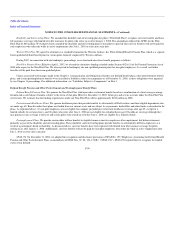

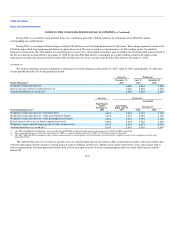

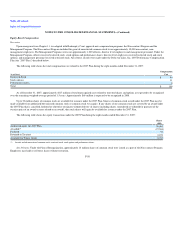

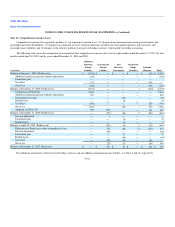

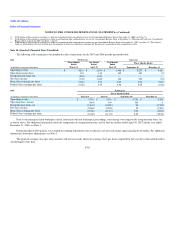

The following table summarizes stock option activity for the eight months ended December 31, 2007:

Shares

(000)

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Life (in years)

Aggregate

Intrinsic

Value (in

millions)

Outstanding at the beginning of the period — $ —

Granted 3,955 18.87

Exercised — —

Forfeited (9) 18.84

Outstanding at the end of the period 3,946 $ 18.87 8.6 $ —

Expected to vest 3,452 $ 18.87 9.1 $ —

Exercisable at the end of the period 244 $ 18.84 1.7 $ —

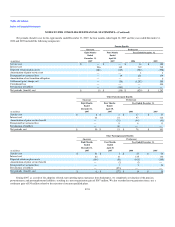

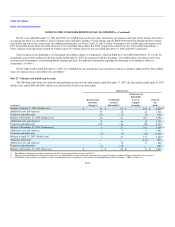

Performance Shares. We granted to eligible officers under the Management Program performance shares with an aggregate target payout opportunity

covering approximately one million shares of common stock. These awards are long-term incentives payable in common stock and are generally contingent

upon our achieving certain financial goals for the year ended December 31, 2007, the two years ending December 31, 2008 and the three years ending

December 31, 2009, and the occurrence of a contemporaneous payout under the broad-based employee Profit Sharing Program.

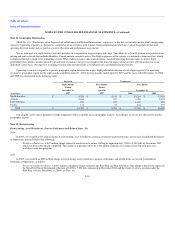

Predecessor

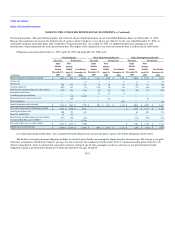

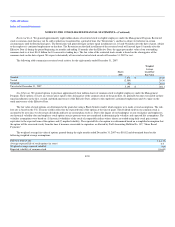

We did not grant any stock options during the four months ended April 30, 2007 or the year ended December 31, 2006. The estimated fair values of

stock options granted during the year ended December 31, 2005 were derived using a Black-Scholes model. The following table includes the assumptions

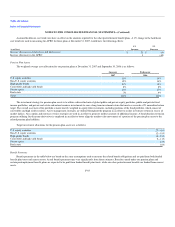

used in estimating fair values and the resulting weighted average fair value of stock options granted in the periods presented:

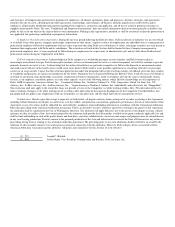

Assumption

Year Ended

December 31,

2005

Risk-free interest rate 3.8%

Average expected life of stock options (in years) 3.0

Expected volatility of common stock 73.6%

Weighted average fair value of a stock option granted $ 2

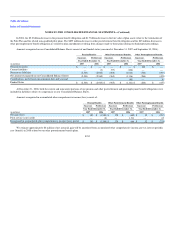

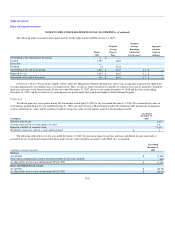

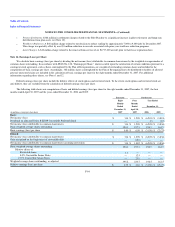

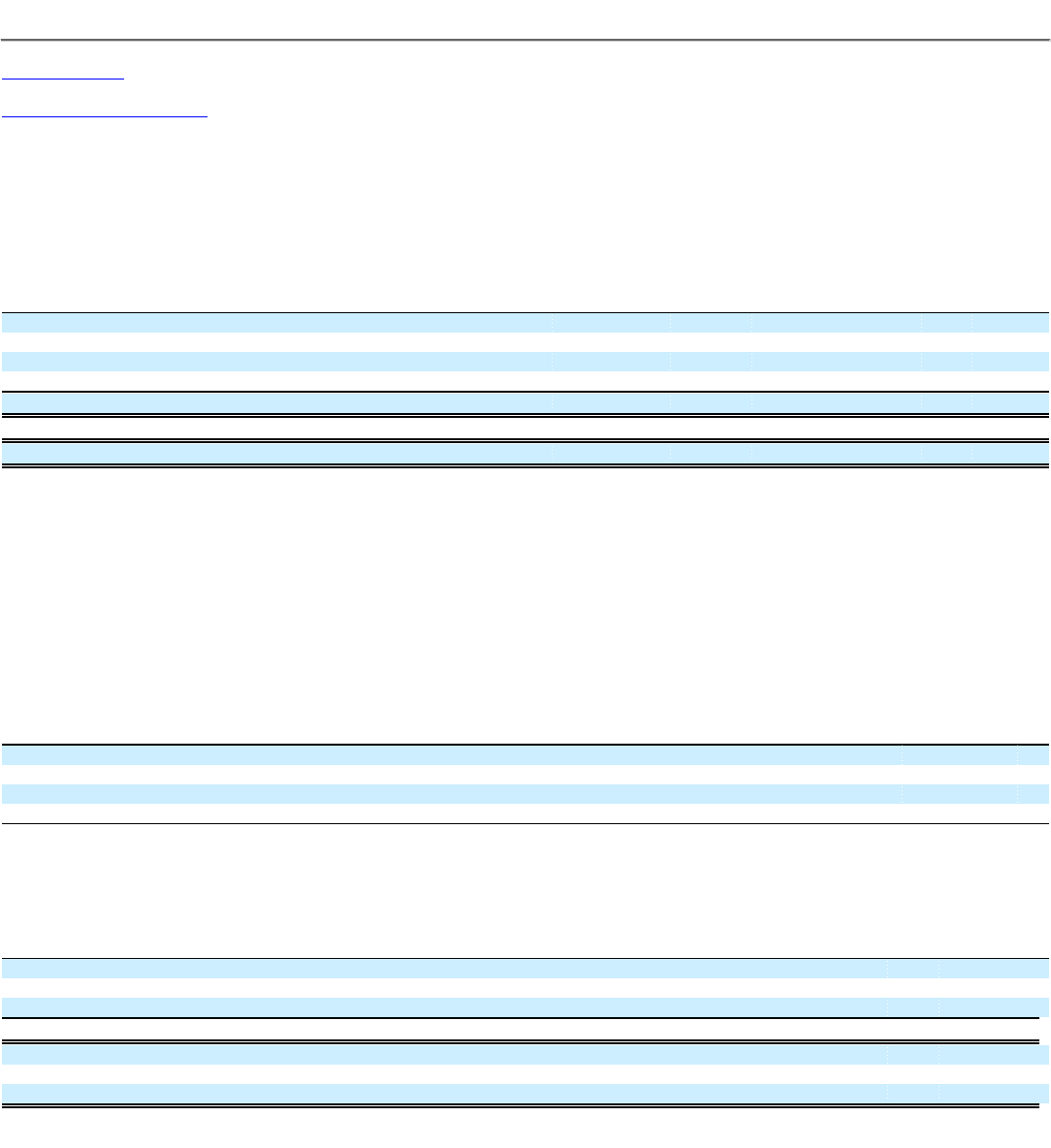

The following table reflects, for the year ended December 31, 2005, the pro forma impact to net loss and basic and diluted loss per share had we

accounted for our stock-based compensation plans under the fair value method in accordance with SFAS 123, as amended:

(in millions, except per share data)

Year Ended

December 31,

2005

Net loss:

As reported $ (3,818)

Stock option compensation expense determined under the fair value method (108)

As adjusted for the fair value method under SFAS 123R $ (3,926)

Basic and diluted loss per share:

As reported $ (23.75)

As adjusted for the fair value method under SFAS 123R $ (24.42)

F-60