Delta Airlines 2007 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

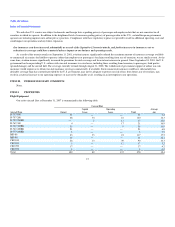

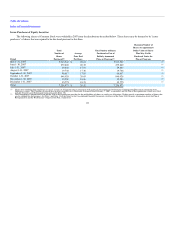

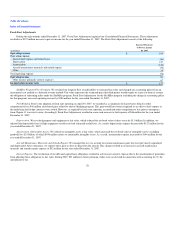

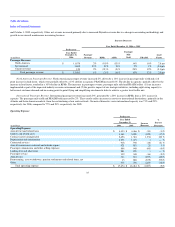

(3) Includes a $1.2 billion non-cash gain or $5.20 diluted EPS for reorganization costs; and a $4 million income tax benefit or $0.02 diluted EPS (see Item 7).

(4) Includes a $6.2 billion non-cash charge or $31.58 diluted EPS for reorganization costs; a $310 million non-cash charge or $1.58 diluted EPS associated with certain accounting

adjustments; and a $765 million income tax benefit or $3.89 diluted EPS (see Item 7).

(5) Includes an $888 million charge or $5.49 diluted EPS for restructuring, asset writedowns, pension settlements and related items, net and an $884 million non-cash charge or $5.47 diluted

EPS for reorganization costs (see Item 7).

(6) Includes a $1.9 billion charge or $14.76 diluted EPS related to the impairment of intangible assets; a $1.2 billion charge or $9.51 diluted EPS for deferred income tax valuation; a $123

million gain, or $0.97 diluted EPS from the sale of investments; and a $41 million gain or $0.33 diluted EPS from restructuring, asset writedowns, pension settlements and related items,

net.

(7) Includes a $268 million charge ($169 million net of tax, or $1.37 diluted EPS) for restructuring, asset writedowns, pension settlements and related items, net; a $398 million gain ($251

million net of tax, or $2.03 diluted EPS) for Appropriations Act compensation; and a $304 million gain ($191 million net of tax, or $1.55 diluted EPS) for certain other income and

expense items.

(8) Includes interest income.

(9) Includes (losses) gains from the sale of investments and fair value adjustments of derivatives.

(10) The 2006 and 2005 Consolidated Summary of Operations and Financial and Statistical Data above have been updated to conform to current period presentation for certain

reclassifications made upon emergence from bankruptcy (see Note 2 of the Notes to the Consolidated Financial Statements).

25