Delta Airlines 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

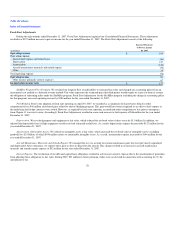

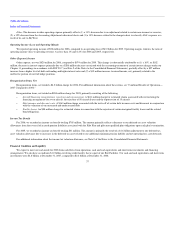

Fresh Start Adjustments

During the eight months ended December 31, 2007, Fresh Start Adjustments impacted our Consolidated Financial Statements. These adjustments

resulted in a $157 million increase to pre-tax income for the year ended December 31, 2007. The Fresh Start Adjustments consist of the following:

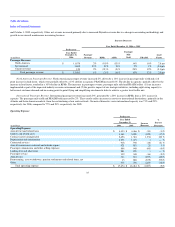

(in millions)

Increase/(Decrease)

to Pre-tax Income

for 2007

Operating revenue $ 188

Operating expense

Aircraft fuel expense and related taxes (46)

Depreciation 127

Amortization (146)

Aircraft maintenance materials and outside repairs (52)

Other 19

Total operating expense (98)

Operating income 90

Other income (primarily interest expense) 67

Income before income taxes $ 157

SkyMiles Frequent Flyer Program. We revalued our frequent flyer award liability to estimated fair value and changed our accounting policy from an

incremental cost method to a deferred revenue method. Fair value represents the estimated price that third parties would require us to pay for them to assume

the obligation of redeeming miles under the SkyMiles program. Fresh Start Adjustments for the SkyMiles program (including the change in accounting policy

for that program) increased operating revenue by $188 million for the year ended December 31, 2007.

Fuel Hedging. Prior to the adoption of fresh start reporting on April 30, 2007, we recorded as a component of shareowners' deficit in other

comprehensive loss $46 million of deferred gains related to our fuel hedging program. This gain would have been recognized as an offset to fuel expense as

the underlying fuel hedge contracts were settled. However, as required by fresh start reporting, accumulated other comprehensive loss prior to emergence

from Chapter 11 was reset to zero. Accordingly, Fresh Start Adjustments resulted in a non-cash increase to fuel expense of $46 million for the year ended

December 31, 2007.

Depreciation. We revalued property and equipment to fair value, which reduced the net book value of these assets by $1.0 billion. In addition, we

adjusted the depreciable lives of flight equipment to reflect revised estimated useful lives. As a result, depreciation expense decreased by $127 million for the

year ended December 31, 2007.

Amortization of Intangible Assets. We valued our intangible assets at fair value, which increased the net book value of intangible assets (excluding

goodwill) by $2.9 billion, of which $956 million relates to amortizable intangible assets. As a result, amortization expense increased by $146 million for the

year ended December 31, 2007.

Aircraft Maintenance Materials and Outside Repairs. We changed the way we account for certain maintenance parts that were previously capitalized

and depreciated. After emergence, we expense these parts as they are placed on the aircraft. This change resulted in an increase in aircraft maintenance

materials and outside repairs expense of $52 million for the year ended December 31, 2007.

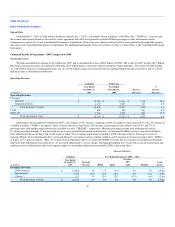

Interest Expense. The revaluation of our debt and capital lease obligations resulted in a decrease in interest expense due to the amortization of premiums

from adjusting these obligations to fair value. During 2007, $33 million in future premium credits were accelerated in connection with accounting for (1) the

amendment to our

28