Delta Airlines 2007 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

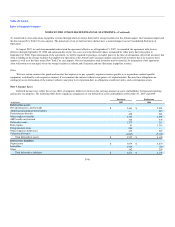

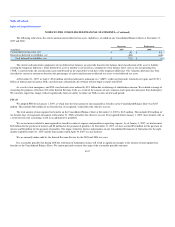

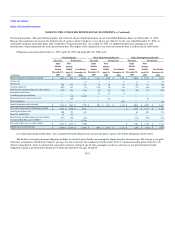

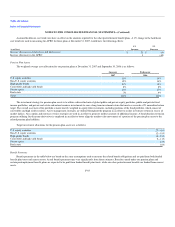

The following table shows the current and noncurrent deferred tax assets (liabilities), recorded on our Consolidated Balance Sheets at December 31,

2007 and 2006:

Successor Predecessor

(in millions) 2007 2006

Current deferred tax assets, net $ 142 $ 402

Noncurrent deferred tax liabilities, net (855) (406)

Total deferred tax liabilities, net $ (713) $ (4)

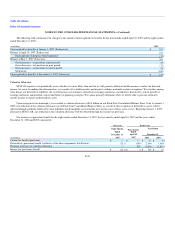

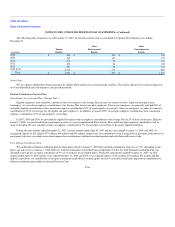

The current and noncurrent components of our deferred tax balances are generally based on the balance sheet classification of the asset or liability

creating the temporary difference. If the deferred tax asset or liability is not based on a component of our balance sheet, such as our net operating loss

("NOL") carryforwards, the classification is presented based on the expected reversal date of the temporary difference. Our valuation allowance has been

classified as current or noncurrent based on the percentages of current and noncurrent deferred tax assets to total deferred tax assets.

At December 31, 2007, we had (1) $346 million of federal alternative minimum tax ("AMT") credit carryforwards, which do not expire and (2) $9.1

billion of federal and state pretax NOL carryforwards, substantially all of which will not begin to expire until 2022.

As a result of our emergence, our NOL carryforwards were reduced by $2.1 billion due to discharge of indebtedness income. We realized a change of

ownership for purposes of Section 382 of the Internal Revenue Code as a result of the issuance of new common stock upon our emergence from bankruptcy.

We currently expect this change will not significantly limit our ability to utilize our NOLs in the carryforward period.

FIN 48

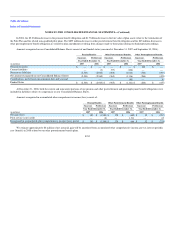

We adopted FIN 48 on January 1, 2007, at which time the total amount of unrecognized tax benefits on the Consolidated Balance Sheet was $217

million. This includes $86 million of tax benefits that, if recognized, would affect the effective tax rate.

The total amount of unrecognized tax benefits on the Consolidated Balance Sheet at December 31, 2007 is $143 million. This includes $38 million of

tax benefits that, if recognized subsequent to December 31, 2008, will affect the effective tax rate. If recognized before January 1, 2009, these benefits will, as

a result of fresh start accounting, result in an adjustment to goodwill.

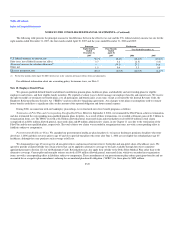

We accrue interest related to unrecognized tax benefits in interest expense and penalties in operating expense. As of January 1, 2007, we had accrued

$65 million for the payment of interest and $5 million for the payment of penalties. At December 31, 2007, we have accrued $54 million for the payment of

interest and $8 million for the payment of penalties. The impact related to interest and penalties on our Consolidated Statements of Operations for the eight

months ended December 31, 2007 and the four months ended April 30, 2007 was not material.

We are currently under audit by the Internal Revenue Service for the 2005 and 2006 tax years.

It is reasonably possible that during 2008 the settlement of bankruptcy claims will result in significant changes to the amount of unrecognized tax

benefits on the Consolidated Balance Sheet. We cannot presently estimate the range of the reasonably possible outcomes.

F-47