Delta Airlines 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

It is reasonably possible that during 2008 the settlement of bankruptcy claims will result in significant changes to the amount of unrecognized tax

benefits on the Consolidated Balance Sheet. We cannot presently estimate the range of the reasonably possible outcomes.

Legal Contingencies. We are involved in various legal proceedings relating to employment practices, environmental issues and other matters

concerning our business. We cannot reasonably estimate the potential loss for certain legal proceedings because, for example, the litigation is in its early

stages or the plaintiff does not specify the damages being sought.

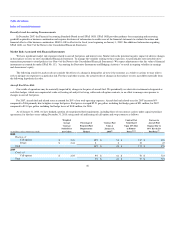

Other Contingent Obligations under Contracts. In addition to the contractual obligations discussed above, we have certain contracts for goods and

services that require us to pay a penalty, acquire inventory specific to us or purchase contract specific equipment, as defined by each respective contract, if we

terminate the contract without cause prior to its expiration date. Because these obligations are contingent on our termination of the contract without cause

prior to its expiration date, no obligation would exist unless such a termination occurs.

For additional information about other contingencies not discussed above, as well as information related to general indemnifications, see Note 8 of the

Notes to the Consolidated Financial Statements.

Application of Critical Accounting Policies

Critical Accounting Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires

management to make certain estimates and assumptions. We periodically evaluate these estimates and assumptions, which are based on historical experience,

changes in the business environment and other factors that management believes to be reasonable under the circumstances. Actual results may differ

materially from these estimates.

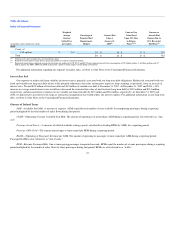

Fresh-Start Reporting. As previously noted, upon emergence from Chapter 11, we adopted fresh start reporting, which required us to revalue our assets

and liabilities to fair value. In estimating fair value, we based our estimates and assumptions on the guidance prescribed by SFAS No. 157, "Fair Value

Measurements" ("SFAS 157"), which we were required to adopt in connection with our adoption of fresh start reporting. SFAS 157, among other things,

defines fair value, establishes a framework for measuring fair value and expands disclosure about fair value measurements.

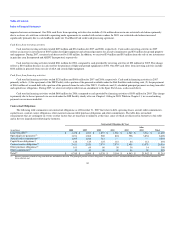

To facilitate the calculation of the enterprise value of the Successor, management developed a set of financial projections for the Successor using a

number of estimates and assumptions. The enterprise and corresponding reorganization value of the Successor was based on financial projections using

various valuation methods, including (1) a comparison of our projected performance to the market values of comparable companies; (2) a review and analysis

of several recent transactions in the airline industry; and (3) a calculation of the present value of future cash flows based on our projections. Utilizing these

methodologies, the reorganization value of the Successor was estimated to be in the range of $9.4 billion to $12.0 billion. The enterprise value, and

corresponding reorganization value, is dependent upon achieving the future financial results set forth in our projections, as well as the realization of certain

other assumptions. There can be no assurance that the projections will be achieved or that the assumptions will be realized. The excess reorganization value

(using the low end of the range) over the fair value of tangible and identifiable intangible assets, net of liabilities, has been reflected as goodwill in the Fresh

Start Consolidated Balance Sheet. The financial projections and estimates of enterprise and reorganization value are not incorporated into this Form 10-K.

All estimates, assumptions and financial projections, including the fair value adjustments, the financial projections, and the enterprise value and

reorganization value projections, are inherently subject to significant uncertainties and the resolution of contingencies beyond our control. Accordingly, there

can be no assurance that the estimates, assumptions and financial projections will be realized, and actual results could vary materially.

42