Delta Airlines 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

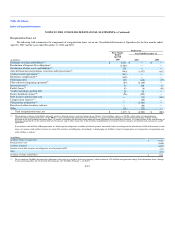

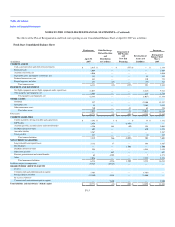

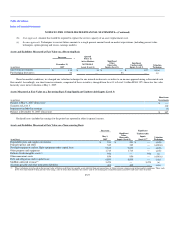

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

classifications, respectively. Effective with our emergence from bankruptcy, we changed our accounting policy from an incremental cost

basis to a deferred revenue model for miles earned through travel. For additional information on the accounting policy for our SkyMiles

Program, see Note 2.

(f) Noncurrent liabilities—other. An adjustment of $1.2 billion primarily related to the tax effect of fresh start valuation adjustments.

(g) Total shareowners' deficit. The adoption of fresh start reporting resulted in a new reporting entity with no beginning retained earnings or

accumulated deficit. All common stock of the Predecessor was eliminated and replaced by the new equity structure of the Successor

based on the Plan of Reorganization. The Fresh Start Consolidated Balance Sheet reflects initial shareowners' equity value of $9.4 billion,

representing the low end in the range of $9.4 billion to $12.0 billion estimated in our financial projections developed in connection with

the Plan of Reorganization. The low end of the range is estimated to reflect market conditions as of the Effective Date and therefore was

used to establish initial shareowners' equity value.

Note 2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the United

States of America ("GAAP"). In preparing our Consolidated Financial Statements for the Predecessor, we applied SOP 90-7, which requires that the financial

statements for periods subsequent to the Chapter 11 filing distinguish transactions and events that were directly associated with the reorganization from the

ongoing operations of the business. Accordingly, certain revenues, expenses, realized gains and losses and provisions for losses that were realized or incurred

in the bankruptcy proceedings were recorded in reorganization items, net on the accompanying Consolidated Statements of Operations. In addition, pre-

petition obligations that were impacted by the bankruptcy reorganization process were classified as liabilities subject to compromise on our Consolidated

Balance Sheet at December 31, 2006. For additional information regarding the discharge of liabilities subject to compromise upon emergence, see Note 1.

We have eliminated all material intercompany transactions in our Consolidated Financial Statements. We do not consolidate the financial statements of

any company in which we have an ownership interest of 50% or less unless we control that company. We did not control any company in which we had an

ownership interest of 50% or less for any period presented in our Consolidated Financial Statements.

Use of Estimates

We are required to make estimates and assumptions when preparing our Consolidated Financial Statements in accordance with GAAP. These estimates

and assumptions affect the amounts reported in our Consolidated Financial Statements and the accompanying notes. Actual results could differ materially

from those estimates.

New Accounting Standards

In December 2007, the Financial Accounting Standards Board ("FASB") issued SFAS No. 141 (revised 2007), "Business Combinations" ("SFAS

141R"). SFAS 141R provides guidance for recognizing and measuring goodwill acquired in a business combination and requires disclosure of information to

enable users of the financial statements to evaluate the nature and financial effects of a business combination. SFAS 141R is effective for fiscal years

beginning on January 1, 2009. For additional information regarding SFAS 141R, see Note 9.

F-17