Delta Airlines 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

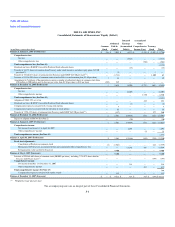

Table of Contents

Index to Financial Statements

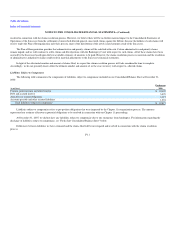

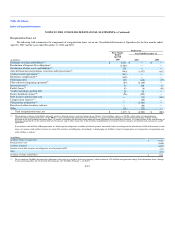

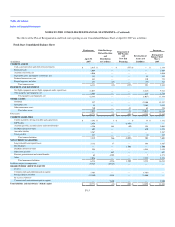

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The Bankruptcy Court also authorized the distribution of equity awards to our approximately 1,200 officers, director level employees and managers and

senior professionals ("management personnel"). For additional information about these awards, see Note 12.

In addition, as of January 31, 2008, we have issued the following debt securities and made the following cash distributions under the Plan of

Reorganization:

• $66 million principal amount of senior unsecured notes in connection with our settlement agreement relating to the restructuring of certain of our

lease and other obligations at the Cincinnati-Northern Kentucky International Airport (the "Cincinnati Airport Settlement Agreement"). For

additional information on this subject, see Note 8;

• an aggregate of $133 million in cash to holders in satisfaction of their claims, including to holders of administrative claims, state and local

priority tax claims, certain secured claims and de minimis allowed unsecured claims;

• $225 million in cash to the Pension Benefit Guaranty Corporation (the "PBGC") in connection with the termination of our qualified defined

benefit pension plan for pilots (the "Pilot Plan"); and

• $650 million in cash to fund an obligation (the "Pilot Obligation") under our comprehensive agreement with the Air Line Pilots Association,

International ("ALPA"), the collective bargaining representative of Delta's pilots, to reduce pilot labor costs. In 2007, we paid $355 million of

this amount and deposited the remaining $295 million in a grantor trust for the benefit of Delta pilots. The amount in the grantor trust is classified

as restricted cash with a corresponding note payable on our Consolidated Balance Sheet until it was distributed in January 2008.

In accordance with the Plan of Reorganization, holders of our equity interests that were in existence prior to April 30, 2007, including our common

stock, did not receive any distributions, and their equity interests were cancelled on the Effective Date.

On the Effective Date, we entered into a senior secured exit financing facility (the "Exit Facilities") to borrow up to $2.5 billion from a syndicate of

lenders. We used a portion of the proceeds from the Exit Facilities and existing cash to repay our two then outstanding debtor-in-possession financing

facilities (the "DIP Facility"). For additional information regarding the Exit Facilities, see Note 6.

We continue to incur expenses related to our Chapter 11 proceedings, primarily professional fees that were classified as a reorganization item by the

Predecessor. After we emerged from bankruptcy, these expenses are classified in their appropriate line item, primarily in other operating expense, in the

Successor's Consolidated Statement of Operations.

Resolution of Outstanding Claims

As permitted under the bankruptcy process, many of the Debtors' creditors filed proofs of claim with the Bankruptcy Court. Through the claims

resolution process, many claims were disallowed by the Bankruptcy Court because they were duplicative, amended or superseded by later filed claims, were

without merit, or were otherwise overstated. Throughout the Chapter 11 proceedings, the Debtors also resolved many claims through settlements or by

Bankruptcy Court orders following the filing of an objection. The Debtors will continue to settle claims and file additional objections with the Bankruptcy

Court.

We currently estimate that the total allowed general, unsecured claims in our Chapter 11 proceedings will be approximately $15 billion, including the

$12.5 billion of claims for which we have issued distributions of common stock. Differences between claim amounts filed and our estimates are being

investigated and will be

F-10