Delta Airlines 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

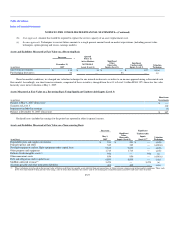

(2) Intangible assets are identified by asset type in Note 5.

(3) The fair value of our SkyMiles frequent flyer award liability was determined based on the estimated price that third parties would require us to pay for them to assume the obligation for

miles expected to be redeemed under the SkyMiles Program. This estimated price was determined based on our weighted average equivalent ticket value of a SkyMiles award which is

redeemed for travel on Delta or a participating airline. The weighted average equivalent ticket value contemplates differing classes of service, domestic and international itineraries and

the carrier providing the award travel.

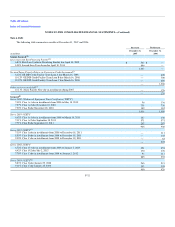

Successor Significant

Unobservable

Inputs (Level 3)

Valuation

Technique

(in millions)

December 31,

2007

Indefinite-lived intangible assets(1) $ 1,997 $ 1,997 (a)(c)

Goodwill(2) 12,104 12,104 (a)(c)

(1) We perform the impairment test for our indefinite-lived intangible assets by comparing the asset's fair value to its carrying value. Fair value is estimated based on recent market

transactions, where available, or projected discounted future cash flows. For additional information regarding impairment, see Note 2.

(2) In evaluating our goodwill for impairment, we first compare our one reporting unit's fair value to its carrying value. We estimate the fair value of our reporting unit by considering (1) our

market capitalization, (2) any premium to our market capitalization an investor would pay for a controlling interest, (3) the potential value of synergies and other benefits that could result

from such interest, (4) market multiple and recent transaction values of peer companies and (5) projected discounted future cash flows, if reasonably estimable.

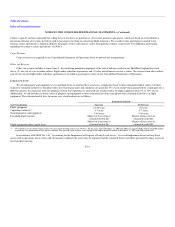

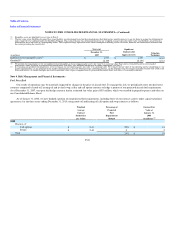

Note 4. Risk Management and Financial Instruments

Fuel Price Risk

Our results of operations may be materially impacted by changes in the price of aircraft fuel. To manage this risk, we periodically enter into derivative

contracts comprised of crude oil, heating oil and jet fuel swap, collar and call option contracts to hedge a portion of our projected aircraft fuel requirements.

As of December 31, 2007, our open fuel hedge contracts had an estimated fair value gain of $53 million, which we recorded in prepaid expenses and other on

our Consolidated Balance Sheet.

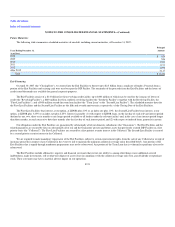

As of January 31, 2008, we have hedged a portion of our projected fuel requirements, including those of our contract carriers under capacity purchase

agreements, for the three years ending December 31, 2010, using crude oil and heating oil call option and swap contracts as follows:

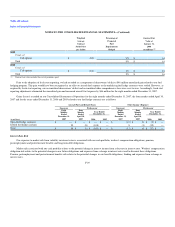

Weighted

Average

Contract

Strike Price

per Gallon

Percentage of

Projected

Fuel

Requirements

Hedged

Contract Fair

Value at

January 31,

2008

(in millions)(1)

2008

Heating oil

Call options $ 2.43 22% $ 91

Swaps $ 2.44 2 2

Total 24% $ 93

F-28