Delta Airlines 2007 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

We concluded that all of our stock options would be cancelled as part of our emergence from Chapter 11. Accordingly, in March 2006, we filed with

the Bankruptcy Court a motion to reject our then outstanding stock options to avoid the administrative and other costs associated with these awards. The

Bankruptcy Court granted our motion, which resulted in substantially all of our stock options being rejected effective March 31, 2006. For the year ended

December 31, 2006, we recorded in our Consolidated Statement of Operations (1) $8 million of compensation expense in conjunction with the adoption of

SFAS 123R, which is recorded in salaries and related costs and (2) $55 million of compensation expense associated with the rejection of stock options, which

is classified in reorganization items, net and represents the unamortized fair value of previously granted stock options when we rejected these stock options.

As of April 30, 2007, we did not have any stock options of the Predecessor outstanding.

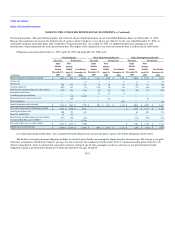

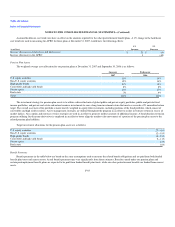

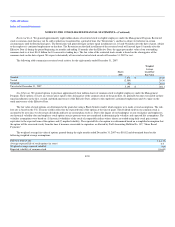

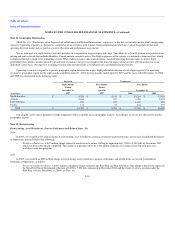

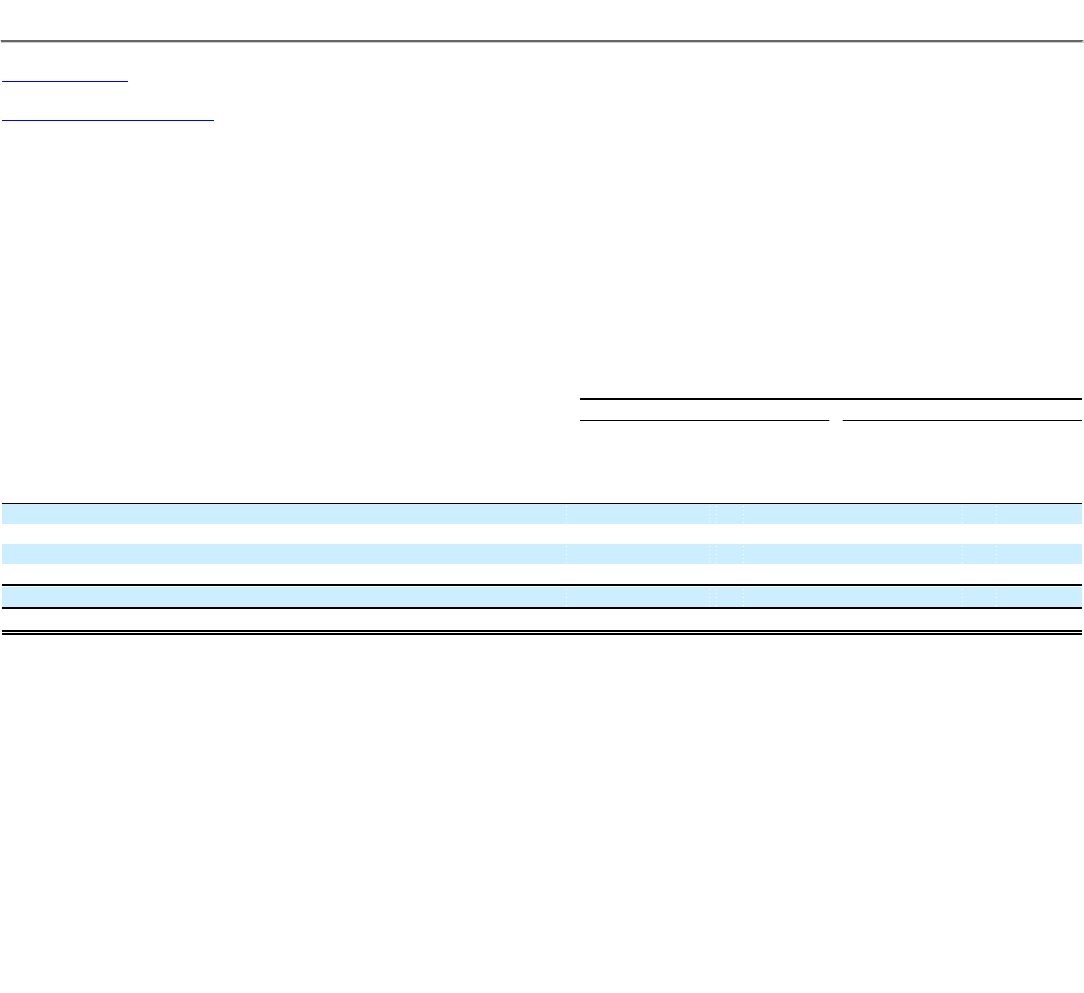

The following table summarizes all stock option activity for the years ended December 31, 2006 and 2005:

Year Ended December 31,

2006 2005

Shares

(000)

Weighted

Average

Exercise

Price

Shares

(000)

Weighted

Average

Exercise

Price

Outstanding at the beginning of the period 92,401 $ 15.76 105,933 $ 14.87

Granted — — 1,939 4.51

Forfeited — — (15,471) 8.26

Rejected (92,086) 15.76 — —

Outstanding at the end of the period 315(1) $ 15.76 92,401 $ 15.76

Exercisable at the end of the period 315 $ 15.76 53,944 $ 22.20

(1) On the Effective Date, all common stock issued by the Predecessor was cancelled.

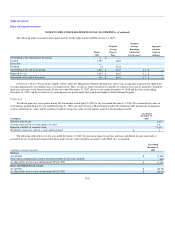

ESOP Preferred Stock

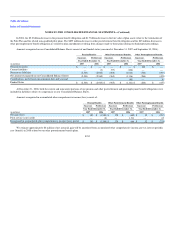

In December 2005, we amended the Savings Plan to give eligible participants the opportunity to receive an in-service distribution of the ESOP

Preferred Stock and common stock in their ESOP accounts in the Savings Plan. Under this amendment, eligible participants could make an election between

December 19, 2005 and January 18, 2006 to receive such an in-service distribution. Upon its distribution, the ESOP Preferred Stock was automatically

converted in accordance with its terms into shares of common stock. Subsequent to January 18, 2006, the trustee of the Savings Plan converted all the

remaining shares of ESOP Preferred Stock into common stock.

During 2006, all shares of ESOP Preferred Stock, which were not allocated to the accounts of participants in the Savings Plan, were allocated to

participants in that plan. All outstanding shares of ESOP Preferred Stock were then converted, in accordance with their terms, into approximately eight

million shares of common stock from treasury at cost. The allocation and conversion of the ESOP Preferred Stock resulted in a $367 million decrease from

treasury stock at cost and a corresponding $144 million decrease in additional paid-in capital. Unpaid dividends on the ESOP Preferred Stock accrued without

interest, until paid, at a rate of $4.32 per share per year. At December 31, 2006, accumulated but unpaid dividends on the ESOP Preferred Stock totaled $52

million, and are recorded in liabilities subject to compromise on our Consolidated Balance Sheet.

F-61