Delta Airlines 2007 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

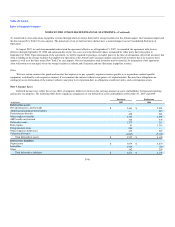

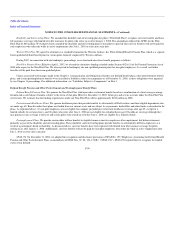

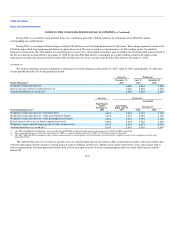

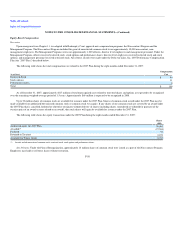

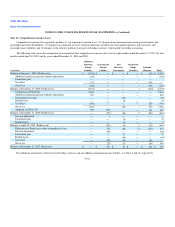

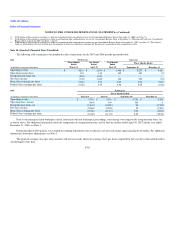

The following table summarizes, as of December 31, 2007, the benefit payments that are scheduled to be paid in the following years ending

December 31:

(in millions)

Pension

Benefits

Other

Postretirement

Benefits

Other

Postemployment

Benefits

2008 $ 448 $ 100 $ 134

2009 467 101 139

2010 459 96 144

2011 455 94 149

2012 451 86 155

2013-2017 2,314 314 856

Total $ 4,594 $ 791 $ 1,577

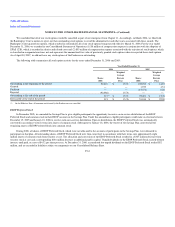

Other Plans

We also sponsor defined benefit pension plans for eligible Delta employees in certain foreign countries. These plans did not have a material impact on

our Consolidated Financial Statements in any period presented.

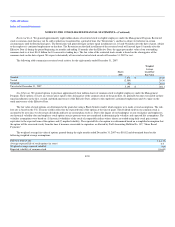

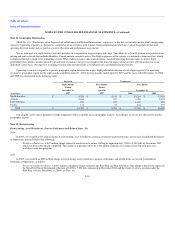

Defined Contribution Pension Plans

Delta Family-Care Savings Plan ("Savings Plan")

Eligible employees may contribute a portion of their covered pay to the Savings Plan on a pre-tax or post tax basis. Upon our emergence from

bankruptcy, we revised our employer contributions to the Savings Plan for our non-pilot employees. Prior to our emergence, we generally matched 50% of

non-pilot employee contributions with a maximum employer contribution of 2% of a participant's covered pay. After our emergence, we make an automatic

contribution of 2% of covered pay for all eligible non-pilot employees. In addition, we match 100% of non-pilot employee contributions with a maximum

employer contribution of 5% of a participant's covered pay.

In 2007, 2006 and 2005, we provided all eligible Delta pilots with an employer contribution to the Savings Plan of 2% of their covered pay. Effective

January 1, 2008, we transferred all pilot participant accounts to a newly implemented Pilots Savings Plan and future pilot employee contributions will be

made to that plan. We also continue to make an employer contribution of 2% of each pilot's covered pay to the newly implemented plan.

During the eight months ended December 31, 2007, the four months ended April 30, 2007 and the years ended December 31, 2006 and 2005, we

recognized expense of $12 million, $77 million, $44 million and $56 million, respectively, for contributions to the Savings Plan or payments made directly to

participants who have exceeded certain limits imposed on contributions to defined contribution plans under the Internal Revenue Code.

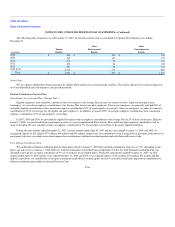

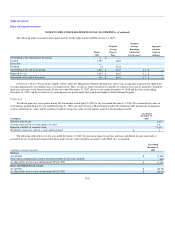

Pilot Defined Contribution Plan

We established a defined contribution plan for Delta pilots effective January 1, 2005 that included contributions from zero to 19%, depending on the

pilot's age and service at January 1, 2005. Effective with the termination of the Pilot Plan on September 2, 2006, the Pilot Defined Contribution Plan was

amended to provide for an annual contribution of 9% of covered pay for all eligible pilots. During the eight months ended December 31, 2007, the four

months ended April 30, 2007 and the years ended December 31, 2006 and 2005, we recognized expense of $24 million, $51 million, $71 million and $83

million, respectively, for contributions to this plan or payments made directly to participants who have exceeded certain limits imposed on contributions to

defined contribution plans under the Internal Revenue Code.

F-56