Delta Airlines 2007 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

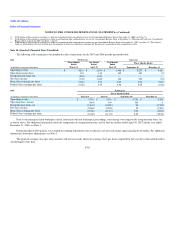

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

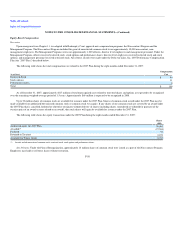

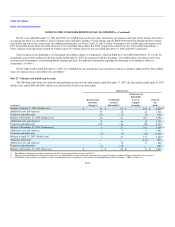

• Pension Settlements. $388 million in settlement charges related to the Pilot Plan due to a significant increase in pilot retirements and lump sum

distributions from plan assets (see Note 10).

• Workforce Reduction. A $46 million charge related to our decision to reduce staffing by approximately 7,000 to 9,000 jobs by December 2007.

This charge was partially offset by a net $3 million reduction in accruals associated with prior year workforce reduction programs.

• Asset Charges. A $10 million charge related to the removal from service of six B-737-200 aircraft prior to their lease expiration dates.

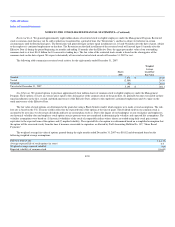

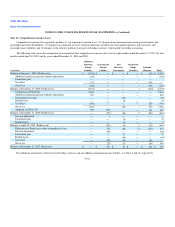

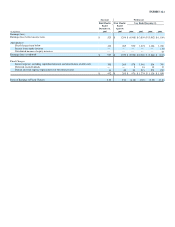

Note 16. Earnings (Loss) per Share

We calculate basic earnings (loss) per share by dividing the net income (loss) attributable to common shareowners by the weighted average number of

common shares outstanding. In accordance with SFAS No. 128, "Earnings per Share," shares issuable upon the satisfaction of certain conditions pursuant to a

contingent stock agreement, such as those contemplated by the Plan of Reorganization, are considered outstanding common shares and included in the

computation of basic earnings per share. Accordingly, 386 million shares contemplated by the Plan of Reorganization to be distributed to holders of allowed

general, unsecured claims are included in the calculation of basic earnings per share for the eight months ended December 31, 2007. For additional

information regarding these shares, see Notes 1 and 12.

Diluted earnings (loss) per share include the dilutive effects of stock options and restricted stock. To the extent stock options and restricted stock are

anti-dilutive, they are excluded from the calculation of diluted earnings (loss) per share.

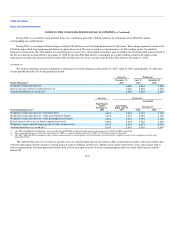

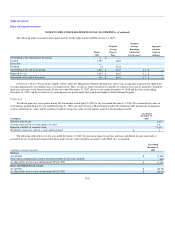

The following table shows our computation of basic and diluted earnings (loss) per share for the eight months ended December 31, 2007, the four

months ended April 30, 2007 and the years ended December 31, 2006 and 2005:

Successor Predecessor

(in millions, except per share data)

Eight

Months

Ended

December 31,

2007

Four

Months

Ended

April 30,

2007

Year Ended

December 31,

2006 2005

Basic:

Net income (loss) $ 314 $ 1,298 $ (6,203) $ (3,818)

Dividends on allocated Series B ESOP Convertible Preferred Stock — — (2) (18)

Net income (loss) attributable to common shareowners $ 314 $ 1,298 $ (6,205) $ (3,836)

Basic weighted average shares outstanding 394.1 197.3 196.5 161.5

Basic earnings (loss) per share $ 0.80 $ 6.58 $ (31.58) $ (23.75)

Diluted:

Net income (loss) attributable to common shareowners $ 314 $ 1,298 $ (6,205) $ (3,836)

Gain recognized on the forgiveness of convertible debt — (216) — —

Net income (loss) attributable to common shareowners assuming conversion $ 314 $ 1,082 $ (6,205) $ (3,836)

Basic weighted average shares outstanding 394.1 197.3 196.5 161.5

Dilutive effects of:

Restricted shares 1.1 — — —

8.0% Convertible Senior Notes — 12.5 — —

2 7/8% Convertible Senior Notes — 23.9 — —

Weighted average shares outstanding, as adjusted 395.2 233.7 196.5 161.5

Dilutive earnings (loss) per share $ 0.79 $ 4.63 $ (31.58) $ (23.75)

F-64