Delta Airlines 2007 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2007 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

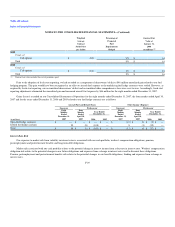

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Derivative Financial Instruments

Fuel Hedging Program

We periodically use derivative instruments designated as cash flow hedges, which are comprised of crude oil, heating oil and jet fuel swap, collar and

call option contracts, to manage our exposure to changes in aircraft fuel prices. In accordance with SFAS No. 133, "Accounting for Derivative Instruments

and Hedging Activities" ("SFAS 133"), we record the fair market value of our fuel hedge contracts on our Consolidated Balance Sheets and recognize certain

changes in these fair values on our Consolidated Statements of Operations.

We believe our fuel hedge contracts will be highly effective during their term in offsetting changes in cash flow attributable to the hedged risk. We

perform both a prospective and retrospective assessment to this effect at least quarterly, including assessing the possibility of counterparty default. If we

determine that a derivative is no longer expected to be highly effective, we discontinue hedge accounting prospectively and recognize subsequent changes in

the fair market value of the hedge to other (expense) income on our Consolidated Statements of Operations rather than being deferred in accumulated other

comprehensive income on our Consolidated Balance Sheets. As a result of our effectiveness assessment at December 31, 2007, we believe our fuel hedge

contracts will continue to be highly effective in achieving offsetting changes in cash flows.

Changes in the fair value of fuel hedge contracts that qualify for hedge accounting are recorded in shareowners' equity as a component of accumulated

other comprehensive income. These gains or losses are generally recognized in aircraft fuel expense and related taxes when the related aircraft fuel purchases

being hedged are consumed. To the extent that the change in the fair value of a fuel hedge contract does not perfectly offset the change in the value of the

aircraft fuel being hedged, the ineffective portion of the hedge is immediately recognized in other (expense) income on our Consolidated Statements of

Operations. For our heating oil and jet fuel option contracts entered into during 2007, ineffectiveness is measured based on the intrinsic value of the

derivative. The difference between the fair value and intrinsic value represents the time value of the option contract. Time value is excluded from the

calculation of ineffectiveness and immediately recognized in other (expense) income on our Consolidated Statements of Operations.

For additional information about our derivative instruments, see Note 4.

Revenue Recognition

Passenger Revenue

Passenger Tickets. We record sales of passenger tickets as air traffic liabilities on our Consolidated Balance Sheets. Passenger revenue is recognized

when we provide transportation or when the ticket expires unused, reducing the related air traffic liability. We periodically evaluate the estimated air traffic

liability and record any resulting adjustments in our Consolidated Statements of Operations in the period in which the evaluations are completed. These

adjustments relate primarily to refunds, exchanges, transactions with other airlines and other items for which final settlement occurs in periods subsequent to

the sale of the related tickets at amounts other than the original sales price.

Taxes and Fees. We are required to charge certain taxes and fees on our passenger tickets. These taxes and fees include U.S. federal transportation

taxes, federal security charges, airport passenger facility charges and foreign arrival and departure taxes. These taxes and fees are legal assessments on the

customer, for which we have an obligation to act as a collection agent. Because we are not entitled to retain these taxes and fees, we do not include such

amounts in passenger revenue. We record a liability when the amounts are collected and reduce the liability when payments are made to the applicable

government agency or operating carrier.

F-19